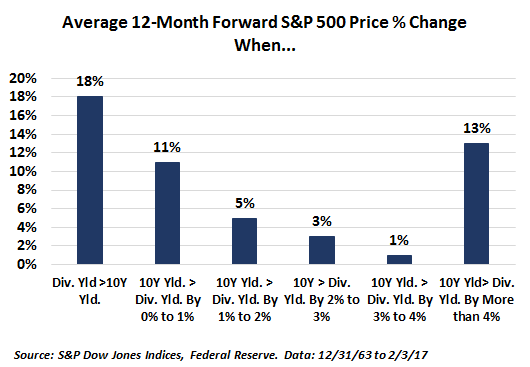

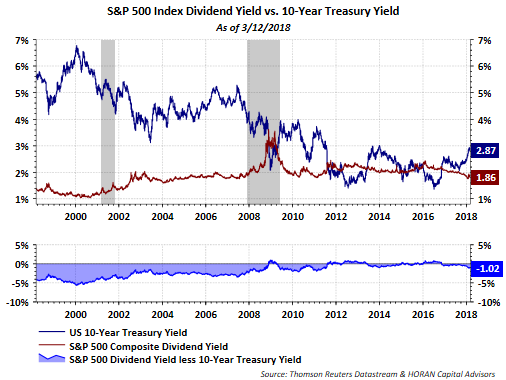

A little over a year ago I noted the yield on the 10-year Treasury surpassed the dividend yield of the S&P 500 Index. With rising bond yields, there becomes a point when the bond yield is sufficiently high relative to the yield on stocks that bonds can challenge stock returns. In that earlier article I referenced a research article written by CFRA Research's Sam Stovall and titled, Rising Prices, Shrinking Yields. In the research article it was noted prospective stock returns became most challenged when the yield on the 10-year U.S. Treasury exceeded the dividend yield of the S&P 500 Index by at least one full percentage point, i.e. 100 basis points. The forward return at varying spreads is detailed below.

In mid-February of this year, the spread differential reached 100 basis points and market expectations are the Fed will continue to move short term rates higher at least several more times this year. That being the case, and if long term rates follow, the spread between the 10 year yield and the S&P 500 dividend yield could continue to widen.

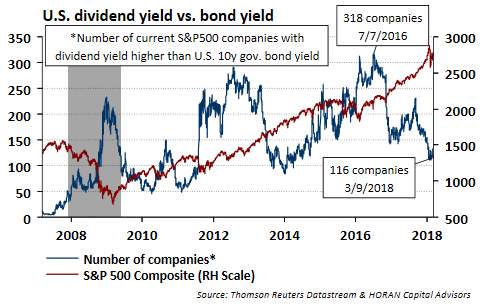

The potential for continued widening of the spread between the bond yield versus the stock yield will serve as a headwind for stocks. Countering this potential headwind at the moment is the recent passage of The Tax Cuts and Jobs Act and the lower tax rate benefiting companies; thus, enhancing their earnings growth. The below chart shows the decline in the number of S&P 500 stocks that have yields greater than the 10-year Treasury.