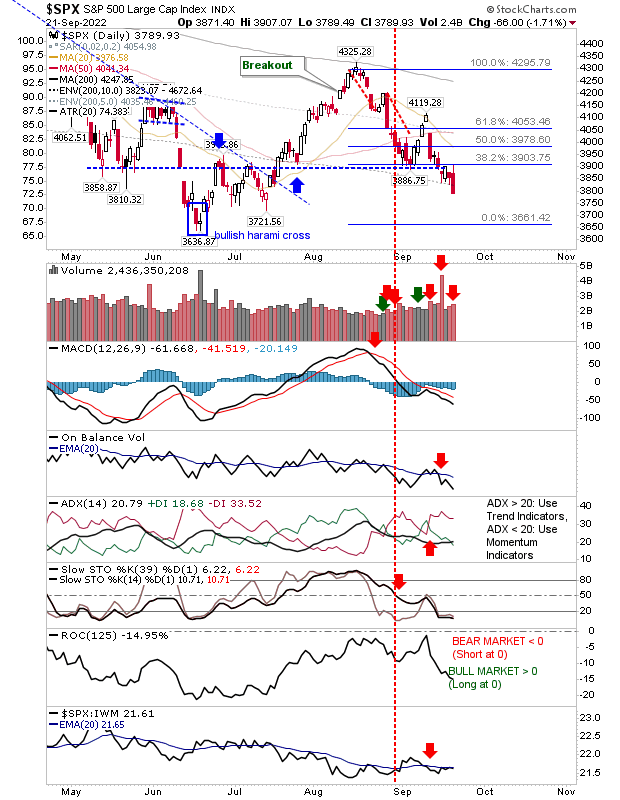

There was no doubt as to where control lies in the market after yesterday's finish. The second reversal opportunity which was playing at the 61.8% retracement of the June-August rally has failed, and with today's volume, ranked as confirmed distribution. It was the same for the Nasdaq, S&P and Russell 2000.

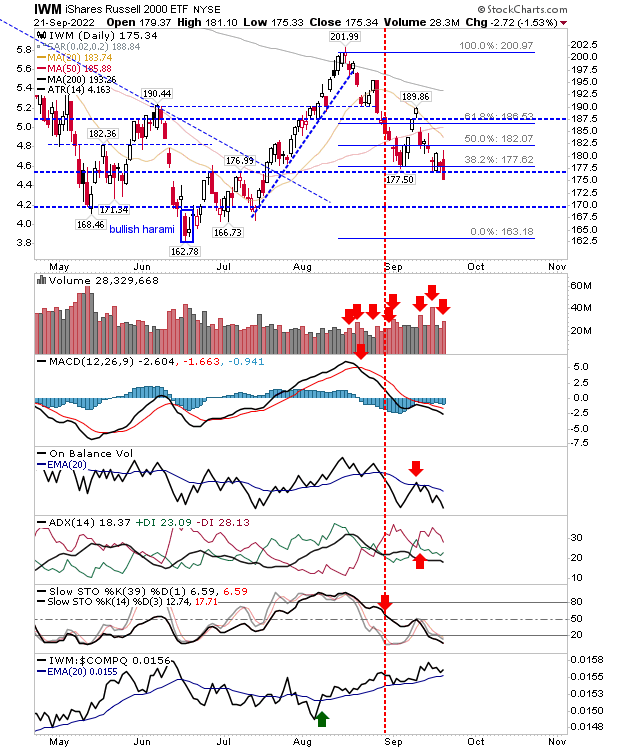

We will start with the Russell 2000. It had the most support to work off, but it has cleanly cut through the Fib retracement zone. It still has the relative performance advantage over the Nasdaq and S&P, but yesterday's candlestick suggests there will be further losses today. There is some support around $170, which is the next target before the June low comes into range.

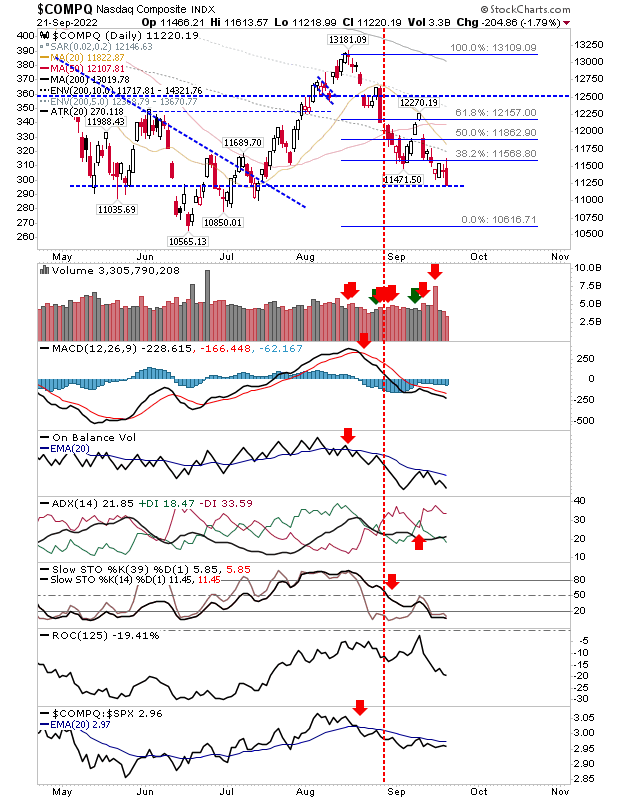

The Nasdaq finished at 11,250 support, which is comparable support level I'm looking for the Russell 2000 to succeed at. If there is a consolidation it's that selling volume was light, but a day like yesterday where early gains were wiped and sellers piled in is not one you want to be in front of.

The S&P has not enjoyed the same level of workable support and it showed yesterday. A move back to June lows seems like the minimum expectation now, but if things were to get worse then the S&P will be the index to lead the way.

A bad day for traders is still a good day for investors looking to accumulate into positions. Further losses are likely but don't try and second guess the market if buying to hold for the long term. The next challenge we need to consider are 200-week MAs. It was the 200-week MA of the indices that played as support in June, but a second such test so close to the last is unlikely to succeed and that is where we are now - there are still two days to go before the weekly price print - so don't be surprised if markets 'stick' to yesterday's close by Friday's end-of-day.