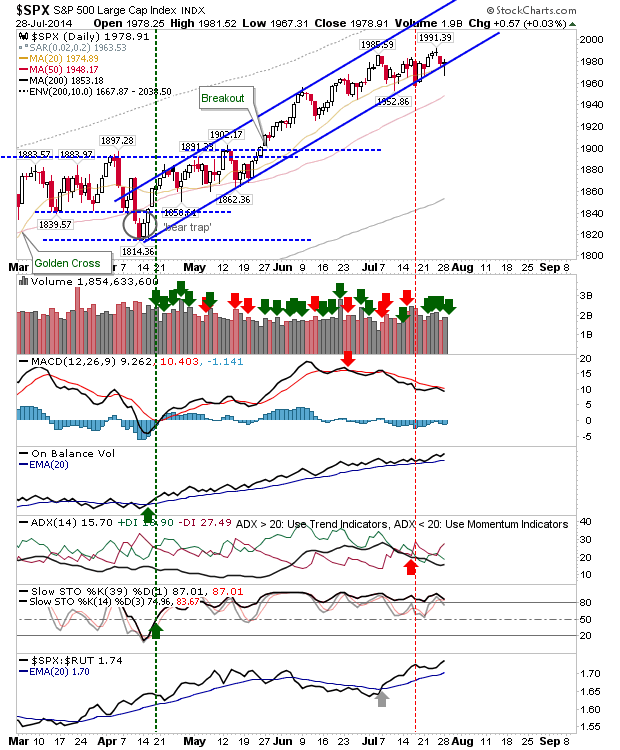

Morning action left the Russell 2000 staring at a new swing low, and the S&P 500 at a channel break. However, buyers returned in the afternoon to return the S&P to support and the Russell 2000 scrambling back to its 200-day MA. Meanwhile, the Semiconductor finished with a bullish doji on the 50-day MA. Given bears failure, bulls have an opportunity to press their advantage in the Semiconductor Index and S&P.

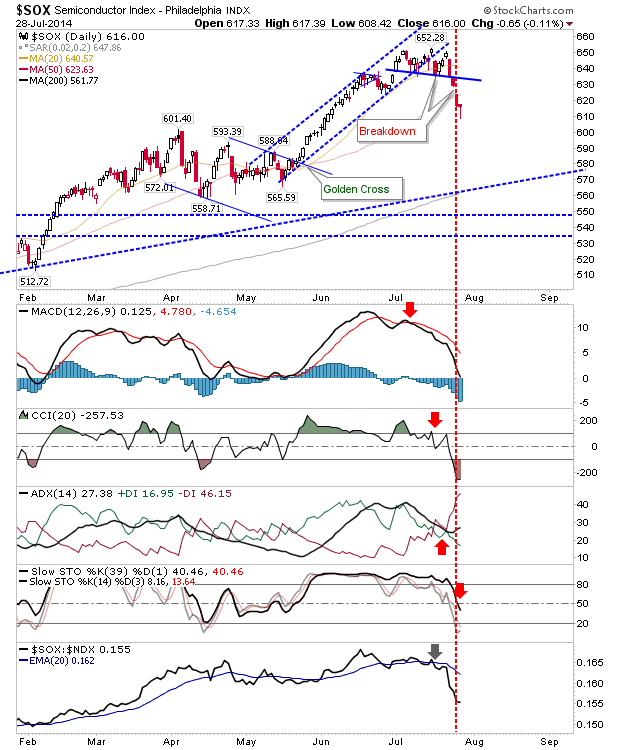

The 608 low in the Semiconductor Index may see a test and perhaps an intraday violation, but there is a fairly decent long side opportunity available, if the 50-day MA can hold.

The S&P has the least risky longside opportunity to work with. The intraday violation of the channel isn't ideal, but it does offer a place for stop; the second doji low from early July at 1,952 is another.

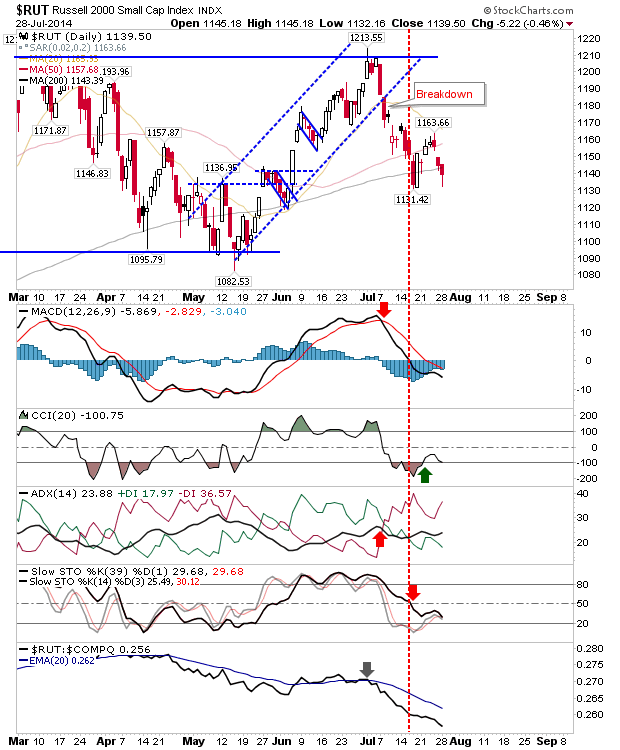

The Russell 2000 had the most bearish action on the day, but there is a chance for a mini-double bottom ('Eve-and-Adam') with the 200-day MA available for bulls.