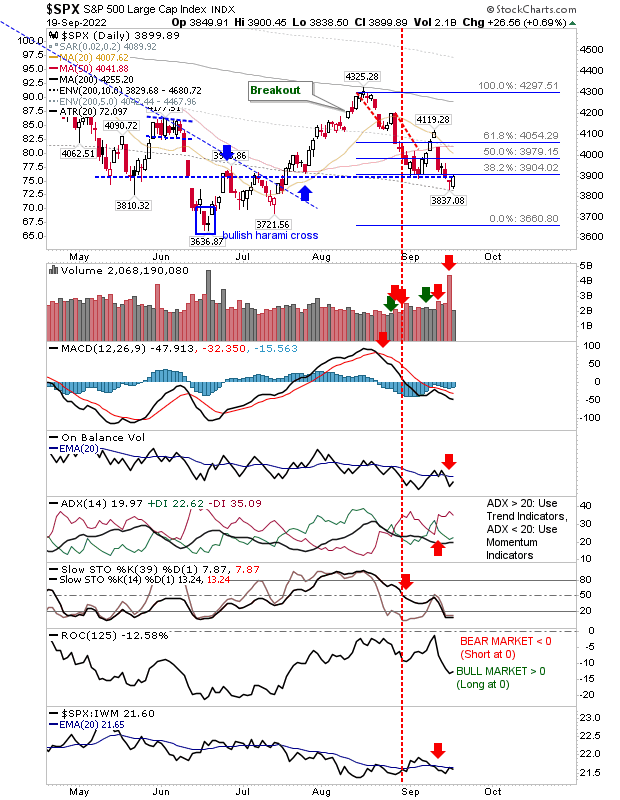

If yesterday's buying volume was greater it would have been considered a good day; instead, it's a day with potential but still needs more from buyers to convince. On the positive side, bullish engulfing patterns like yesterday's are reliable reversal patterns, and traders could use them as buying opportunities with a stop below the low of the pattern (exit on a close below rather than an intraday violation).

How much upside to look for will be contingent on the amount of buying volume we see over the coming days, but closing the gap down in early September following the 4-day sequence of gains would be a good start as an initial target.

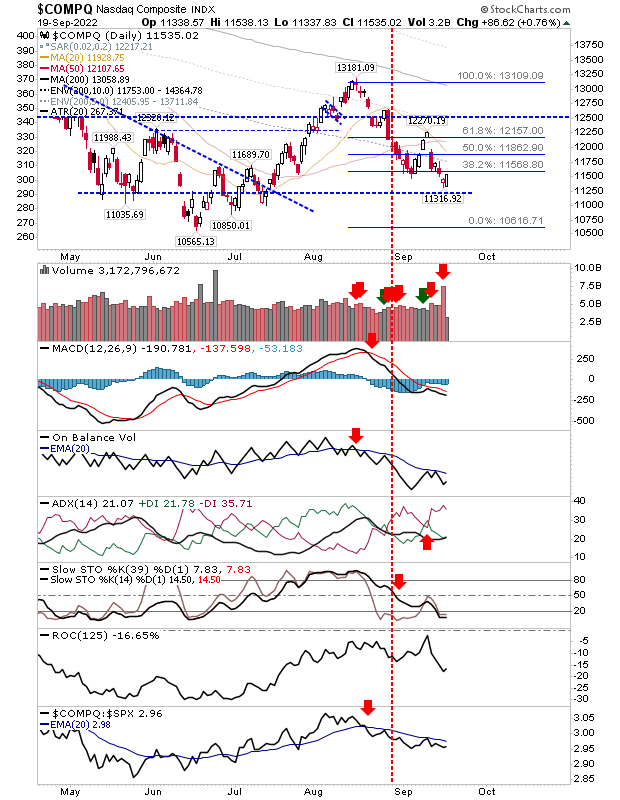

In the case of the Nasdaq, we didn't see a whole lot of technical improvement, neither was there much in the way of relative performance gains to peer indices. So, at the moment it's a pure price play trading just above support.

The S&P 500 is in a similar predicament as the Nasdaq, although its bullish engulfing pattern occurred just below support. It has seen some relative technical improvement over the Russell 2000 and the Nasdaq (to a lesser extent). The same trading rules apply and the September gap down is the target.

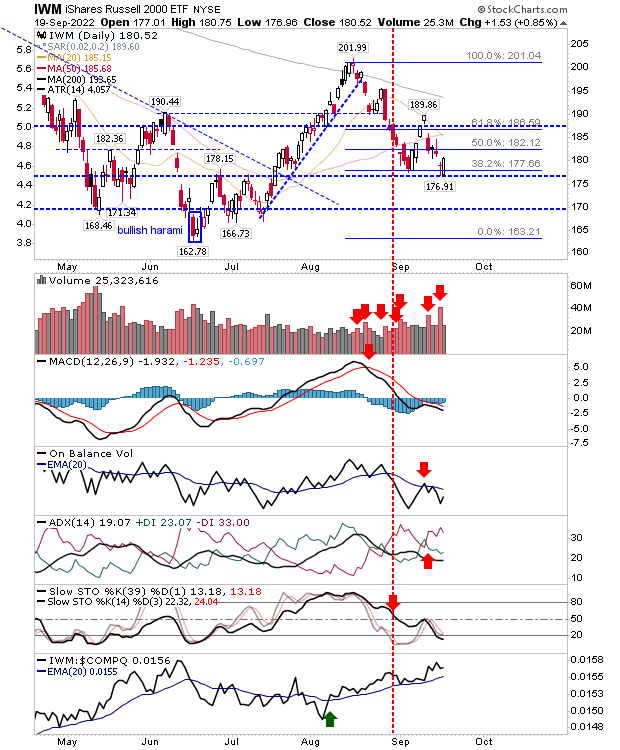

The Russell 2000 is the index currently outperforming the Nasdaq, and today's bullish engulfing pattern occurred at price and Fibonacci support. Likewise as a trade, play to the September gap down - then the 200-day MA. Of the three indices, this trade is the one most likely to succeed.

Bulls have made a better start to this trade than the last 'perfect' set up they had at the end of August. But it's up to them to deliver; yesterday was a start, but it needs more today if there is to be doubt sown into the mind of bears.