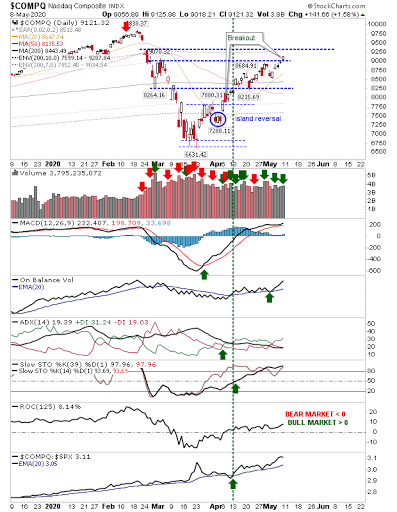

Do we have a resolution to the trading range with the NASDAQ now posting a new swing high for the March rally? Must be the 20 million job losses was considered better than the 22 million expected :(

Hard to fathom why the gains, but it's during times of doubt when substantial money remains on the sidelines that a gradual return to the market can fuel these rallies. Remember, trading volume from the middle of March to the end of that month was substantial and anyone who bought during that period will be sitting on profit and not likely keen to take profits—keeping supply tight.

Just to add to Friday's breakout in the NASDAQ, volume climbed to mark accumulation.

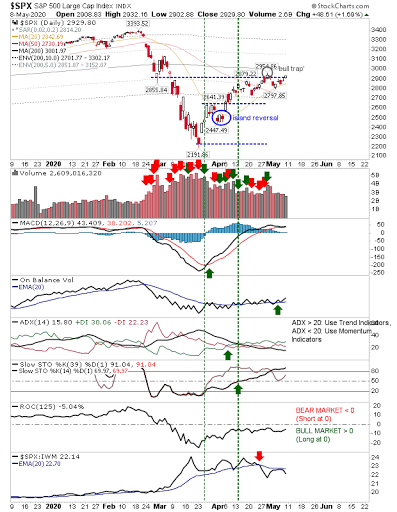

The S&P wasn't as lucky with the 'bull trap' still intact—although the NASDAQ sets a precedent for the other indices to follow. Compared to the NASDAQ, trading volume has been relatively light, but once money cycles back into this index it should help bulls.

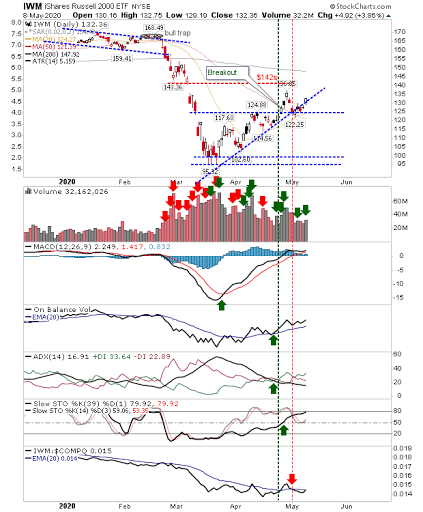

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) was able to bounce off support and is on the verge of a 'bear trap'—which is bullish for this index. As with the S&P, there isn't alot of trading volume going through this index—which is disappointing from a bull market stand point.

For next week, the NASDAQ is going to be the market lead. I can see the S&P following suit, even if it's just a flight to safety, so a breakout has a good chance of succeeding. But the Russell 2000 is a concern. It has so far been bypassed by bulls and this a little concerning. Buying volume needs to pick up.