BoJ Negative Rates Seeping Through:

Confession: I wasn’t in the office for the Bank of Japan negative interest rate decision. It was Friday afternoon in Sydney, I had some errands I had to run and thought what was the harm of giving myself an early mark…

BOOM!

This piece from MarketWatch is a great overview piece explaining the decision, why it was made and what negative interest rates are meant to achieve.

“The Bank of Japan announced it had cut the rate on excess reserves to minus 0.1%, meaning institutions will have to pay the central bank for the privilege of parking reserves that exceed those required by regulators.”

Stock markets around the world of course enjoyed the stimulus that ‘cheap’ money (free money? I’m still not sure how to express this) provides, with the opposite being said for the Japanese yen. Both charts we take a look at below.

Elsewhere:

Greece is back in the headlines, with fresh rounds of talks between Athens and creditors starting Monday in Europe.

Lenders are returning to Greece to start evaluating the next step of the bailout program implementation in the coming weeks. The talks will include Athens and the heads of international lending institutions: the European Commission, the IMF, the European Stability Mechanism and the ECB. This is not expected to have the impact it once did but it is here once again.

In oil markets, Saudi Arabia has publicly stated to Al Arabiya television that contrary to earlier reports, they are actually looking to cooperate with other oil producing nations to support the market. There are plenty more legs in this story I’m sure, but there are also plenty of legless headline spikes to come. Don’t get caught with your pants down!

Wrapping up, we today see a bit of a Manufacturing PMI data dump out of China while tomorrow sees the Reserve Bank of Australia come back from their little Christmas/New Years break. Better than expected jobs figures and a consistently low Australian dollar has helped the Australian economy over Christmas and nobody is expecting any big surprises from the notoriously conservative Glenn Stevens.

But hey, we said that on Friday. Lets just say that I won’t be ducking away from my desk tomorrow!

Chart of the Day:

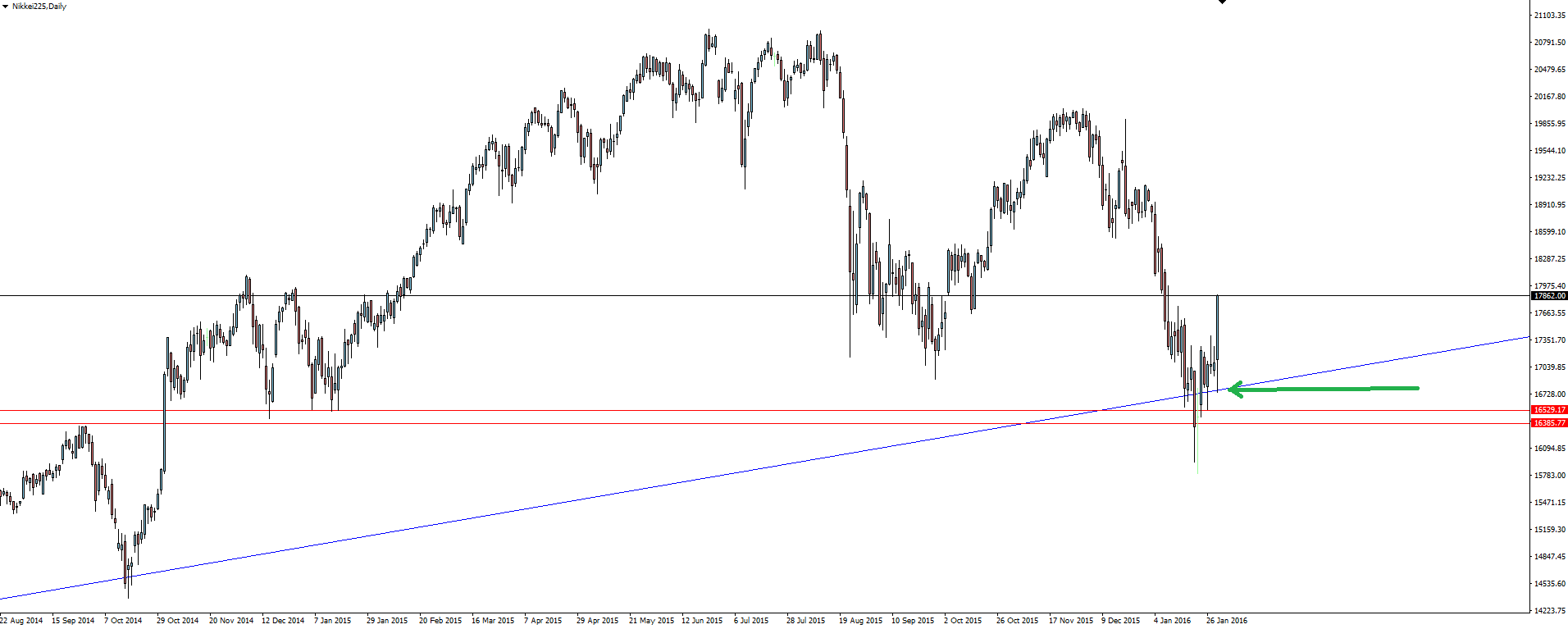

Following on from our indices analysis post in the Technical Analysis section of the Vantage FX News Centre, Friday’s BoJ move gave us an interesting technical point which we feature in today’s chart of the day.

The economics of negative interest rates and how the theory will actually transfer into the real world economy is something the jury is still out on, but the Japanese stock market liked the idea behind it anyway…

Nikkei 225 Daily:

Look at what the bottom of Friday’s Nikkei 225 daily candle wick lines up with.

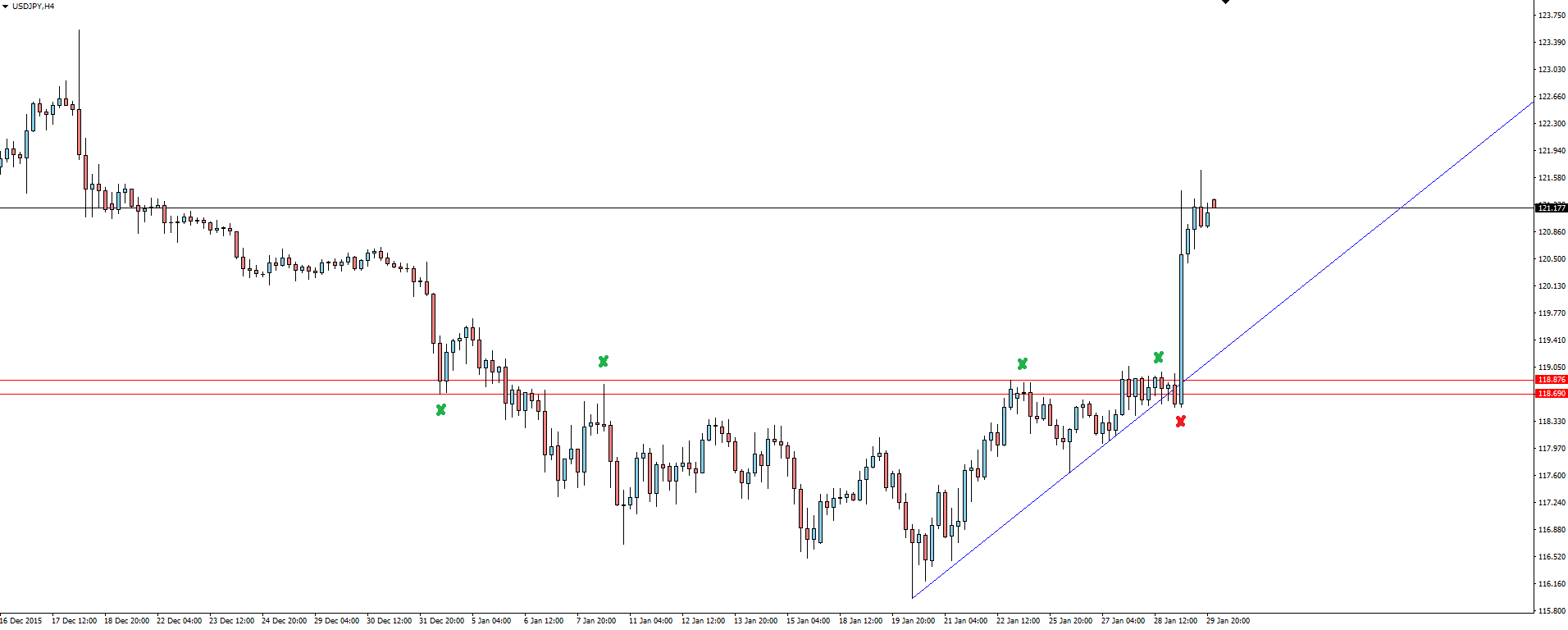

How about Friday’s USD/JPY setup we were watching?

“When there are no more sellers left to be absorbed, the supply/demand imbalance is what causes breakouts from the horizontal, upside resistance of the tri.”

Fundamentals and Technicals in full harmony.

On the Calendar Monday:

CNY Manufacturing PMI

CNY Non-Manufacturing PMI

CNY Caixin Manufacturing PMI

USD ISM Manufacturing PMI

EUR ECB President Draghi Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by ECN Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and STP Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.