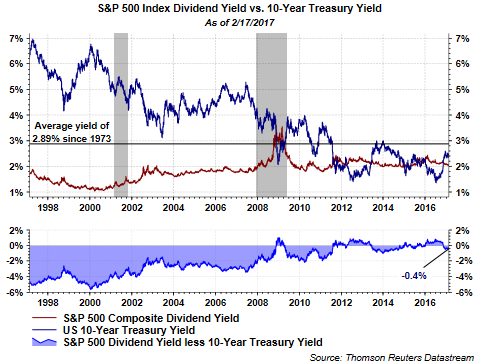

For most of 2016 the dividend yield on the S&P 500 Index was greater than the yield on the 10-year U.S. Treasury. Historically, this has served as a positive sign for forward stock price returns. With the strong equity market returns in 2016 and the move higher since the election, the S&P 500 yield is now lower than the 10-year Treasury. In addition to the move higher in stocks, bond prices have declined as well (a higher yield) resulting in bonds now having a higher yield than the S&P 500 Index.

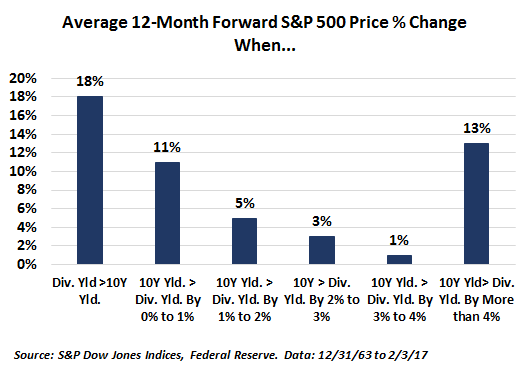

What may seem like meager yields for both stocks and bonds, investors have a propensity to purchase the better yielding asset. So, as bonds begin to provide competition for stocks, might the higher yield of fixed income investments turn into a headwind for stocks? CFRA recently prepared a report noting the performance of the S&P 500 Index at various yield differentials.

With the S&P 500 Index dividend yield now equaling about 2.0% and the 10-year Treasury yield equaling 2.4%, is the .4% greater treasury yield sufficient enough to serve as a constraint to higher stock prices? Historically, as the below chart shows, stock returns are not challenged until the yield difference is greater than 1%.

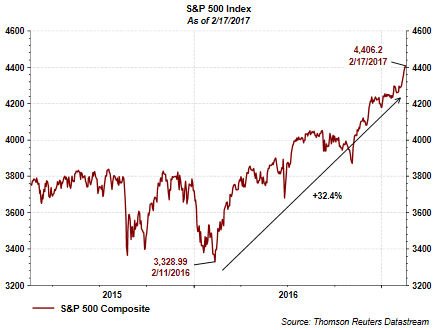

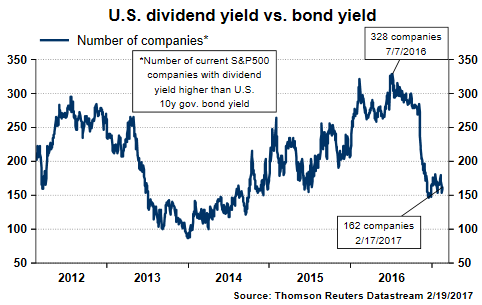

And finally, with the strong upside move in the S&P 500 Index since the February 2016 low, fewer S&P 500 stocks now have yields greater than the 10-year Treasury.

As the CFRA report notes, "Prior to 1990, the yield on the 500 served as a warning to investors that the market was getting over-heated. A dip below 3.0% signaled caution, while a drop below 2.7% was flashing red alert." However, as the report notes, and a worthwhile read, since 1990, companies have been more inclined to reinvest earnings back into the company as well as pursue more stock buybacks. With bond yields on the rise, bond prices are likely to see continued downward pressure. However, when the yield differential widens enough, stocks will face some headwinds as investor once again look to bonds as a source of income.