By Clement Thibault

In just a few days, it’s conceivable that the European Union’s political and economic future could be reshaped by this Thursday’s scheduled UK referendum vote regarding whether Britain should retain membership in, or exit, the EU. Popularly known as ‘Brexit’ – shorthand for Britain Exit—the vote outcome could have far-reaching consequences for not just the British and Eurozone economies, but also for global currency and equity markets in particular.

Over the course of three articles, two of which were published last week, we’re taking a deeper look at what the vote means for all involved. Today’s article describes the affect the vote might have on global and UK stocks. Part I, Brexit: Everything You Need To Know (But Were Afraid To Ask), offered an over view of reasons for the referendum; The second installment, Brexit: Everything You Need To Know, Part II: The FX Effect, considered the consequences either a remain or leave outcome might have on major currencies.

As discussed in our previous article, consensus opinion believes that if the leave faction wins the upcoming Brexit referendum, the pound sterling could see a devaluation of as much as 15-20%. Currency devaluations are often followed by a rise in the country's leading equities index.

This happens because the price of goods in the local currency decreases versus trading partners’ currencies, thereby making exports by local companies more attractive compared to imports of competitive goods. As a result, local company profits rise, which, for publicly traded companies, generally drives up the price of shares.

In the UK, the leading index is the FTSE 100, a stock index of the 100 largest companies—based on market cap—listed on the London stock exchange. Similar to the US’s S&P 500, where companies such as Apple (NASDAQ:AAPL) or Alphabet (NASDAQ:GOOGL) are traded, the FTSE 100 is made up of such high profile companies as Royal Dutch Shell A (LON:RDSa), HSBC (LON:HSBA), and British American Tobacco PLC (LON:BATS), to name a few.

FTSE Could Rise, Sectors Might Suffer

Though the UK's equity market could plummet immediately after the vote if the Leaves win, a currency devaluation might cause it to rise in the medium-term, as a Brexit takes effect. However, some companies will still bear the brunt of the change in, or nullification of, trade agreements. A breakdown by sector better illustrates the possible consequences.

For starters, the repercussions of Brexit on UK companies depends on how long it will take for the UK to renegotiate with the EU and other trade partners, as well as how the transition period might play out. A report by the Atradius Group found that sectors most likely to be hurt by a Brexit include Mineral Fuels, Chemicals, and Manufactured Goods. Companies within these niches all export more than half of their total output to the EU, making them extremely vulnerable should a trade stoppage occur. The Oil & Gas segment, considered a sub-sector of the Chemicals industry, exports 77% of its output to the EU.

Companies which provide services rather than goods—currently about 80% of the UK economy—are also very much at risk. London is now the biggest financial hub in Europe, and it exports about a third of its total services to the EU. Additionally, many EU investment banks have London headquarters, which would have to be moved.

According to the Wall Street Journal:

“In addition to short-term market turmoil and share selloffs, analysts say, a UK exit would trigger one-off restructuring costs for investment banks in London who may have to relocate their London hubs, could sour banks’ loans to pan-European companies which could face new trade restrictions and generally damp demand for credit.”

As a result, bank stocks including France’s Societe Generale (PA:SOGN), Germany’s Deutsche Bank (DE:DBKGn), and even the US’s JP Morgan Chase (NYSE:JPM) could take a hit. Even UK-headquartered commercial lenders such as Royal Bank of Scotland (NYSE:RBS), Barclays (NYSE:BCS) and Lloyds (NYSE:LYG) might see a ‘moderate impact’ notes the Financial Times.

While new trade agreements are being ironed out, it is expected that accords on services will be more difficult to mediate due to their fluidity and intangible characteristics. Thus, services in general—and financial services in particular—are more likely to be frozen out of the EU for a longer period of time; It’s even possible that not all services will eventually gain access to the EU's single market.

FTSE 100 multinationals, such as GlaxoSmithKline (NYSE:GSK) and Unilever (NYSE:UL) are expected to be less effected by Brexit, as their businesses are simply not as dependent on the EU market.

GSK, for example, has a presence in more than 150 markets, has a network of 89 manufacturing sites, and has large R&D centers in the UK, US, Belgium and China. Unilever has a presence in 190 countries. Only 7,500 of its total 170,000 employees are based in Britain.

Both companies are not especially exposed or vulnerable to the UK market. At best, a sympathy drop in shares would allow an investor to buy these stocks at a discount.

Bigger Hurdle for FTSE 250 Companies

Smaller export companies—relying on the proximity of the EU and the opportunity of unlimited access to its larger market for expanding their businesses—are much more likely to suffer from Brexit. According to a ParcelHero report, the typical small and medium sized enterprise that imports and exports to the EU should expect to spend about £163,000 (about $231,000 USD) extra annually, should the UK leave the Union.

On top of that, recent analysis from Credit Suisse reports that components of the FTSE 250 earn, on average, about 50 percent of their revenue in the UK, leaving these companies much more exposed to domestic headwinds, as compared to the larger-cap FTSE 100. Goldman Sachs has highlighted 10 companies which they believe could be heavily damaged by Brexit; Nine, including Bovis Homes (LON:BVS), Persimmon (LON:PSN) and Intu Properties (LON:INTUP), operate in the Real Estate industry. The tenth, Travis Perkins (LON:TPK), is in the building supply and construction business. None of this is surprising, considering their domestic exposure.

Therefore, while the FTSE 100 might be able to withstand Brexit, the hurdle could be much harder to overcome for FTSE 250 companies.

As can be seen in the chart above, the FTSE 250 has been in turmoil since the beginning of 2016. The index was testing support levels in January and February of this year.

The next support level not yet broken is at around 14000, or about 2400 points lower than today. This would constitute a loss of approximately 15% from current prices, a reasonable expectation.

Lower than that would put the price at 12000, erasing almost a third of the value of the listed mid-caps. Should this occur, it would be a different game altogether. That being the case, investors are warned that small and mid-caps are probably best left alone for the coming month.

In addition, it’s always wise to diversify holdings, but in the face of the potential uncertainty and possible instability a Brexit might cause, it’s a must-do. A blend of large cap American stalwarts such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Exxon (NYSE:XOM), to go along with your FTSE stocks, could help weather the storm.

Hedge funds have recently increased holdings in such UK-based companies as Vodafone (NASDAQ:VOD), SKY (LON:SKYB), ARM Holdings (NASDAQ:ARMH) and Rio Tinto (NYSE:RIO). Bear in mind, off course, that every portfolio is different and there is no one-size-fits-all solution.

If you are extremely worried about the possibility of Brexit and its global economic implications, you may want to add in some gold, which tends to rise during risky periods.

Conclusion

Most recent polls indicate that the UK voter base is split right down the middle, which means a Brexit could be a real possibility. As of this writing, The Financial Times’ "poll tracker" shows the 'Leave' and 'Stay' campaigns are evenly split at 44%, with 12% undecided. Only a minority of polls in the last month have recorded a difference of more than 5 percent between the two campaigns, and almost all show there’s at least a 10% margin of undecided voters.

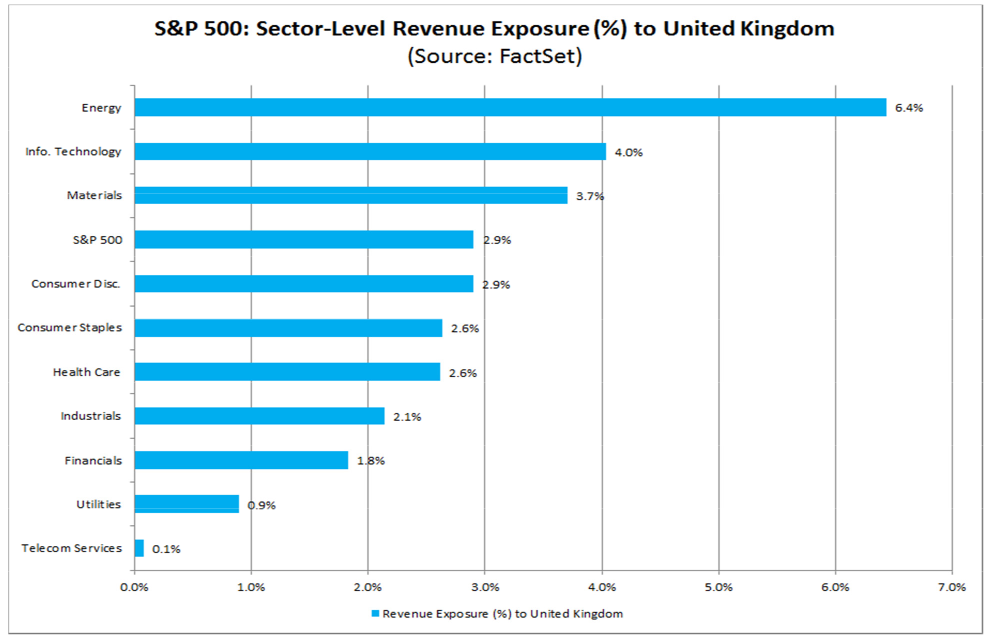

Will an exit change anything on the U.S. stock market front? According to the chart below, from Factset, S&P 500 companies have limited exposure to the UK:

But, as mentioned previously, there is absolutely no way of knowing how things will actually play out on June 23rd—or afterward. The level of the stakes involved is much higher than for any individual portfolio, company, or country for that matter.

Based on available data, we can try and predict consequences but of course there are no guarantees. Investors have been unsettled about Britain since the referendum announcement, so it’s likely that some panic moves in stock markets could occur should the UK vote to leave the EU.

As always when it comes to financial markets, being knowledgeable and acting prudently can help investors and traders make more intelligent decisions when the time comes.

Editor's Note: Return to Part I, here. Return to Part II, here.