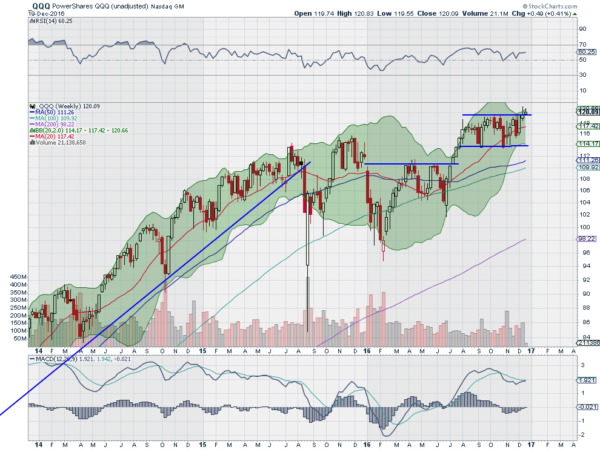

The Nasdaq 100 broke out to the upside last week. If you look hard you can see it in the chart below. Yes it was more of a timid tap on the roof and then realization that it broke. But technically it has happened. The upper shadow or wick of the second to last candle pushed up to a new high on the weekly basis. It did not hold up at the end of the week, but Monday saw the move back higher. In the pre-market Tuesday the price is continuing to the upside.

The Nasdaq 100 has been lagging since the election, continuing to consolidate at its highs from 2001 and the summer. 15 years of history should take some time to erase, so the long consolidation is not unusual. What was though was the speed of the S&P 500 and Russell 2000 moves without the Nasdaq 100. Is it ready to catch up?

The chart above suggest that may be the case, especially if it can hold the break out this week. That would give a target to the upside of 132. The Bollinger Bands® are opening to allow a move higher. The RSI is in the bullish zone. The MACD is turning back up and about to cross up. All of these indicators support a continued move higher. And a 12 point move higher would be only a subtle move in the QQQ’s of 10%, something the Russell 2000 did in just a couple of days. Fasten your seat belts. The Santa Claus rally may have begun in the Nasdaq 100 with that little tap last week.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.