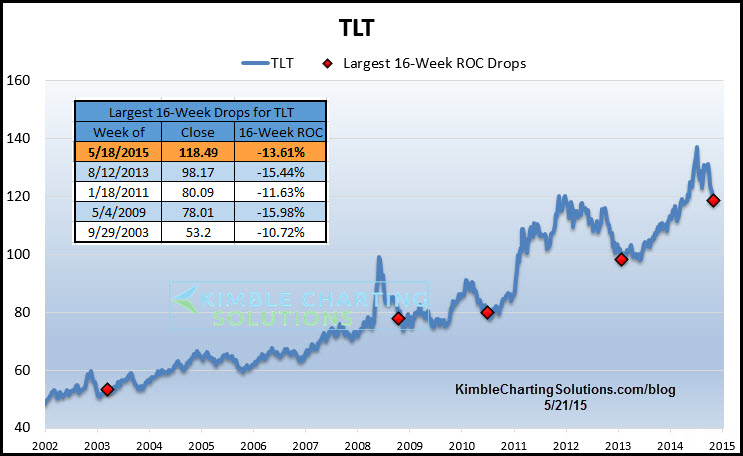

Some times stocks and bonds head in different directions. So far this year, stocks are flat and bonds are down hard. The table below shows that (ARCA:TLT) just experienced the 3rd worst 16-week performance in the history of TLT.

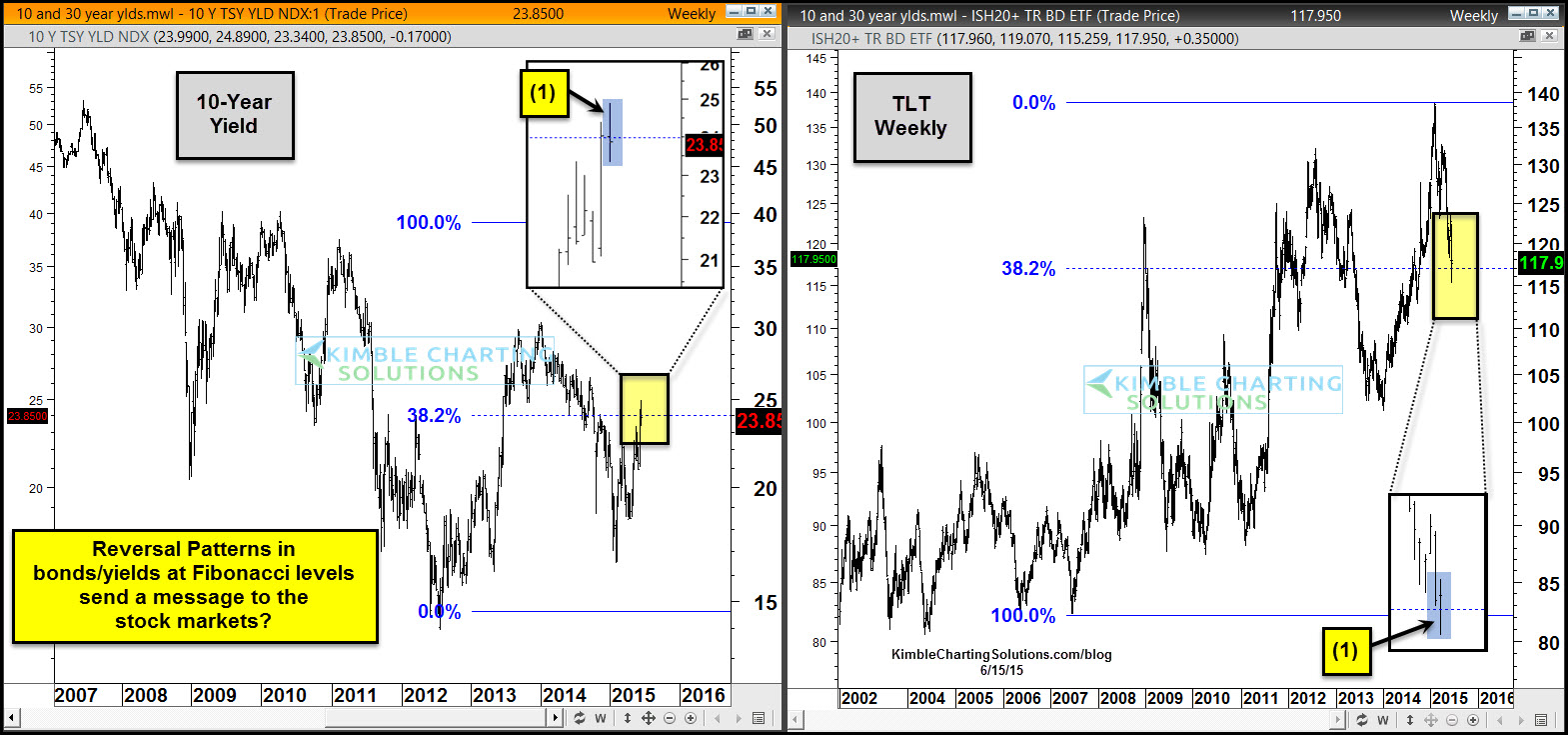

The chart above looks at the yield on the 10-year note and popular bond ETF TLT on a weekly basis. Both the yield on the 10-year note and TLT could have made weekly reversal patterns at long-term Fibonacci resistance/support levels at (1) above.

Could these reversal patterns at key levels suggest a reversal in trend for bonds/yields?

If bonds happen to reverse trend, could it have something to do with a move in stocks?

Could the S&P 500 and the DAX be repeating patterns from 2000 and 2007?

With the NASDAQ Composite back at 2000 highs and the S&P 500 and DAX at potential “Twin Peaks,” what bonds and stocks do in the next few weeks could be pretty important from a big-picture perspective.