Today, all lights are likely to fall to monetary policy decisions by two major central banks: The BoE and the ECB. The former is expected to hike rates for the second time since the coronavirus outbreak, while the latter is widely anticipated to stand pat. However, we will closely monitor the outcome for clues and hints on its future course of action.

Investors Lock Gaze on Boe and ECB Meeting Outcomes

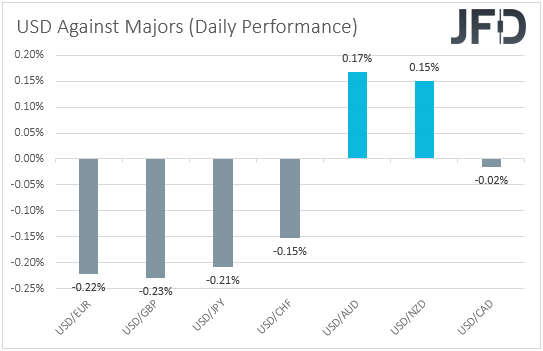

The US dollar continued trading lower against most of the other major currencies on Wednesday and during the Asian session Thursday. It gained ground only against AUD and NZD, while it was found virtually unchanged against CAD. The greenback lost the most ground versus GBP and EUR, the central banks of which decide on monetary policy today.

The weakening of the US dollar suggests that market participants may have continued to buy stocks, but the relative strength of the yen and the franc, and the weakening of the risk-linked Aussie and Kiwi point otherwise.

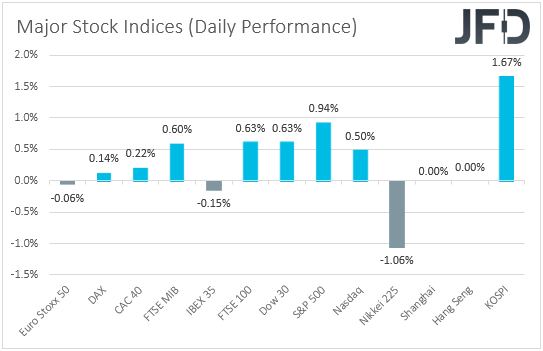

Therefore, we prefer to turn our gaze to the equity world to clear things up. Most major EU and US indices traded in the green, with only a couple finishing virtually unchanged. However, today in Asia, Nikkei slid 1.06%, while, on its first trading session for the week, KOSPI jumped 1.67%, perhaps to catch up with the recovery seen in other indices the last few days.

Now, today, as we already noted, we have two major central banks deciding on monetary policy, and those are the BoE and the ECB. First, we have the BoE, which, at its latest gathering, decided to push the hike button for the first time since the coronavirus outbreak, lifting interest rates to 0.25% from 0.10% and adding that more modest tightening is underway.

Recent UK data have been relatively supportive, with the unemployment rate declining further in November, the CPIs accelerating more than anticipated in December, and the preliminary PMIs revealing further economic expansion during January, despite at a slower pace than in December.

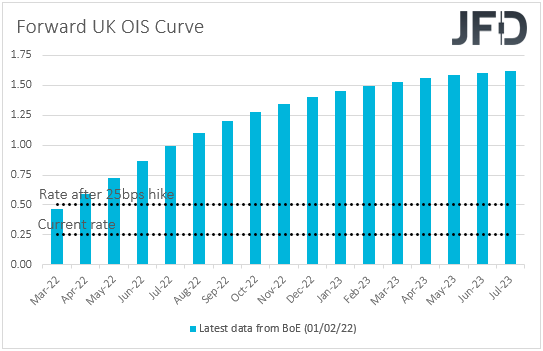

Thus, we see the case for a quarter-point increase at this gathering, which is our view and the market consensus. According to the UK OIS (Overnight Index Swaps) forward yield curve, investors fully price in such an action, while they see the case for nearly four more hikes by the end of the year.

Thus, a 25 bps hike by itself is unlikely to prove a significant market mover. Market attention is likely to fall to clues and hints on how fast policymakers plan to proceed with upcoming lift-offs. What’s more, remember that 0.5% is the level the Bank placed as a threshold for beginning to shrink its balance sheet.

Therefore, we will look for references on that front as well, as well as on the updated economic projections. Let’s not forget that this will be a Super Thursday for the BoE. Anything suggesting an aggressive rate path and a balance-sheet reduction could support the British pound, which could keep outperforming currencies like the Aussie and the euro due to monetary policy divergences.

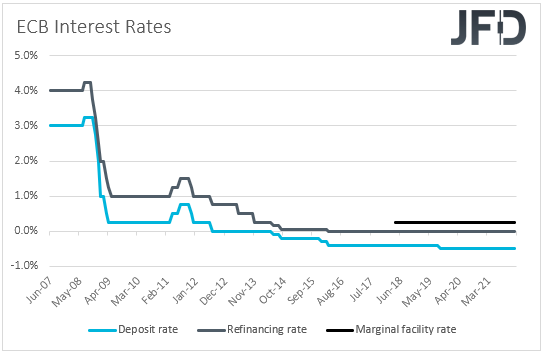

Soon after the BoE, we have the ECB deciding on monetary policy, but no action is expected from this Bank. Despite market participants pricing in a small rate increase by the end of this year, the Governing Council has believed that something like that is unlikely.

ECB President Christine Lagarde expressed that view several times in the past, while a couple of weeks ago, she said that inflation in the Eurozone will decrease gradually over the year and that the ECB does not need to act as boldly as the Fed, due to a different economic situation.

That said, with both Eurozone’s inflation rates coming in higher than expected, it would be interesting to see whether Lagarde and her colleagues will repeat the view that interest rates are unlikely to be lifted this year. Due to the slowdown in economic activity for Q4, we believe that there is a decent chance for such an outcome, which could come as a disappointment to those expecting a slight lift-off. Thus, the euro may come under renewed selling interest.

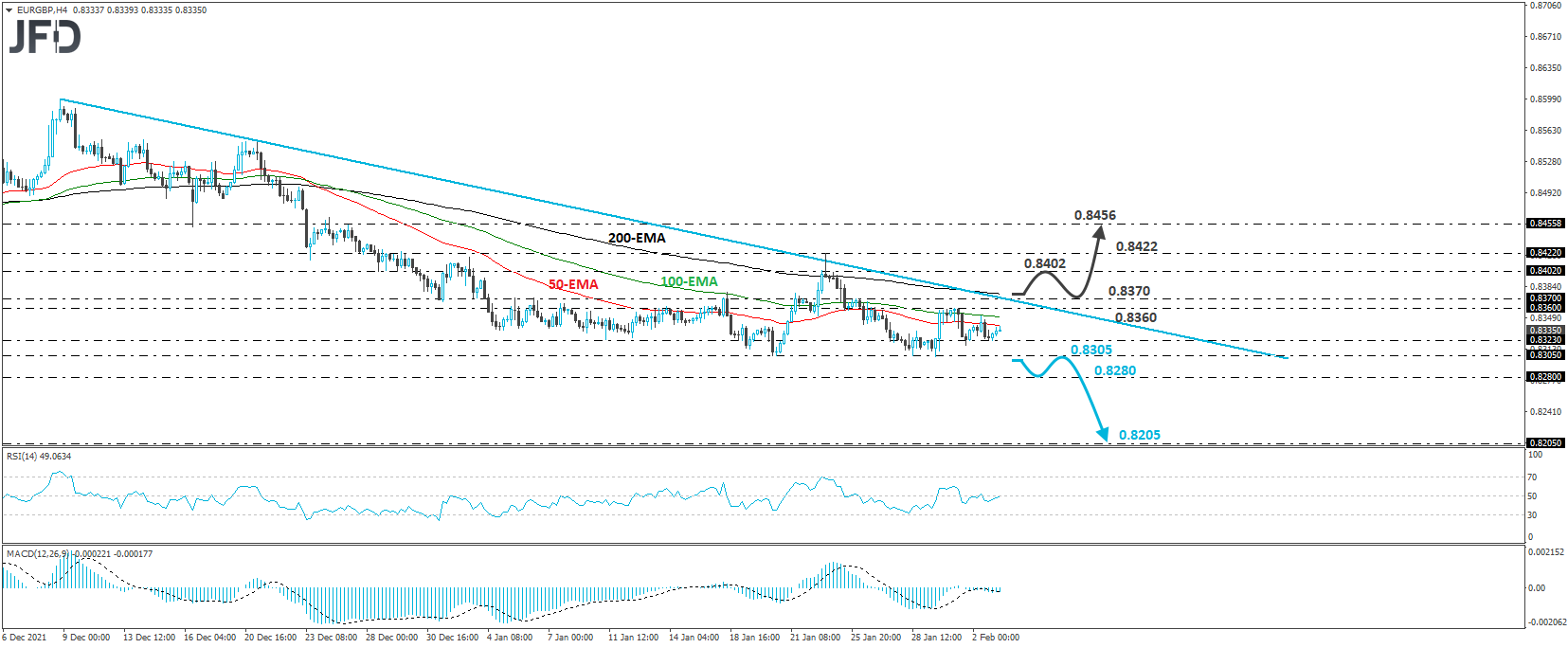

EUR/GBP – Technical Outlook

EUR/GBP traded in a consolidative manner yesterday, staying slightly above the 0.8323 barrier. However, overall, the pair is trading below the downside resistance line drawn from the high of Dec. 8, and thus, we would consider the short-term outlook to be still negative.

A break below the key barrier of 0.8305, which has been providing support since Jan. 20, would confirm a forthcoming lower low on the daily chart and may initially target the 0.8280 zone, marked by the low of Feb. 18. If the bears are not willing to stop there, then the rate will enter territories last seen back in 2016, and the following territory to consider as a support may be the low of Jun. 29 of that year, at around 0.8205.

On the upside, we would like to see a clear break above 0.8370, the high of Jan. 26, before we start examining a bullish reversal. This could confirm the break above the aforementioned downside line and pave the way towards the 0.8402 level, or the 0.8422 barrier, marked by the highs of Jan. 25 and 24, respectively. If neither hurdle can stop the bulls, then a break higher could see scope for advances towards the peak of Dec. 27, at 0.8456.

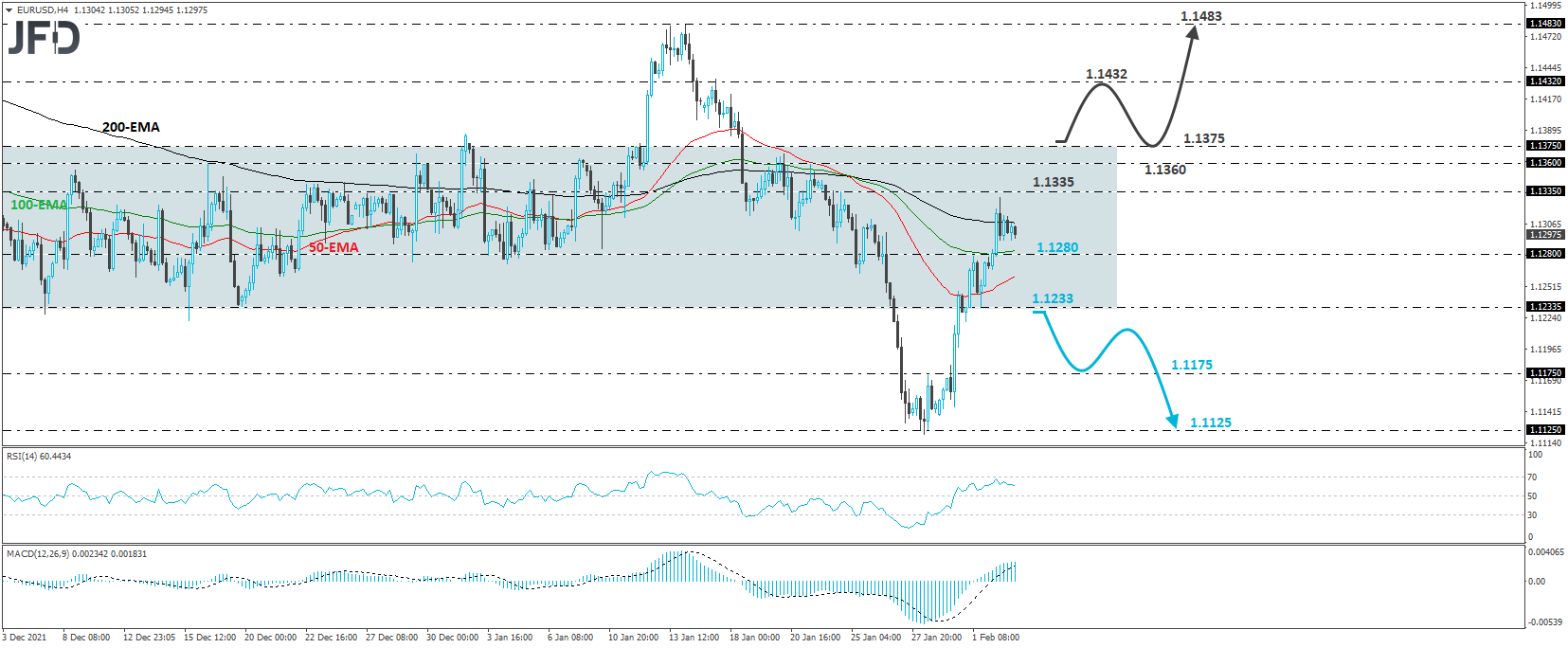

EUR/USD – Technical Outlook

EUR/USD recovered strongly lately, entering back into the sideways range that had been containing most of the price action between Nov. 26 and Jan. 26. In our view, this has turned the short-term outlook back to neutral, and even if we see a slide triggered by the ECB outcome, we would like to see an apparent dip back below 1.1234 before we start examining the bearish case again.

If indeed, we do see that break soon, we believe that the bears will get encouraged to push the action down to the inside swing high of Jan. 28, at 1.1175, the break of which could carry extensions towards the low of the same day, at around 1.1125, or even the rounder figure of 1.1100.

In our view, the outlook could turn bullish upon a break above the range's upper bound, at around 1.1375. This could initially result in advances towards the peak of Jan. 17, at 1.1432, the break of which could extend the gains towards the peak of Jan. 14, at 1.1483.

As for the Rest of Today’s Events

We have the final Markit services and composite PMIs for January from the Eurozone, the UK, and the US, as well as the ISM non-manufacturing index for the month.

As is usually the case, the final Markit prints are expected to confirm their initial forecasts, while the ISM index is anticipated to have declined somewhat, to 59.3 from 62.3. Like every Thursday, we also get the US initial jobless claims for the prior week.