Global equity markets have turned sour as the energy sectors stumble on crude oil’s decline on the fallout from both the Baker Hughes rig count and Iran capitalising on their exemption from the OPEC output deal to increase output. However, suspicion continues to run high ahead of January 13 meeting that OPEC ‘capacity to reach an irrevocable agreement to limit production is questionable. It appears the combination of the above factors has cleared out a sizable portion of weaker long oil patch positioning.

Add Brexit to the list of the main sentiment drivers as sterling moved to a ten-week low in response to PM May’s warning on EU unity. Traders are now dialled in on the Supreme Court ruling, which will decide if parliamentary approval is needed to trigger Article 50. The critical outcome may come as early as this week.

Also, the Brexit narrative has contributed to market apprehension and added to sour Global Risk sentiment.

The G-10 reactions have been more a position circumstance than anything else has, as forex dealers have been unable to find a comfort zone this year. Despite turning the 2016 yearbook with a strong USD slant, there has been a reluctance for traders to add to dollar longs as fear and uncertainty over the incoming US administration policy mounts.

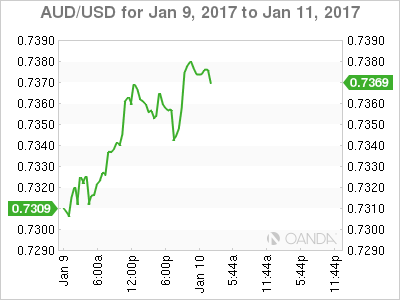

Australian Dollar

The Australian dollar benefited from both the strength in industrial commodities and lower US bond yields, as the USD weakened across most G10 currencies overnight. I suspect the limited USD follow through on the inflationary US Average Hourly Earnings has spooked some. In addition, the AUD has benefited from some yield-seeking flow as investors look for a shelter as uncertainty begins to mount. In the span of 24 hours, we have gone from a high USD rate hike bias to one where there is growing global political reasons for keeping rates lower for longer, leaving traders with a lot to iron out.

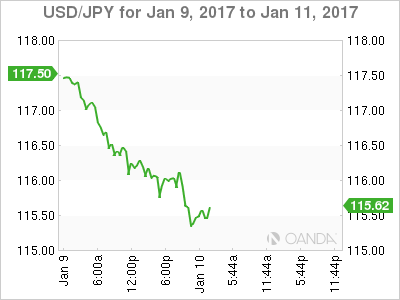

Japanese Yen

A combination of NFP profit-taking, ten-year US Treasury yields dropping to 2.37 and Brexit induced risk off Jitter repricing has seen the USD/JPY drop to 115.80 in early APAC trade as some weaker stops were triggered on the break of 116.00. Given the market’s positioning, USDJPY is extremely susceptible to both weak US data and or risk off sentiment and overnight investors were keen to take shelter under the Yens umbrella as Brexit Cloud storms start to build.

However, I suspect when we look back in mid-February, this will likely be viewed as a hiccup as if the baseline US fiscal storyline plays out on cue ,US yields have much further to climb.

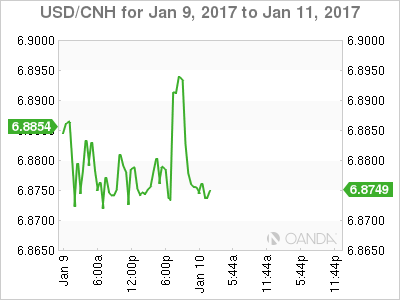

The front end of the interest rate curve eased dramatically on Monday with implied overnight funding rates offered between 10-14 % as such we saw a massive convergence between the CNY/CNH currency differentials that widened due to the massive short offshore CNH funding costs. Still, 14 % is hardly a walk in the park and overall conviction remains low as traders are in reevaluation mode trying to figure out their next move. Global uncertainty is adding to much discomfort on dealing desk this morning.

On a wing and a prayer ,Malaysia PM assured investors that the MYR would stabilise in coming days as he believes oil markets are in for better days. He also highlighted MYR’s decline was caused by factors beyond Malaysia’s control; the PM says and is a source of US interest rate hike and expectations, offshore market and excessive speculation. However, despite USD yields softening overnight, there continues to be little interest in going long MYR as investors view other ASEAN currencies more attractive to bank their risk.