It was another rather boring day, with the S&P 500 finishing basically flat down 8 bps. The NASDAQ 100 had the better day, with the Invesco QQQ Trust (NASDAQ:QQQ)s rising by roughly 30 bps.

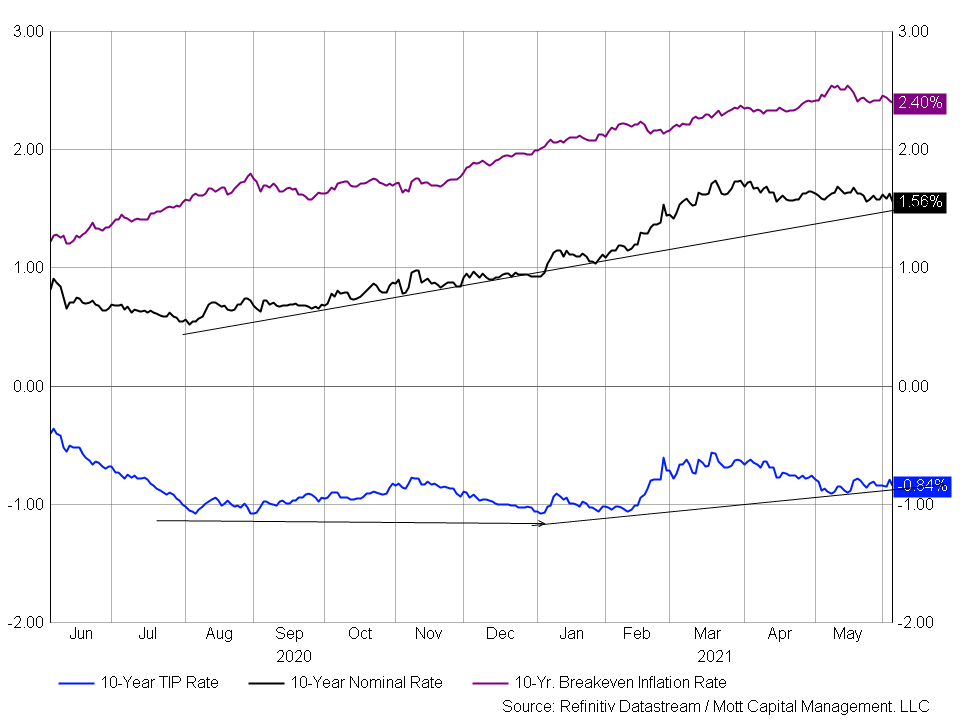

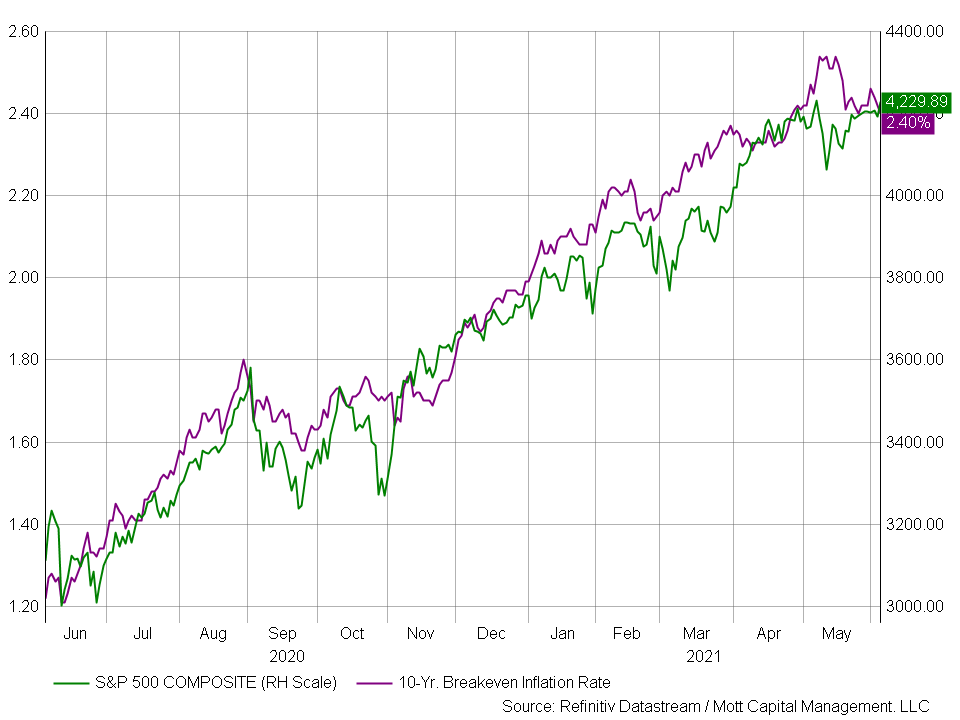

Breakeven inflation rates fell again on Monday to 2.39%, on the 10-year. The 10-year TIPS was up 3.4 bps to -84 bps. So it appears that for now, we continue to see downward pressure on inflation expectations. This may only accelerate depending on how the CPI comes in later this week.

It isn’t so much that rates are falling; nominal rates have flatlined, and TIP rates are steadily increasing. It is, to some degree, taking away some of those artificially high inflation expectations because TIP rates failed to participate with nominal rates for most of the spring.

Again, I do not think it is by chance that the S&P 500 has stalled out in recent weeks, as inflation expectations have not only peaked, but appear to be giving back some of their gains.

Housing

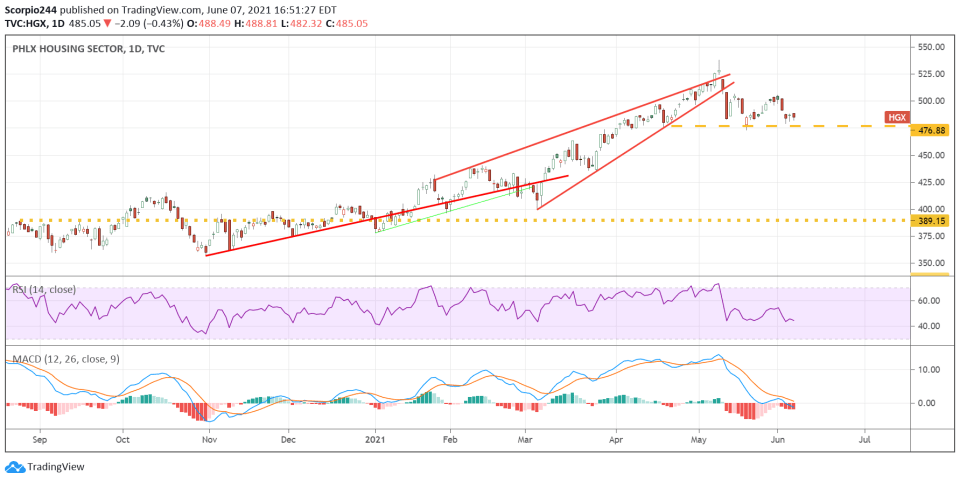

I also don’t think it is by chance that the reflation trade is starting to show signs of breaking down, with the PHLX Housing Index falling another 40 bps Monday. It is getting very close to making a big break lower, as it has not hit oversold levels yet on the RSI, and the MACD is still directionally moving lower as well.

Lumber

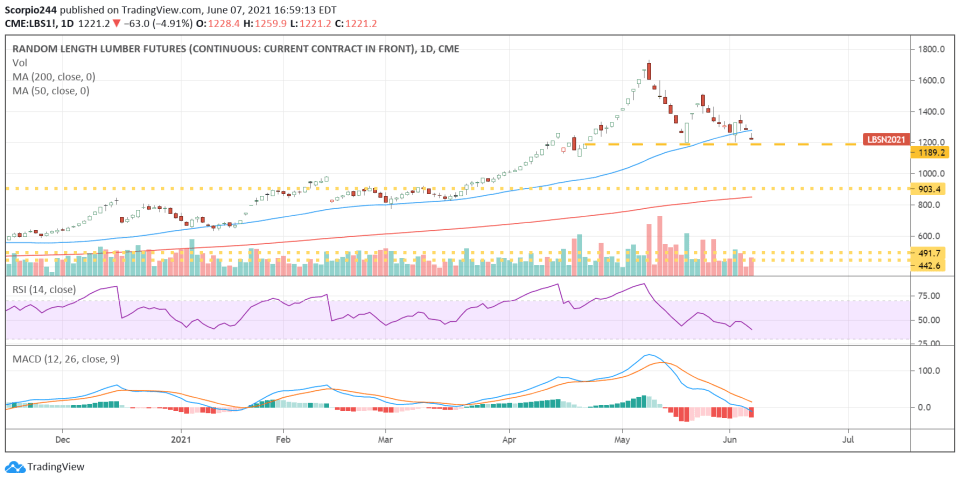

Lumber is one of those assets that hardly trade, so who knows what is really going on. But prices don’t lie, and they are certainly trending lower. More important, it fell below the 50-day moving average, generally not a great sign.

It is in a zone of support around $1,100 and $1,200. This is a pretty critical zone of support because it could be a long way down if that region breaks.

Dow Transports

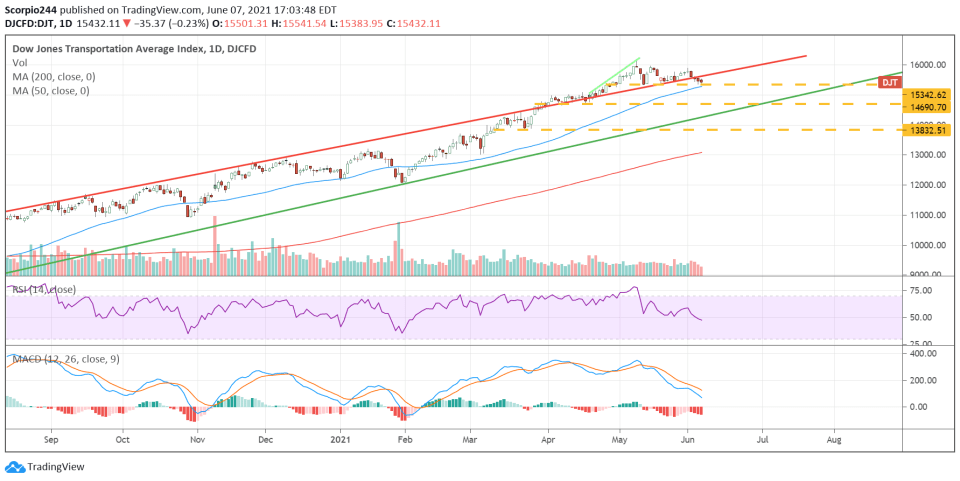

The Dow Transports finished lower by 23 bps and was within striking distance of its 50-day moving average. The 200-day moving average was about 15% lower. I’m not suggesting it falls that far yet, but it does not look healthy at the moment either. This 15,300 level is significant.

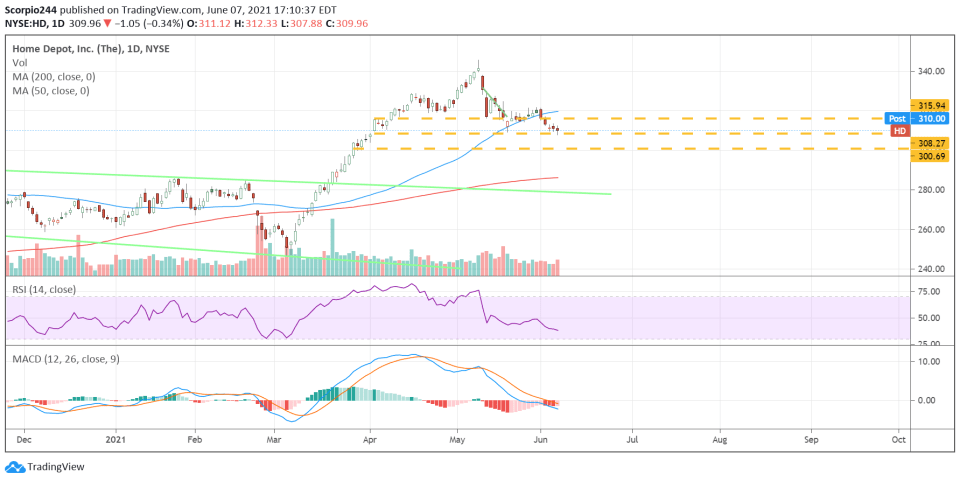

Home Depot

Consumer discretionary, continues to trade poorly too, and that could partly be due to Home Depot (NYSE:HD). The stock was just grinding lower, while all the positive momentum appeared to be melting away, with $300 drawing closer.

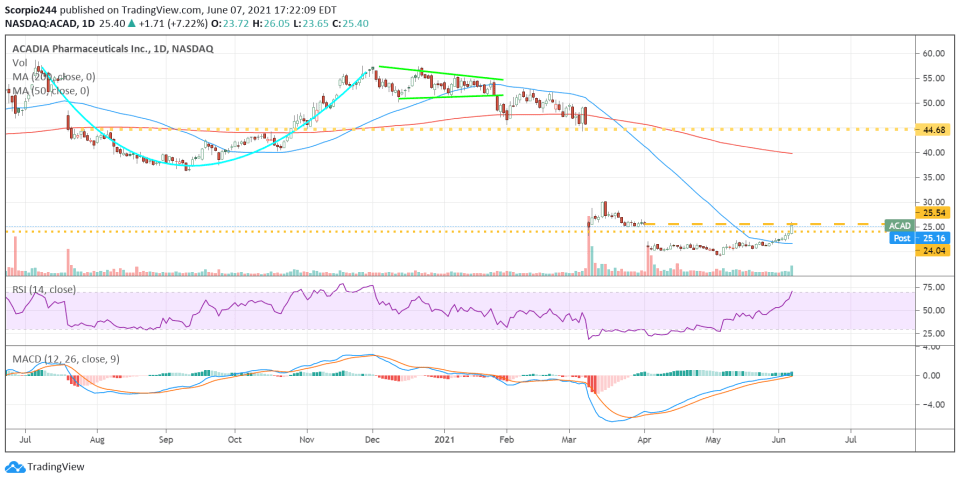

Acadia

Biogen (NASDAQ:BIIB) soared today; now that’s a stock we haven’t spoken about in years after it was approved for its Alzheimer's drug.

I’m surprised it got approved. Obviously, the whole market was surprised given its nearly 40% rise. Anyway, so the FDA approved this questionable drug, but for some reason, didn’t want to approve ACADIA Pharmaceuticals' (NASDAQ:ACAD) treatment for Dementia-related psychosis.

Now granted, two different drugs, two different indications. But at the end of the day, there aren’t many options out there for anything Alzheimer’s or Dementia related. So why the FDA rejected Nuplazid, which had an efficacious phase 3 trial, and is currently approved in Parkinson’s disease psychosis, is beyond me.

If anything, maybe Acadia now has a leg to stand on due to this approval for Biogen when it has its Type A meeting. It is probably why Acadia rose sharply yesterday and closed at least one gap. Now, if it can close that bigger gap, that would be something.

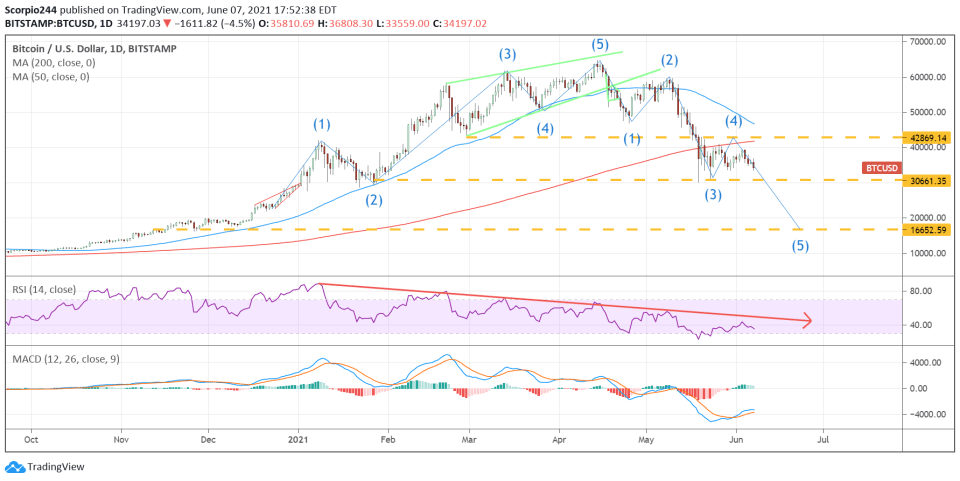

Bitcoin

I almost forgot about Bitcoin. The crypto looks again to be on the cusp of melting down. It failed on a few occasions to overtake the 200-day moving average and was moving to the lower end of its trading range.

33,000 is a massive level for this, and if it breaks, it likely signals the start of a wave “5” down and what could be a massive drop, perhaps back to 16,600.

Again, I am no fan of Bitcoin; I don’t believe in it. I see no use for it, and there is no way any government will move its currency over to Bitcoin. Even San Salvador changed its tune Monday afternoon, saying the dollar would remain legal tender, with Bitcoin as an option and linked to dollar exchange rates.

So again, I don’t see it happening; as for digital transactions, we have had those for years, well before bitcoin. We live in a digital transaction world. We don’t need bitcoin for that or any crypto for that matter.

Not to mention, what kind of reserve currency moves around 3% on a negative tweet? Additionally, what makes a dollar worth a dollar because it has the full faith and backing of the US government? What is the backing for Bitcoin?

At the end of the day, the dollar will remain the world’s reserve currency because what other options exist in the free world? Not many.