Stocks finished the day mostly higher, with the S&P 500 advancing by roughly 0.50% and the NASDAQ 100 up about 0.25%.

There was an unusual rotation within the S&P 500, with 436 stocks ending higher and just 66 lower. It’s peculiar to see such rotations and have the index increase by only 0.50%.

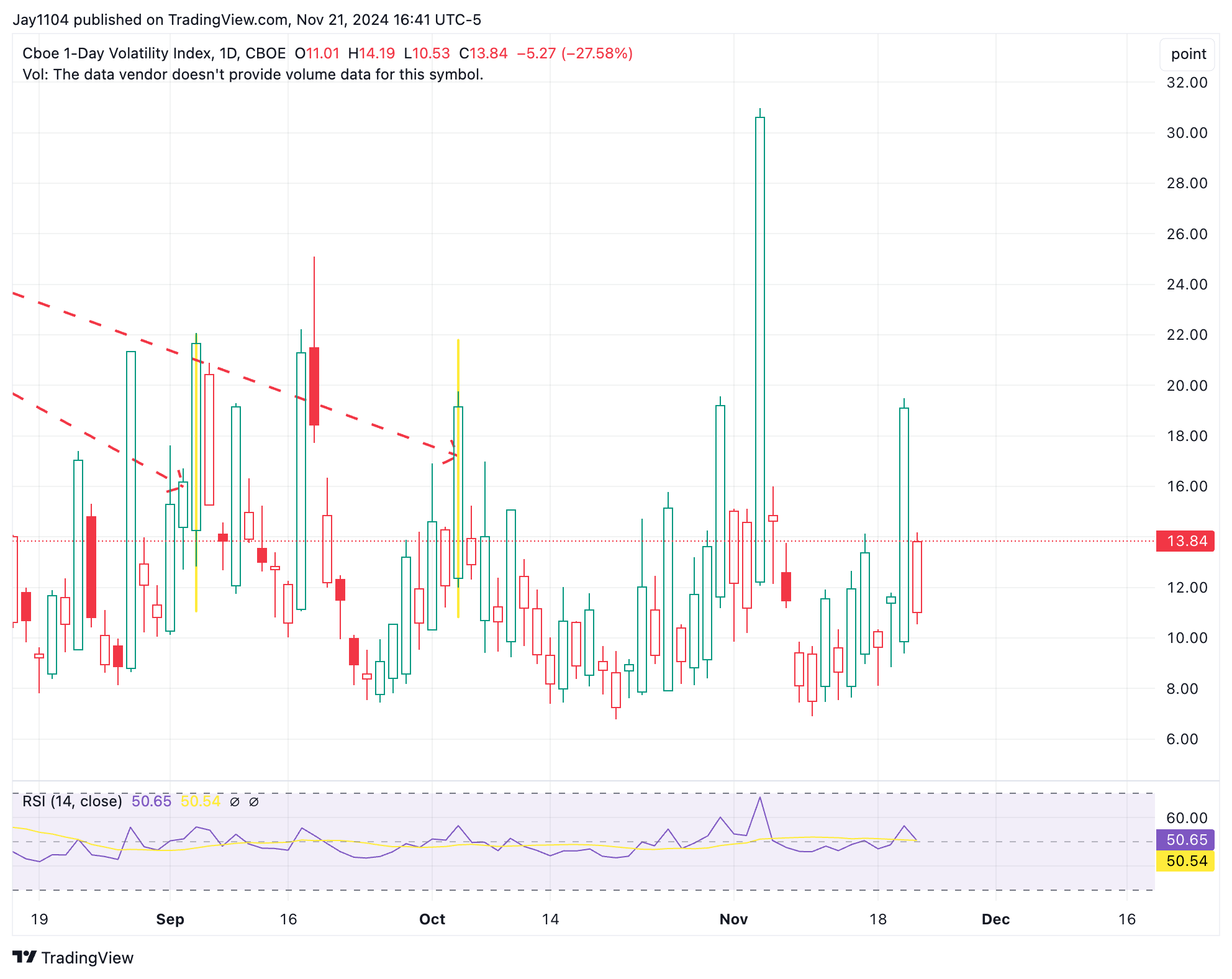

This suggests that something mechanical might have been at play, possibly a sharp decline in short-dated implied volatility following the reset after Nvidia’s (NASDAQ:NVDA) results.

The VIX 1 Day fell to 13.9 from yesterday’s close of 19.1.

Today, the HYG was relatively flat, suggesting a more muted trading mood in the market overall, unlike the significant rotational movements seen in the S&P 500.

Additionally, the 1-month implied correlation index rose today to 16.4, marking an increase over several consecutive days. Typically, the S&P 500 and the implied correlation index move in opposite directions.

However, in an unusual turn of events, both the S&P 500 and the implied correlation index have risen together over the last four days.

This suggests that underlying dynamics in the equity market might not be as bullish as recent days have portrayed. To this point, the S&P 500 has closed the gap from November 14 and appears to have formed a megaphone pattern, which could be interpreted as bearish. We need to be mindful of the possibility of a break lower, potentially falling below 5850.

In the meantime, the dollar index is on the verge of breaking above the highs last seen in October 2023. Should this occur, it could pave the way for the DXY to climb to around 109.

Finally, 2-year inflation swaps continue to rise, increasing by another 1.2 basis points to 2.71% today. This strongly suggests that rates will climb even higher. I anticipate that rates across the curve will begin to rise very soon. Perhaps the market is waiting for the appointment of the Treasury Secretary for the Trump administration. However, for now, 10-year rates seem too low given the direction in which inflation expectations are headed.