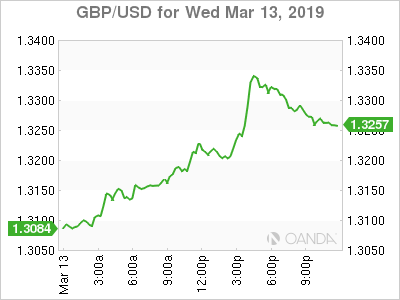

- Brexit – Parliament votes to reject No-Deal Brexit anytime

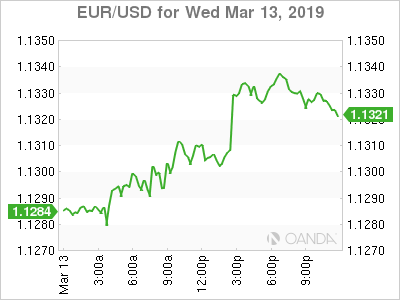

- USD – Dollar sinks as risk appetite dwindles

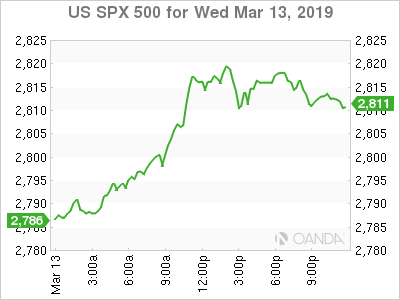

- Stocks – S&P 500 recaptures 2,800 but well-off highs after FAA reverses stance on 737s

- Treasuries – Demand falls on 30 year

- Oil – Extends gain as the dollar remains under pressure

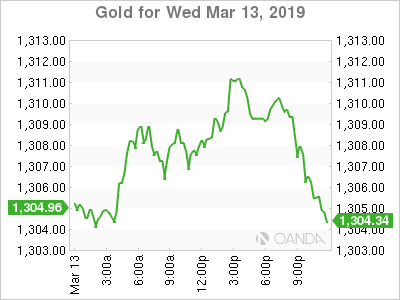

- Gold – Gets groove back as dollar declines

Brexit

Today’s Brexit votes went mostly as planned as Parliament declared the UK will not leave the EU without a withdrawal deal in place. Expectations are for tomorrow’s vote see an extension for Article 50 and the British pound could continue to rise if the extension receives EU approval and is 2-months and not over a year.

Parliament rejected a no-deal Brexit in any scenario by a 312-308 vote. After yesterday’s defeat, the PM May’s days appear numbered. Her Brexit deals have lost by a historic 230 votes and 149 votes. She may try to push a third Brexit deal by March 20th and that would be expected to fail. The next course of action would probably a confidence vote that could mean the end of her term.

USD

The US dollar fell against most of its trading partners as supportive monetary policy and stabilizing global growth concerns suggest the demand for safe-haven currencies could ease. Tonight, Chinese data could confirm the weakness is slowing with the world’s second-largest economy. The February reading for industrial production is expected to decline from 6.2% to 5.6%, while retails sales could fall from 9.0% to 8.2%. Fixed assets are more of a leading indicator and could see an improvement from 5.9% to 6.1%. The recent pickup could be helped by the massive bond issuance by the local Chinese government.

Stocks

Same story, different day. US stocks were supported early in New York on improving producer price data and durable good orders. The economic releases suggest that the Fed’s policy is appropriate and the dovish pivot remains in place. The S&P 500 index rallied above the psychological 2,800 level and at one point over the 2,817 resistance level that was in place since October.

Stocks did see a quick reversal once President Trump broke the news that US would ground all of Boeing’s 737 Max aircrafts. The move initially dragged the Dow Jones Industrial Average sharply lower along with Boeing (NYSE:BA) shares, as this was viewed as a major reversal from the Federal Aviation Administration. The Boeing news did take S&P 500 index tentatively below the noted 2,817 level and for momentum traders to remain bullish we may need to see price finish the week above here.

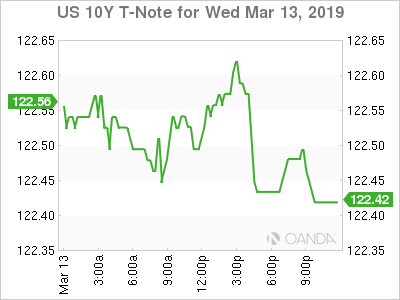

Treasuries

A soft US 30-year auction for primary buyers saw weaker demand than the 10-year auction from earlier in the week. The $16 billion auction helped drive yield higher across the Treasury curve with the 10-year rising 2 basis points to 2.621%. The recent trend with yields have been lower over the past 10 days and today’s rise supports yield curve steepening. Concerns over the US deficit and debt ceiling may be reflected in falling demand for longer-term debt. The Fed’s put is likely to keep yields down, but US debt concerns will grow in the summer.

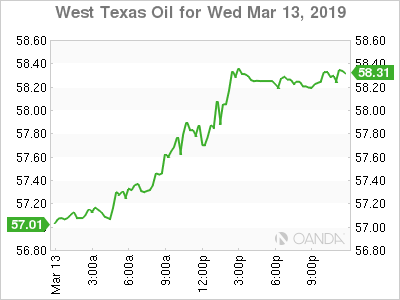

Oil

The EIA report was very bullish for oil prices. The weekly EIA release showed a decline of 3.9 million barrels from the prior week, well below the median estimate of a build of 3.0 million barrels and exceeding the lowest estimate which called for a decline of 2.7 million barrels.

Oil prices may remain bid as improving demand appears to be driving inventories lower. Rising US production concerns appear to be offset by the production cuts being delivered by OPEC and friends.

Gold

Gold prices continued to rise from a major support base as the dollar fell and despite US stocks hitting a four-month high. Stabilizing US data supported the overall risk-on trading environment for commodities and uncertainty with US-China trade deal remains a key catalyst for the precious metal.

Yesterday, subdued inflation helped the yellow metal recapture the $1,300 an ounce level. As more central banks become dovish or pessimistic with their economic forecasts, gold may be poised to rise higher.