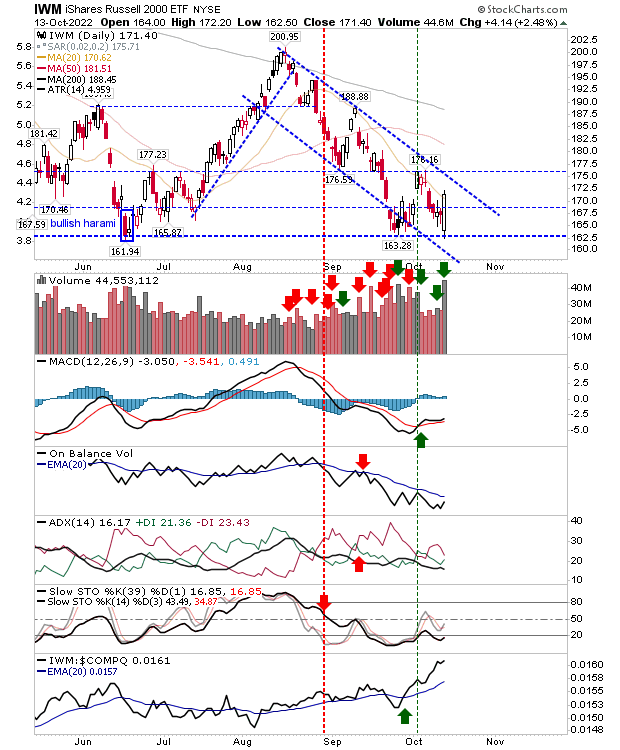

Will today be the day markets get their latest swing low? The Russell 2000 continues to be the index to offer most for bulls as support of $162.50 held firm. The large white candlestick was supported by strong buying volume, but if anything, today's candlestick was *too* big and is vulnerable to getting pegged back tomorrow.

Technicals in the Russell 2000 weren't vastly improved by today's buying. The MACD still has its 'buy' trigger but didn't advance much. On-Balance-Volume has been trending down throughout September and October and today's buying, while welcome, didn't make a huge dent in that trend. The one real positive for this index is the continued improvement in relative performance to the NADAQ and S&P 500.

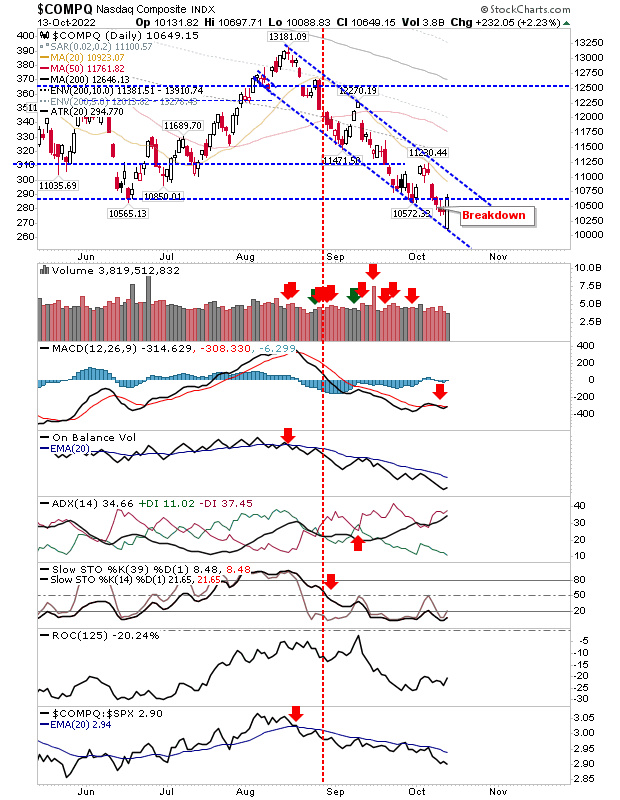

The NADAQ is trending lower within a well defined channel. Thursday's large gain managed to bring the index back to support marked by the June swing low, but it could do with some follow through tomorrow as an intraday reversal on Friday could lead some lasting damage. Technicals remain net negative, including a marked downtrend in On-Balance-Volume.

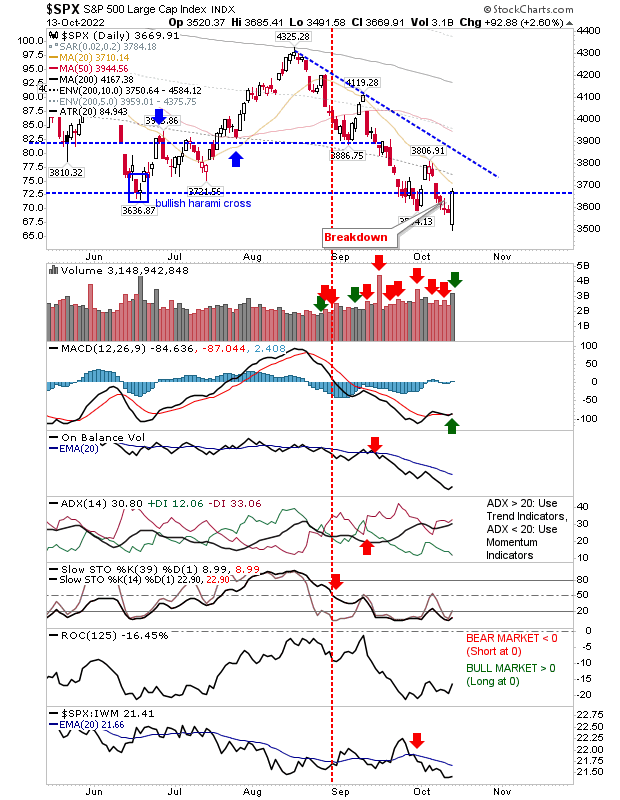

The S&P 500 mirrored the NADAQ in also closing on the June swing low. The one small difference was the fresh MACD trigger 'buy' (well below the bullish zero line, so it's a weak signal). Other technicals are firmly bearish.

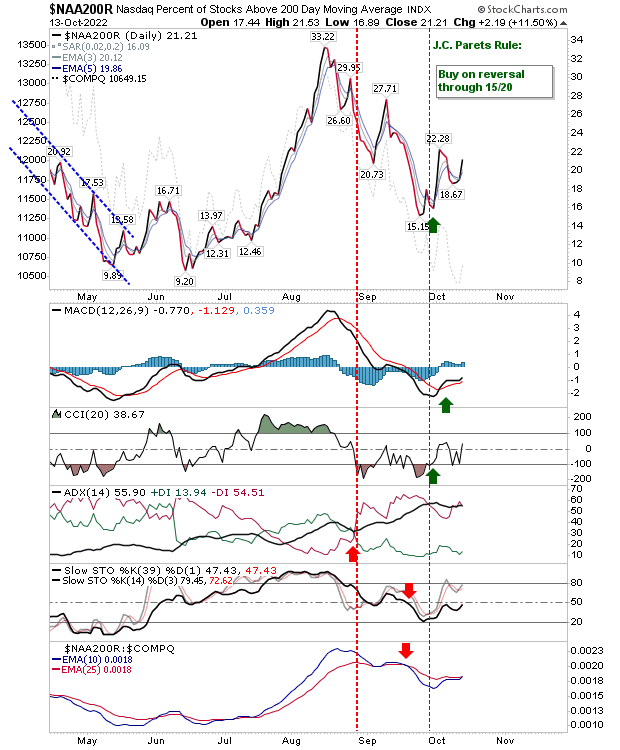

If there is a non-index chart to watch it's the Percentage of NADAQ Stocks above their 200-day MA. There is a sharp bullish divergence in this breadth metric relative to the index. If you are looking to buy tech stocks, screen for NADAQ stocks above their 200-day MAs.