Investing.com’s stocks of the week

It is a new quarter and the way things are unfolding in Asia today one could feel confident that we are reliving Q1, where all the talking points focused on if we could sustain the gains in risk assets.

It is widely documented now that the move in Q1 was driven by an almost synchronized turn from central banks to ease financial conditions, improve liquidity and allow economics to turn. A sizeable bid in both nominal and real bond yields married with very dovish interest rate pricing structure has also been firmly in play and equities responded positively. A lack of volatility (vol) and any real trend in FX markets also helped, and the hunt for yield is on.

So, what takes us higher in equities is one major consideration, but for FX traders, perhaps the more pertinent question is what will create more intense and lasting vol.

A better feel to economic data

If we are going to see Q2 perform anywhere near what we saw in Q1 then we will need to see better data flow, a commitment from central banks not to readily react to the data, and a lower-for-longer mentality. That said, as long as inflation is following its current trajectory there is little reason to feel we will see a lasting sell-off in bonds or rates, and if the yield curve is to steepen from here, then it will be very gradual.

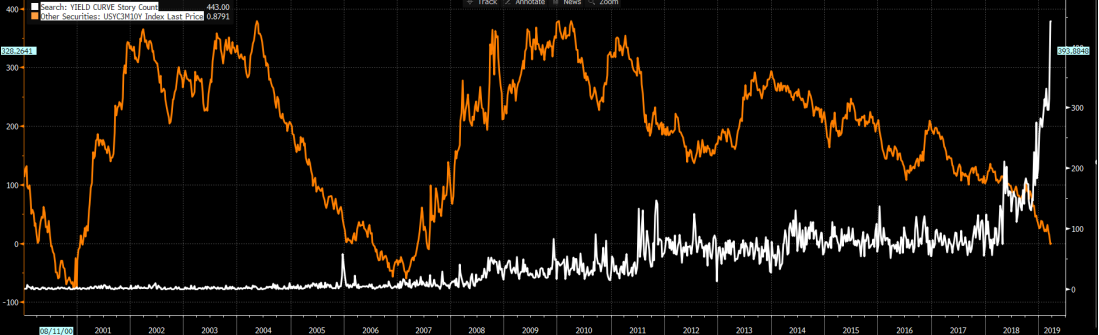

It certainly feels as though there is scope for global bond markets to sell-off in the short-term and we are seeing signs of this today, with Aussie 3-year Treasury yields gaining four basis points to 1.42%. We are seeing strong selling in China’ s bond markets, while US Treasury futures are selling off across the curve today. We also have to think we have hit peak yield curve inversion news as well, as this Bloomberg chart displays, with the "yield curve" story count (white) vs UST 3m10yr curve.

In terms of news flow, locally, we’ve seen a slight rebound in NAB business conditions, a solid 40bp rise in the Melbourne Institute inflation gauge and less bad (-0.7%) core logic house price index. However, the PMI data from China on Sunday, with manufacturing index pushing back into expansion territory, as well as today's release of the CAIXIN China PMI report, which printed 50.8 and easily above the 50.0 consensus print is undoubtedly supporting equity markets. With the ASX 200 advancing nicely through 6200, and the bull flag set-up, where a daily close through 6230 argues for a test of the March highs and into 6300.

S&P 500 futures are also finding good buyers here, helped by a 2% move in the Nikkei 225 and follow-through buying in Chinese and Hong Kong equities and we expect a stronger open in Europe. This, in turn, should support the EUR to an extent, with Europe seen as another proxy of the Chinese economy. I am happy to remain positive on risk assets for now, as the ‘goldilocks’ scenario I have written about of late is still proviolent.

Aussie event risk in focus

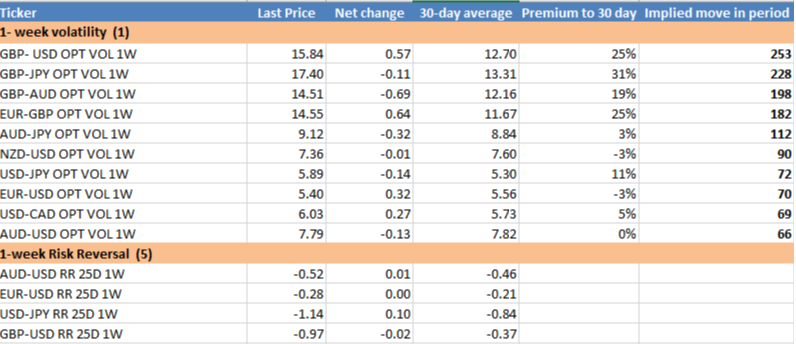

Across G10 FX markets today we see some confidence in AUD/USD to hold the 71-handle, with better interest to buy AUD/JPY and to sell GBP/AUD, which are also having the most significant moves across the matrix of FX pairs. It is a big week for Aussie data, with the RBA decision (14:30aedt) and federal budget release (19:30 aedt) due tomorrow, while we also get retail sales and trade data through the week. As we can see from the volatility matrix, implied vol in the pair sits at 7.79%, in-line with the 30-day average. This gives us an implied move on the week of 66-pips, which hardly reeks of fireworks and bear in mind in the US we have retail sales (due at 23:30aedt) and ISM manufacturing (01:00 aedt), as well as services ISM and nonfarm payrolls later in the week.

The RBA meeting is likely a non-event, and while we may get further tweaks to the statement, the bank will be very keen to see the fiscal measures announced in tomorrow’s budget to see if they are a sugar hit to the Aussie economy or something that could shake us all into a more prolonged spending spree. In-turn backed by renewed confidence from business to pay higher wages. With the July RBA meeting priced at a 50% chance of a cut, June and July are the meetings we should focus on, as the market feels these are live. It also feels that the hurdle to move the AUD significantly lower, given the extent of rate cuts that are priced across the curve, is sufficiently high enough that we will need to see far higher implied volatility and a strong move higher in US inflation expectations.

As we can see from the weekly Commitment of Traders report, that looks at the net positioning of FX futures from various players, we can see leveraged accounts have modestly increased AUD shorts of late, but positioning is by no means stretched at -18k contracts. Asset managers hold a bigger short exposure at -34k. So, on the whole, the market goes into the data releases short of AUD and pricing in a strong element of easing.

Brexit talks roll on

Outside of the key data releases that can influence, there is still interest in the Brexit process and that plays out again early tomorrow morning for those based in Asia with next round of indicative voting. The market remains short GBP, and long GBP vols and big moves are expected this week, and this is a major consideration for those left holding exposures, as big moves and incorrect position are a quick way to do real damage to one’s trading account balance.

For those still trading, this debacle will be keen to see if there is a consensus in the indicative votes, specifically for the model involving staying in the customs union. Should this materialize then it would no doubt attract GBP buyers, although, it would also incentives the Brexiters to vote for Theresa May’s deal, with speculation of another vote tomorrow.

If we see a consensus for a model involving a customs union membership, but a subsequent fourth vote fails, then we head to the emergency EU Summit on 10th April. A decision would need to be made to offer a longer extension involving a push towards the House consensus. This would require the UK to take part in the European Parliamentary election. This would open up huge social ramifications and powerful objections from the leave camp. It would likely be positive for business too who crave certainty, and one suspects it would be very positive for GBP as well.