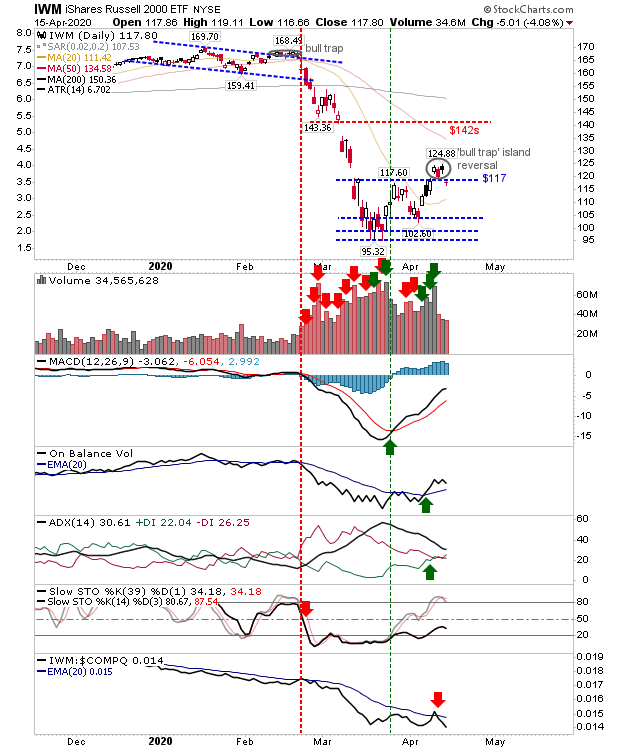

A mixed bag of action yesterday for the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) as bears created a 'bull trap island reversal' on the break—and subsequent move below $118. It was a move which ran contrary to what's happening in the S&P and NASDAQ.

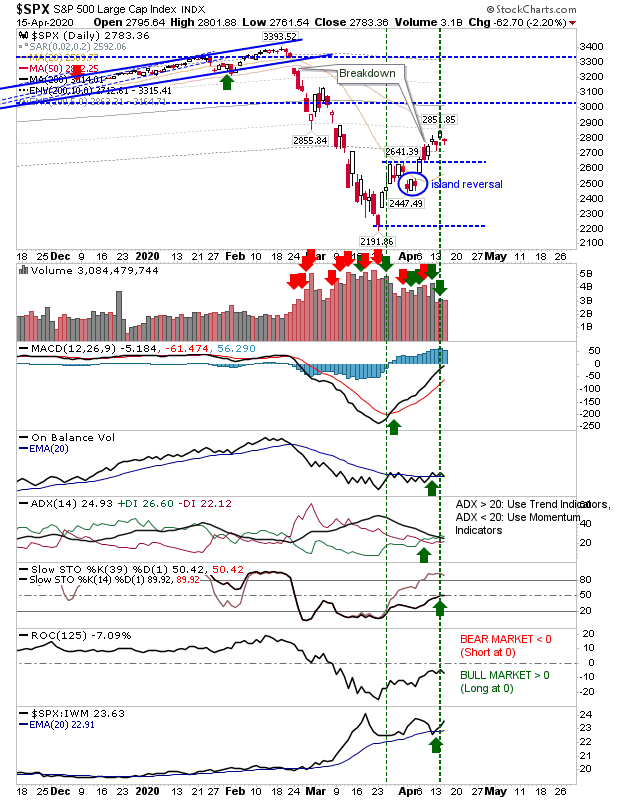

The S&P didn't give up its breakout and if it wasn't for the bearishness in the Russell 2000, yesterday would have ranked as a very ordinary day. If the Russell 2000 can't recover then the likelihood of the S&P bounce failing becomes a lot higher. Technicals are still net bullish.

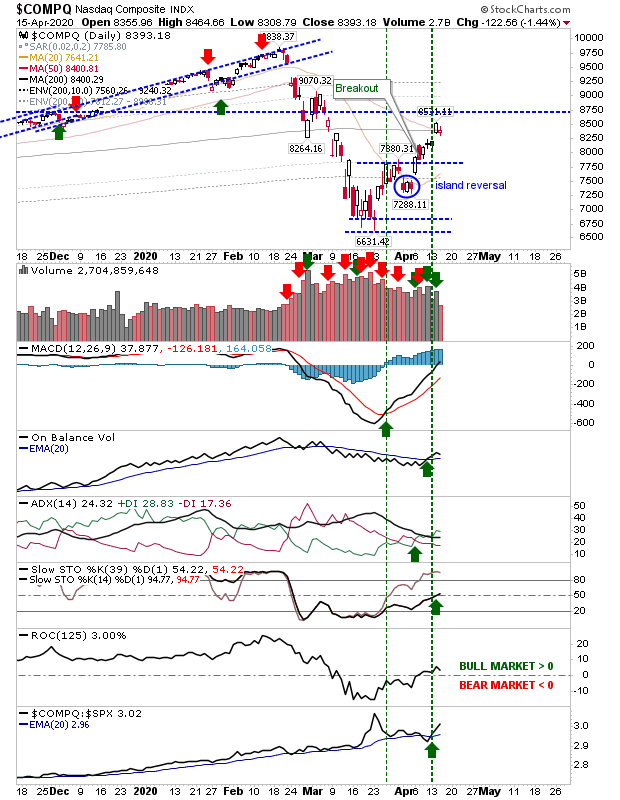

The NASDAQ held on to support of the 50-day and 200-day MAs and is the bulls best chance of returning to February highs. Assuming this rally holds then the next challenge is the swing high of 9.070. Again, in itself, there is nothing bearish in current NASDAQ action—it's just the Russell 2000 is putting a spanner in the works.

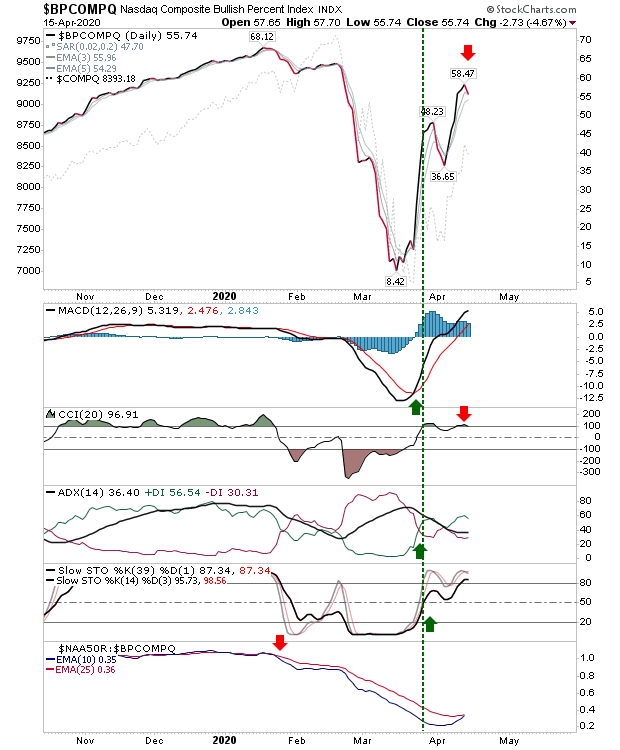

It is also interesting to see the Percentage of NASDAQ Stocks on Bullish Percent Buy signals near levels last seen pre-crash in February.

Small Caps have diverged from Tech and Large Caps. There can only be one winner; either this goes the way of Small Caps and and all indices drift lower, or Large Caps and Tech indices drag Small Caps by the scruff of the neck and move higher. It was Small Caps diverging from indices in the early part of 2020 which helped set things up to be worse than they might have otherwise have been. Is this situation repeating again?