The tough start to the week has seen much of this lost ground recovered, but getting to challenge highs is still some way off.

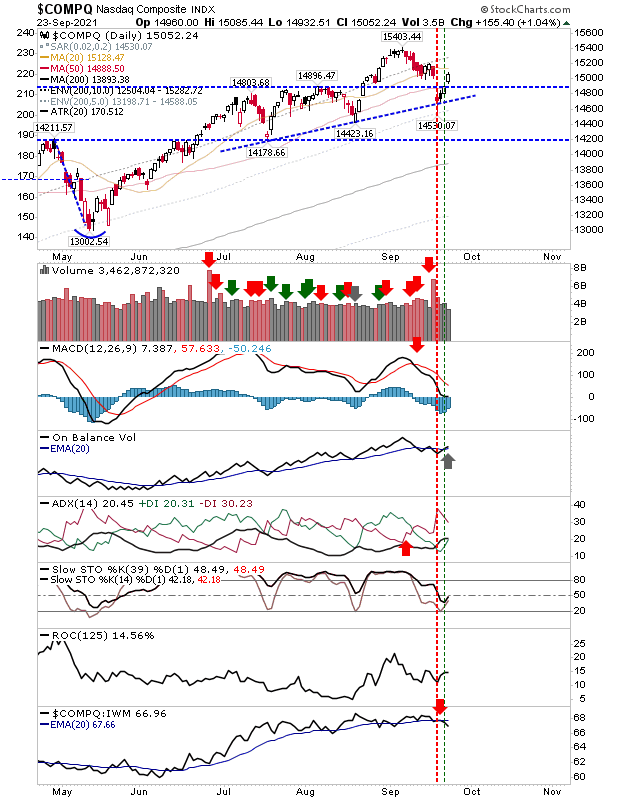

The NASDAQ is at least approaching its 20-day MA as technicals see a small recovery with a new On-Balance-Volume 'buy' trigger. The index did successfully defend support connecting the July and August swing lows, although it did suffer a relative performance loss against the MACD.

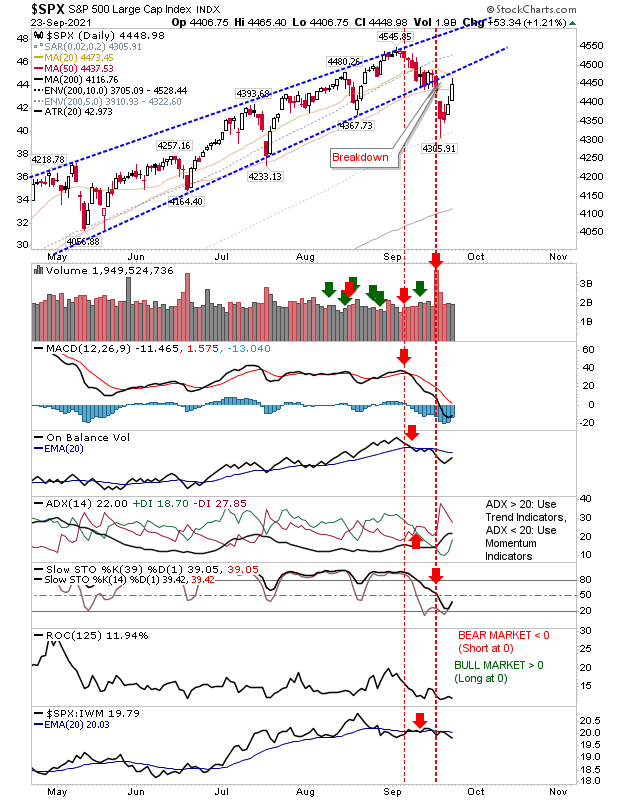

The S&P had already seen a breakdown from its rising wedge, so today's gain was enough to see it get back above its 50-day MA, but it wasn't enough to challenge former support - now resistance. Technicals are net negative. This looks likely to fail on the test of wedge resistance but let price action determine what happens next.

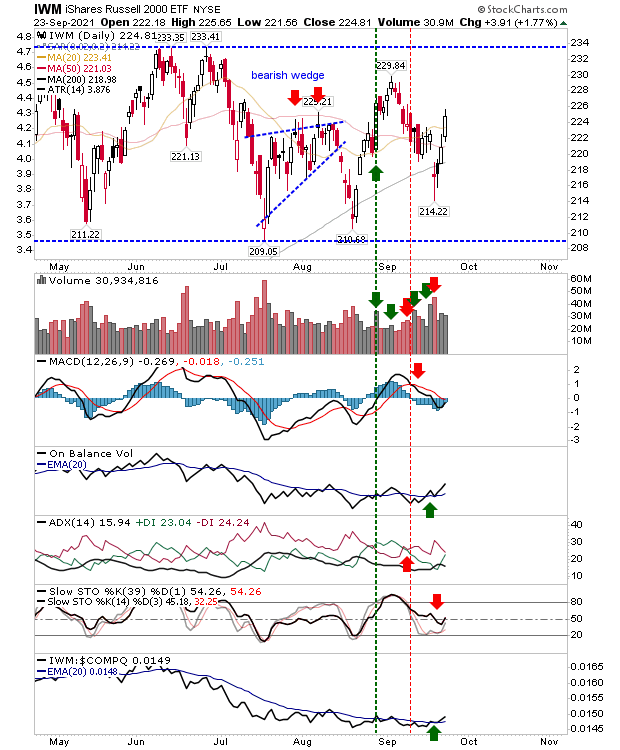

The Russell 2000 made a second test and bounce from its 200-day MA as it also made a move through its 20-day and 50-day MAs. The index remains range bound with mixed technicals - not surprising given this action.Until there is challenge of range support or resistance there is little to be read into the ebb and flow of daily price.

Going forward in the short term, we have to see how much influence the pattern breakdown in the S&P proves to be. It's going to be a few days, if not weeks, before the Russell 2000 resolves which way it's going to break. Given the extent of the rally from Covid-19 lows, don't be surprised if the net effect of the breadowns is just to push markets sideways for a while. It's easy to get sucked into the doom-and-gloom of the internet, but price action doesn't warrant that.