The US dollar rebounded strongly against every other major currency, while Wall Street took a sharp dive, returning the gains made after Wednesday’s Fed decision. This was because market participants brought back their bets over a 75 bps hike in July.

In the UK, the BoE hiked by 25 bps as expected, but it warned over recession risks, something that resulted in a tumble in the pound. Today, the spotlight turns to the employment reports for April from the US and Canada.

Investors Bring Bank Triple Fed Hike Bets, BoE Delivers a Dovish Hike

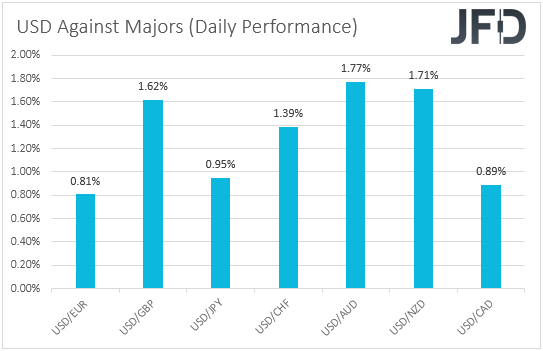

The US dollar rebounded and outperformed all the other major currencies on Thursday and during the Asian morning Friday, gaining the most versus AUD, NZD, and GBP.

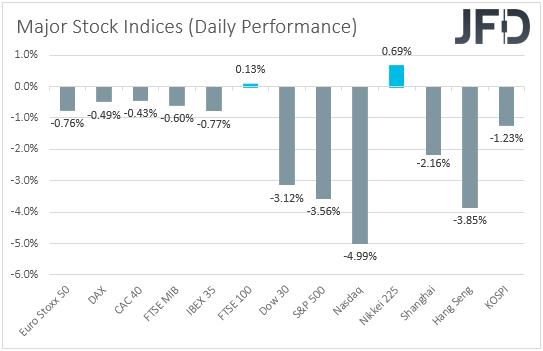

This suggests that market sentiment deteriorated again at some point yesterday or today in Asia. Indeed, turning our gaze to the equity world, we see that all but one of the major European indices under our radar closed in the red, with risk aversion intensifying during the US session and rolling into the Asian trading today. Only Japan’s Nikkei 225 traded in the green.

With no clear event to trigger a flight to safety, we will stick to our guns that market participants still saw the Fed as the most hawkish central bank, even after Fed Chair Jerome Powell poured cold water on the idea of raising interest rates by 75 bps at the next gathering.

Remember that even before the gathering, we saw decent chances for an aftermath rebound if the greenback came under selling interest due to a disappointment. The reason was that even with 50 bps increments, the Fed would still be among the most hawkish major central banks.

However, market participants did not stay convinced that the Fed would hike by 50 bps at the upcoming gathering and brought back to the table bets regarding a triple hike. The CME FedWatch tool now assigns an 87% probability for such a move, a bigger percentage than before Wednesday’s decision. So, with such aggressive expectations over the Fed’s future course of action, we expect the US dollar to continue its prevailing uptrend.

Now, besides investors bringing their triple hike Fed bets back to the table, we also had a BoE gathering yesterday. The Bank decided to hike interest rates by 25 bps, as was widely anticipated. Still, in contrast to expectations of a dissenter calling for no change, three policymakers favored a 50 bps increase.

And yet the pound fell. Why? Because of the bank’s warnings over recession risks. In the inflation report, the Bank revised its inflation forecasts, expecting consumer prices to peak above 10% in the last three months of the year, but downgraded its GDP forecasts to show a contraction of 0.25% in 2023 from a previous estimate of 1.25% growth.

It also cut its projection for 2024 to 0.25% from 1.0%. In the meeting minutes, it was also revealed that two members argued that the guidance was too strong, given the risks to growth, meaning that they may be against further hikes for the next few months.

So, in our view, all this suggests that the BoE may continue raising interest rates to bring inflation back down to target, but due to the recession risks, the pace may be much slower than previously anticipated. For now, the pound is likely to continue drifting lower, especially against the US dollar, but even against the euro, as there are still participants believing that a July hike may be appropriate by the ECB.

AUD/USD – Technical Outlook

AUD/USD traded lower yesterday after hitting resistance at 0.7270. Overall, the bears kept the rate below the downside resistance line drawn from the high of Apr. 5, and thus, we will maintain the view that the near-term outlook is still negative.

A clear and decisive dip below 0.7030 will confirm a forthcoming lower low on the 4-hour and daily charts and may initially target the low of Jan. 28, at 0.6965. If the sellers are unwilling to stop there, we may see them marching even lower towards the 0.6835 zone, marked as a support by the low of Jun. 30, 2020.

On the upside, we would consider the case of a bullish reversal only if we see a clear break above 0.7345. The rate will already be well above the aforementioned downside line, and the bulls may get encouraged to climb towards the 0.7458 or 0.7493 barriers, marked by the highs of Apr. 20 and 12, respectively. If neither obstacle can halt the advance, we may see extensions towards the 0.7593 level, marked by the high of Apr. 6.

EUR/GBP – Technical Outlook

EUR/GBP skyrocketed yesterday after the BoE decision, breaking even above the peak of Mar. 31, at 0.8512. The rate is now well above both the upside support line drawn from the low of Apr. 14 and the downside one taken from the high of Apr. 26. That’s why we will consider the short-term picture to be positive.

Yesterday, the rate hit resistance at 0.8546; it shows that a retreat may be looming. However, we see decent chances for the bulls to recharge from above the upside line drawn from the low of Apr. 14, perhaps from near the 0.8465 zone. A potential forthcoming rebound may result in another test at 0.8546, the break of which would confirm a forthcoming higher high and may carry extensions towards the 0.8599 zone, marked by the high of Dec. 8.

We will only consider the bearish case after the retreat extending below 0.8370. This will confirm a forthcoming lower low, while the rate will be below the aforementioned diagonal lines. A slide towards 0.8310 could be triggered, the break of which could carry extensions towards the 0.8280 or 0.8250 zones, defined as supports by the lows of Apr. 19 and 14, respectively.

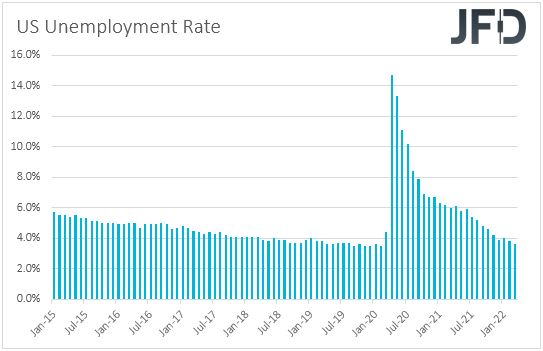

US NFPs and Canada’s Jobs Data Take Center StageToday, investors are likely to turn their gaze to the employment reports for April from the US and Canada. Getting the ball rolling with the US, nonfarm payrolls are expected to have slowed somewhat, to 380k from 431k.

The unemployment rate is expected to have ticked down to 3.5% from 3.6%. Average hourly earnings are forecast to have increased at the same monthly pace as in March, but this will result in a downtick to +5.5% from +5.6% in the YoY rate.

We see the case of such numbers adding more credence to the view of more aggressive hikes by the Fed, despite a slight slowdown in payrolls and wages. In other words, we expect the US dollar to stay in uptrend mode after the employment report as well.

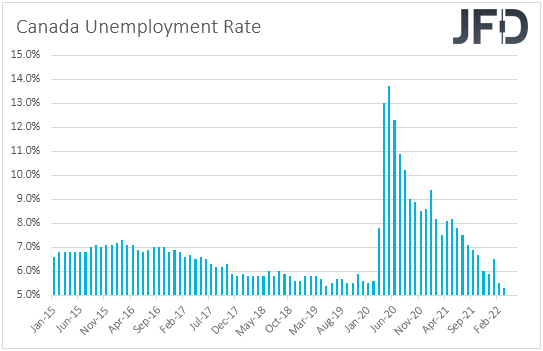

In Canada, the unemployment rate is forecast to slide to 5.2% from 5.3%, and the net change in employment to slow somewhat, to 57.5k from 72.5k. At its latest gathering, the BoC decided to hike rates by 50 bps, noting that interest rates will need to rise further.

Governor Macklem specifically said, “We need higher rates, and the economy can handle them,” adding that they are prepared to move as forcefully as needed to get inflation on target.

With that in mind, and also taking into account that inflation accelerated by much more than expected in March, we believe that a decent employment report could add more support to the Canadian dollar, especially against currencies the central banks of which are expected to stay dovish or proceed in a much more cautious manner than the BoC in normalizing their policy.

Nonetheless, due to the aggressive expectations surrounding the Fed, we don’t expect the Loonie to outperform the US dollar as well. We believe that there is still some more upside for USD/CAD.