November got off to a strong start early last week, and the rally broadened to include financial and retail stocks. But after a torrid six weeks of bullish behavior while ignoring (or perhaps reveling in) concerns about the global economy during, U.S. stocks encountered some strong technical resistance in the middle of last week, and it has continued into Monday. The Dow Jones Transportation Index continues to a drag on the overall market, and this segment will need to gather some enthusiasm if the broader indexes are to resume their advance. Nevertheless, seasonality and a strong technical picture have renewed bullish conviction, so the path of least resistance is still up.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market Overview

The title of this article might make a good verse for a new market-oriented Christmas carol. You are welcome to offer up your own suggestions (I can’t wait to see this, especially from the market Scrooges out there).

Friday brought us the first dose of holiday cheer from an economic standpoint when we learned that the economy added 271,000 jobs in October, the unemployment rate fell to 5.0%, and average hourly earnings rose 2.4%. The weak US employment report for September was seen as at least partially responsible for October’s global rally. So, the question is, will the strong October jobs report do the opposite?

In a classic case of good-news-is-bad-news, this terrific economic news appears to have been taken as a temporary sell signal by investors since it was perceived as a green light for unwanted changes to monetary policies. Actually, it’s not so much that the changes are unwanted as that it creates uncertainty about the ultimate impact of moving away from the long-standing ZIRP policy. After all, nothing is ever as simple as it seems. Any change in policy, whether fiscal or monetary, will have direct and indirect effects that are both positive and negative, and we can only guess as to what those might be.

So, investors took some risk off the table on Friday, and then Monday’s trading brought a continuation of the pullback, which market commentators blamed on weak Chinese trade data and a reduction in the OECD's global growth forecast.

But the reality from a technical (chart) standpoint is that the market simply became so overbought that it needed to stop for a breather. Any excuse would do. The big October rally began with short-covering as the major driver, and more recently was led by large and mega-caps that masked the persistently weak market breadth. It has been particularly hard this year to outperform the cap-weighted S&P 500 large-cap index.

Notably, ETFGI reported that exchange-traded funds listed in the U.S. have gathered a record $175 billion in net new assets this year, as of the end of October, with over $28 billion coming in October alone, which marked the ninth consecutive month of positive net inflows. Also S&P reported that ETFs in all U.S. sectors except Healthcare experienced inflows during the month, with Consumer Staples and Real Estate segments particularly strong, while Utilities and Energy were the most highly correlated internally (which makes sense given that these sectors are typically buffeted by macro issues).

Certainly, market participants are factoring in higher short-term rates and a further strengthening dollar, which are expected to negatively impact income-oriented companies (like REITs and Utilities) and export-oriented multinationals, as well as emerging market debtors (whose debt is usually repaid in more-expensive dollars). Indeed, immediately after the Friday jobs report, the 10-year Treasury yield popped while REITs and Utilities fell.

After the latest FOMC statement, the fed funds futures (which tend to be quite prescient) are now forecasting a 68% chance of a quarter-point rate hike at the December 16 meeting, while bond guru Bill Gross has asserted that there is a 100% chance of a December hike. On the other hand, Jeffrey Gundlach of DoubleLine Capital believes the Fed should hold off, noting that the implied inflation rate in bond pricing is near zero, the Goldman Sachs (N:GS) Financial Conditions Index sits at its worst level since the Great Recession, a strengthening dollar is badly hurting corporate earnings, and danger is growing in the high-yield credit markets.

Nevertheless, longer-term rates are indeed moving up. The 10-year Treasury yield closed Friday at 2.33%, which is up significantly from 2.06% just two weeks ago. However, there is an interesting observation about the yield curve’s response since the lows of October 14. The 2-year/10-year spread has remained steady at about 1.43 (2.33-0.90), while the 5-year/30-year spread has actually flattened from 1.56% (2.84-0.56) on October 14 to 1.35% (3.09-1.74) on Friday.

This flattening is probably not what many observers expected, but demand for higher-rate long-dated Treasuries remains strong, especially among foreign investors seeking the safety of the U.S. as the ECB and BOJ are hinting at additional QE. It is also worth noting is that this year is on pace to set yet another record for corporate bond issuance, with the biggest and strongest of corporations essentially getting the risk-free interest rate on their debt, which continues to fuel stock buybacks and M&A.

For my betting money, I’m from Missouri when it comes to the Fed actually boosting the fed funds rate in this global economic environment, as the adverse risks of tightening still seem to outweigh the positives. I’ll believe it when I see it. But even if they do, it will only be a token raise, and monetary policy will still remain loose for the foreseeable future.

The CBOE Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 14.33 and has been essentially straddling the 15 fear threshold. Then on Monday, VIX spiked 15% to close at 16.52.

We may be seeing the start of a rotation now that the Fed has the data to justify a rate hike -- and assuming that they choose to act -- with money moving from income and export-oriented stocks into growth. The rotation may also involve a movement from large caps into mid and small caps, and perhaps from NYSE listings into NASDAQ. This would be a formula that makes Santa Claus proud and investors happy, at least for the near term.

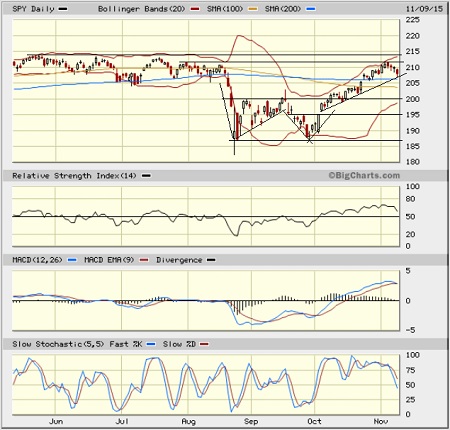

SPY chart review:

The SPDR S&P 500 Trust (N:SPY) closed Monday at 208 and remains above both its 50-day and 200-day simple moving averages. In fact, it came close to testing the 200-day intraday on Monday before getting a late-day bounce. The W-bottom formation off of 187 was a very bullish pattern, and indeed October was quite strong, leading to overbought conditions that needed to be worked off. As I expected, the August highs around 211-212 provided resistance. The pullback over the past few days has allowed oscillators like RSI, MACD, and Slow Stochastic to begin their cycle down, but that doesn’t mean they have to cycle all the way back to oversold territory. Ever since the gap up on October 5, there is an uptrend line forming that connects the subsequent daily lows, and Monday’s action shows that the uptrend line also provided support, along with the 200-day SMA. This uptrend line may be forming a bullish wedge as it approaches resistance at 212 that will likely resolve to the upside. Next resistance is the summer high near 214. Support resides at the 200-day and 100-day SMAs, previous support at 204, followed by the 50-day SMA and the round-number 200 level (corresponding to 2,000 on the S&P 500), and then the gap up from 195.

Latest sector rankings:

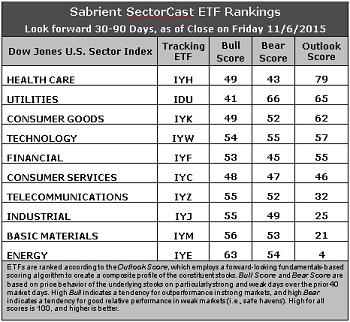

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (N:IYF), Technology (N:IYW), Industrial (N:IYJ), Healthcare (N:IYH), Consumer Goods (N:IYK), Consumer Services (N:IYC), Energy (N:IYE), Basic Materials (N:IYM), Telecommunications (N:IYZ), and Utilities (N:IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Healthcare remains in the top spot this week with an Outlook score of 79, despite the turmoil among biotechs. Although none of its factor scores are particularly notable, it displays a solid forward long-term growth rate and return ratios, and relatively good sentiment among Wall Street analysts (net revisions to earnings estimates). Even though the overall trend continues to be skewed toward reductions to forward estimates in all sectors, a lack of cuts, even without a strong upside bias, earns a sector a good relative score. Largely because of this, Utilities remains in second with a score of 65, primarily boasting a relatively low forward P/E. Consumer Goods (Staples/Noncyclical), Technology, and Financial round out the top five, followed by Consumer Services (Discretionary/Cyclical). Notably, Industrial continues to fall in the rankings. Financial still displays the lowest forward P/E (about 15.2x), which is just slightly better than Utilities, while Technology has the highest forward long-term growth rate and Telecom the best (or least negative) Wall Street sentiment.

2. Energy remains at the bottom with an Outlook score of 3 as the sector scores among the worst in most factors of the GARP model, although the sell-side has lightened up on the barrage of downward revisions. In particular, the sector still shows an increasingly negative forward long-term growth rate and low return ratios, as well as the highest forward P/E (which is now over 27x). Basic Materials takes the other spot in the bottom two with an Outlook score of 21.

3. Looking at the Bull scores, Energy tops the list with a 63, while Utilities is the lowest at 41. The top-bottom spread 22 points, which reflects low sector correlations on particularly strong market days, which is good. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities displays the top score of 66, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. Healthcare now scores the lowest at 43, as investors flee this sector during market weakness. The top-bottom spread has surged to 23 points, which reflects low sector correlations on weak market days, which is good. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Utilities and Healthcare display the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. However, looking at just the Bull/Bear combination, Energy is by far the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Healthcare is the worst.

6. I must say, this week’s fundamentals-based Outlook rankings have taken a defensive turn, although I will still categorize them as neutral, with defensive sectors Utilities and Consumer Goods (Staples/Noncyclical) in the top three and Telecom rising, plus falling scores for economically-sensitive sectors Technology, Consumer Services (Discretionary/Cyclical), and Industrial. Also, the constant flow of negative earnings revisions from Wall Street is unsettling. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stocks And ETFs

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), maintains a bullish bias and suggests holding Energy, Technology, and Financial, in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs in SectorCast from the Energy, Technology, and Financial sectors include IQ Global Oil Small Cap ETF (N:IOIL), SPDR S&P Software & Services ETF (N:XSW), and iShares US Regional Banks (N:IAT). Other highly-ranked ETFs in our quant model include US Global Jets ETF (N:JETS), which is mostly airlines, plus the First Trust LongShort Equity ETF (FTLS), which employs an absolute return strategy that licenses our Earnings Quality Rank (a quant model we developed together with our forensic accounting subsidiary Gradient Analytics).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Energy, Technology, and Financial sectors include Western Refining (N:WNR), Rowan Companies plc (N:RDC), Adobe Systems (O:ADBE), VeriSign (O:VRSN), Signature Bank (O:SBNY), and PacWest Bancorp (O:PACW). All are highly ranked in the Sabrient Ratings Algorithm and also score among the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of Sabrient subsidiary Gradient Analytics.

If you prefer to take a neutral bias, the Sector Rotation model suggests holding Healthcare, Utilities, and Consumer Goods (Staples/Noncyclical), in that order. But if you prefer a defensive stance on the market, the model suggests holding Utilities, Technology, and Consumer Goods, in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.