T2108 Status: 56.9%

T2107 Status: 56.0%

VIX Status: 13.4

General (Short-term) Trading Call: Neutral.

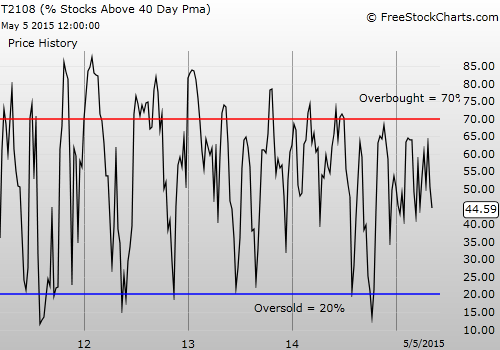

Active T2108 periods: Day #136 over 20%, Day #95 above 30%, Day #39 above 40% (overperiod), Day #1 under 50% (underperiod), Day #5 under 60%, Day #205 under 70%

Commentary

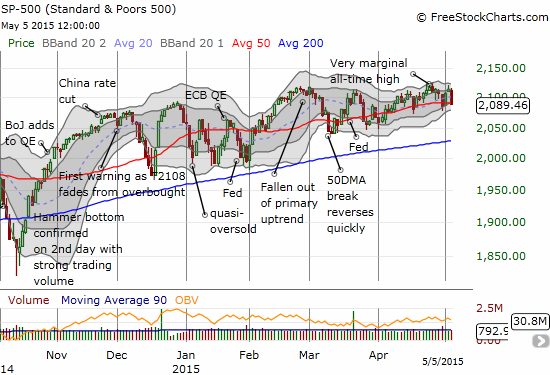

I have almost felt like a broken record since November/December whenever I note that the S&P 500 (via ARCA:SPY) is trading in a chopfest. Yet, “chopfest” is exactly the perfect description for this trading action even as the index steadily creeps higher along its 50DMA support.

The S&P 500 has gone almost nowhere since the chopfest began in November – yet the uptrend from the 50DMA has lasted the entire time

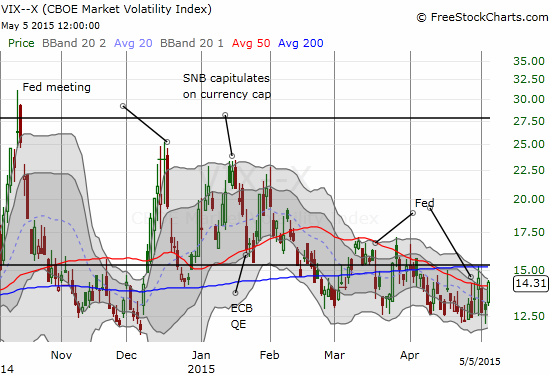

During this chopfest, volatility has made some big moves. However, for almost three months, volatility has remained relatively mute. It is very easy to get lulled asleep here, but I would say volatility is becoming a coiled spring at this point.

Is the VIX coiling for another jump higher?

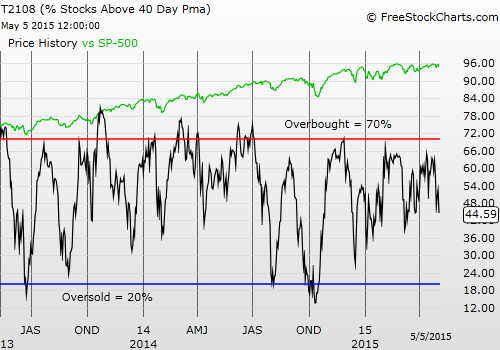

Although the S&P 500’s 1.2% decline just reversed Friday’s one-day surge, T2108 has moved to a fresh 5-week low. At 44.6%, I find myself thinking about oversold conditions again…and I know NOT to get too excited. Yet, the extended decline of T2108 relative to the S&P 500 has me wondering whether a bigger breakdown is finally around the corner. I have not yet acted on this suspicion.

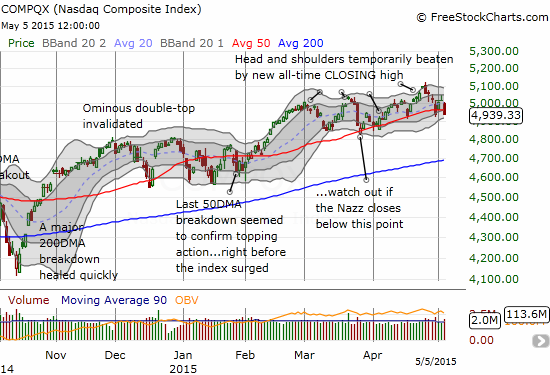

The 50DMA has also acted as support and a magnet for the NASDAQ (via NASDAQ:QQQ). The trading has been better-behaved than on the S&P 500.

The NASDAQ is also following along its 50DMA

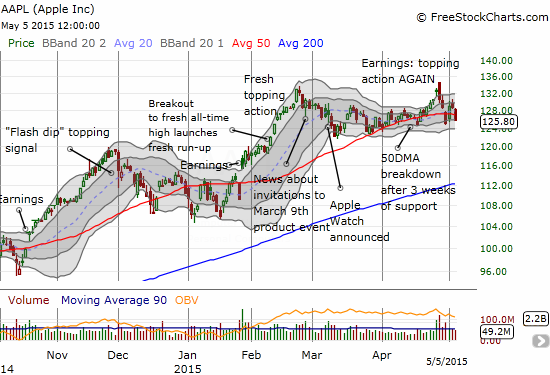

So it should not comes as a surprise to note that Apple (NASDAQ:AAPL) continues to pivot around its 50DMA. This trading behavior has easily dominated the Apple Trading Model (ATM) for many weeks now. A potentially large caveat arrived today in the form of a DECLINE in the 50DMA. If AAPL does not pick up the pace soon, this loss of momentum could feed on itself – especially given the stock has failed to generate much post-Watch momentum and excitement. The latest topping pattern is looming ever larger at this point: the post-earnings “gap and crap” combined with a bearish engulfing pattern.

Apple may be losing momentum as the 50DMA begins to turn downward

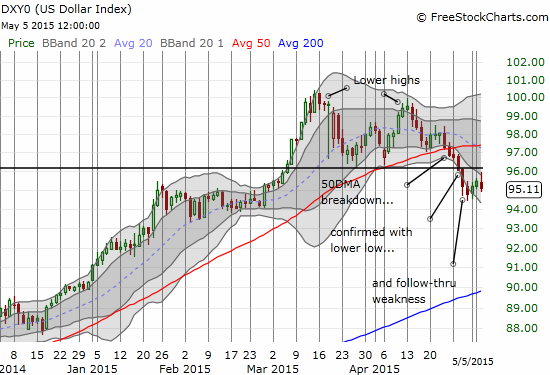

The dollar index is looming as a bigger and bigger wildcard. The primary uptrend at the 50DMA has ended and given way to a confirmed breakdown. Yesterday (May 5) the index attempted to rally but stopped cold at resistance which was former support.

The dollar index is slowly breaking down. Can it recover its former luster?

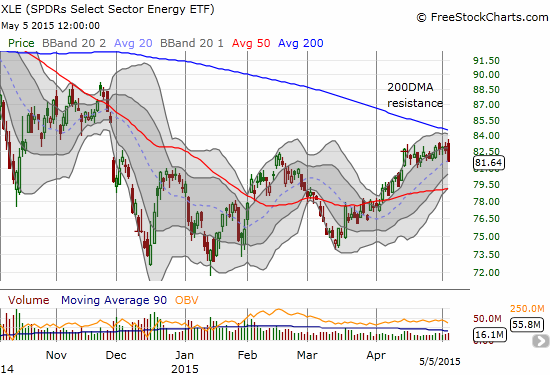

The dollar’s new weakness has potentially large implications for commodities and emerging markets. Oil in the form of United States Oil ETF (NYSE:USO) is continuing its rally. However, a STRANGE thing happened today. While USO gapped up, Energy Select Sector SPDR ETF (ARCA:XLE) failed to hold onto its opening gains. The volume was not high, but the price action looks like the end of a move. With oil sapping away the consumer surplus that economists have been waiting to get applied to the economy, several economic assumptions and inflation forecasts may need adjustment soon.

Which oil play will blink and lead the other one?

United States Oil ETF (USO) gapped higher as oil continues its rally from its recent bottom…

The rally for Energy Select Sector SPDR ETF (XLE) may have just ended for now.

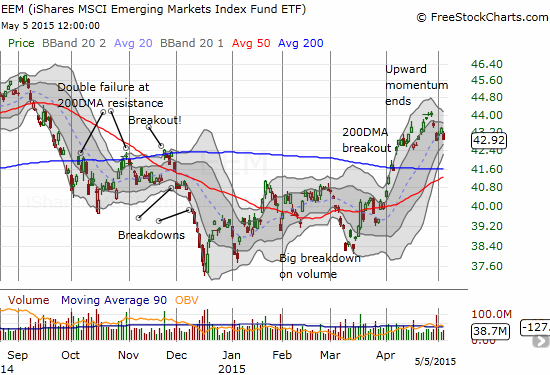

I took this divergence as a signal that dollar-related/sensitive bets could be ready for a big move. I made a big bet on my favorite hedge play: iShares MSCI Emerging Markets (ARCA:EEM). I am weighted to the bearish side, and I extended out the typical trade with puts expiring in June and calls expiring in July.

iShares MSCI Emerging Markets (EEM) takes a long overdue rest

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Disclosure: long EEM calls and puts