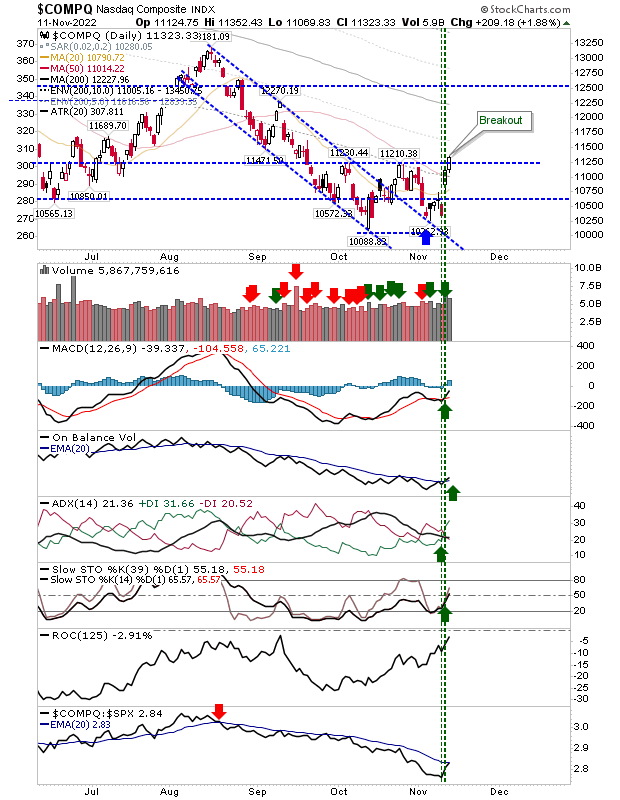

Friday's star was the Nasdaq as it managed to break past resistance marked by swing highs in September and October. There wasn't any accumulation volume to go with the breakout, but there was a 'buy' trigger in On-Balance-Volume - in fact, all supporting technicals are net bullish. And, relative performance of the index to the S&P is near a new 'buy' trigger. For next week, we will want to see the 11,250 zone hold as support - intraday violations are okay, end-of-day breaks are not.

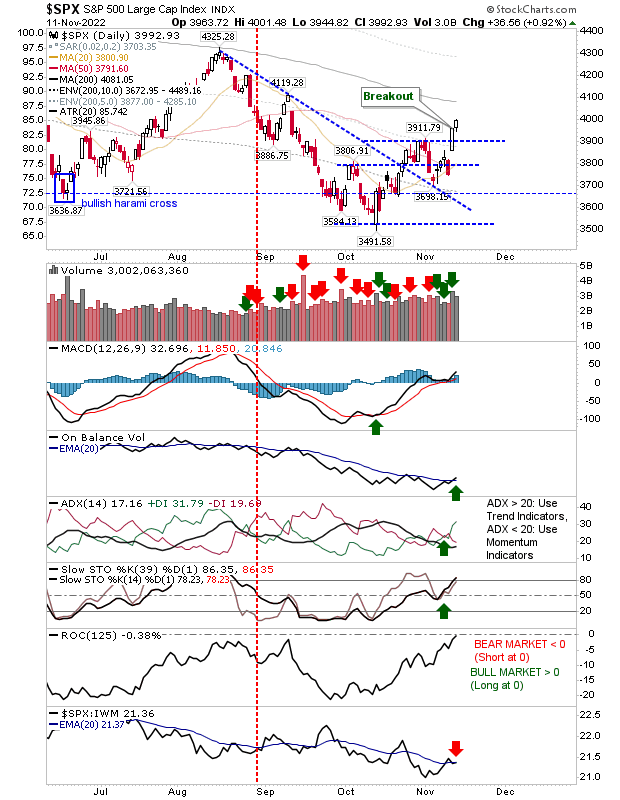

The S&P added to its Thursday breakout, albeit on lighter volume than Thursday's. This gives the index some room to work with in terms of defending breakout support around 3,900, but there is still the question of overhead resistance at its 200-day MA. As with the Nasdaq, technicals are net bullish. It should be okay to the 200-day MA, but I would look for it to struggle beyond that.

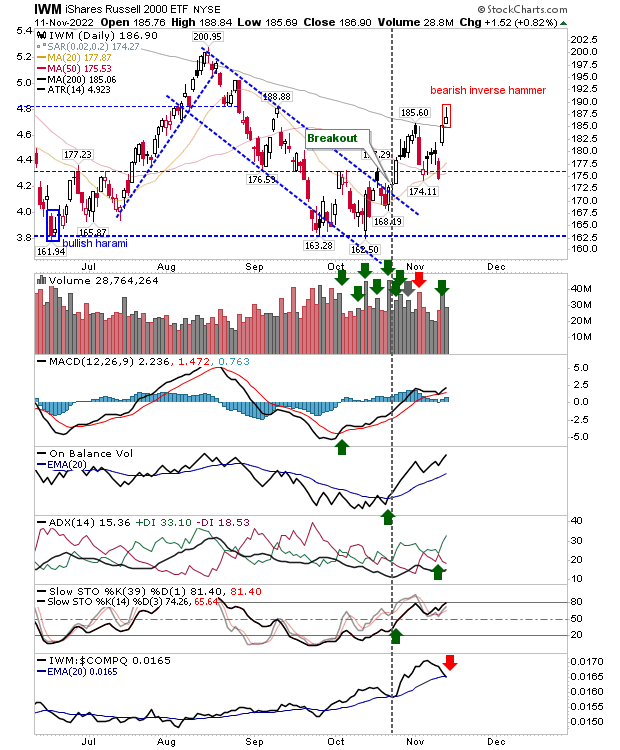

Which brings us to the Russell 2000. It did manage to break through its 200-day MA on Thursday, but it finished Friday on a bearish 'inverse hammer', which now leaves it vulnerable to an undercut of its 200-day MA. It does have the benefit of bullish technicals, although the index has started to underperform against the Nasdaq.

Given the extent of the Covid rally, I suspect the current advance will stall out on tests of the all-time high (sometime in 2023), and after that, we will have a sideways move to consolidate this advance - which could last time. Of course, this is speculation, but I find it hard to think we will see a new high, and then thing keep going higher from the current advance.