Bristol-Myers Squibb Company (NYSE:BMY)

Bristol-Myers Squibb, $BMY, pulled back from a high in October to support and consolidated for over 3 months. After a quick touch at the 200 day SMA, it then started higher, finding resistance in the middle of February. It pulled back from there, through prior support and kept going lower until finding support at the end of April. It has consolidated since under resistance. Friday saw it back at that resistance with the RSI rising near the mid line and the MACD moving up toward zero. Look for a push over resistance to participate higher…..

Deere & Company (NYSE:DE)

Deere, $DE, started higher in August last year, reaching a peak in February. It pulled back from there in a channel through the 200 day SMA and finding support in early March. Since then it has made two legs higher, with short bull flags following them. A third leg is about to begin. The RSI is rising and bullish with the MACD moving up and positive. Look for continuation to participate higher…..

Green Dot Corporation (NYSE:GDOT)

Green Dot, $GDOT, consolidated under resistance for 4 months before breaking to the upside. It held the break, consolidating for 6 weeks before dropping back and closing the gap. Another 6 weeks of consolidation and then it gapped higher to a new all-time high in May. Since it has consolidated in a bull flag. The RSI is in the bullish zone and has pulled back from an overbought condition. The MACD is also pulling back from an extreme. Look for a break of the flag to the upside to participate higher…..

Intel (NASDAQ:INTC)

Intel, $INTC, started to move higher in September last year. It was fast and steady at first but then got choppy from November. Recently it has been consolidating under resistance. The RSI is steady in the bullish zone with the MACD flat but positive. Look for a break higher to participate…..

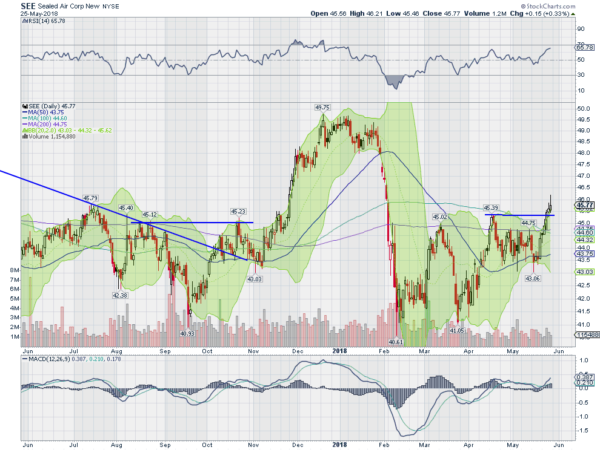

Sealed Air (NYSE:SEE)

Sealed Air, $SEE, pulled back from a top in January, finding support at the September low. It rose to the 200 day SMA from there and then retested the low in March. Since then it has made a higher high and a higher low at the 50 day SMA. Last week it moved up to another higher high. The RSI is rising and bullish with the MACD positive and moving up. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into Memorial Day Weekend, the unofficial start of summer, sees equity markets remaining in consolidation.

Elsewhere look for Gold to possibly confirm a reversal higher while Crude Oil pulls back hard in the uptrend. The US Dollar Index looks to continue to move to the upside while US Treasuries race higher in the short term. The Shanghai Composite looks to have resumed the downtrend and Emerging Markets continue to hold over support, marking time.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Despite that good news equities continue to plod along sideways mainly. The longer timeframe remains constructive with the IWM leading in the shorter timeframe but the QQQ looking to catch up. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.