A severe crypto market correction has sent Bitcoin (BTC) and Ethereum (ETH) prices plummeting, with BTC falling to $53,000 and ETH turning negative for 2024 amidst widespread market panic.

The selloff accelerated during Sunday evening US hours, pushing Bitcoin to levels not seen since February and Ethereum back to December prices.

Bitcoin has dropped 12% in the past 24 hours and 20% week-over-week, while Ethereum has plunged 21% in 24 hours and 30% over the past week, erasing its year-to-date gains.

Crypto indices from CoinGecko show that most markets are down 10% over the past 24 hours, reflecting the widespread nature of the crypto market downturn. Notably, the decentralized finance sector showed a 17.3% decline over the past 24 hours, with a 27.8% dive from the past week.

Bank of Japan Rate Hike Impacts Crypto Markets

The trigger for this massive correction appears to be the Bank of Japan’s unexpected interest rate hike last week, which sent the yen soaring and Japanese stocks tumbling, according to a report from Bloomberg issued three hours prior to this writing.

The Nikkei index has fallen roughly 15% over three sessions and is now 20% below its mid-July peak. This volatility has spread globally, with the US Nasdaq sliding over 5% in the last two trading sessions of the previous week.

Adding to market uncertainty, the US Federal Reserve’s ambivalence about potential September rate cuts has surprised investors. In response, traders have priced in a 100% chance of lower U.S. base rates in September, with a 71% probability of a 50 basis point cut.

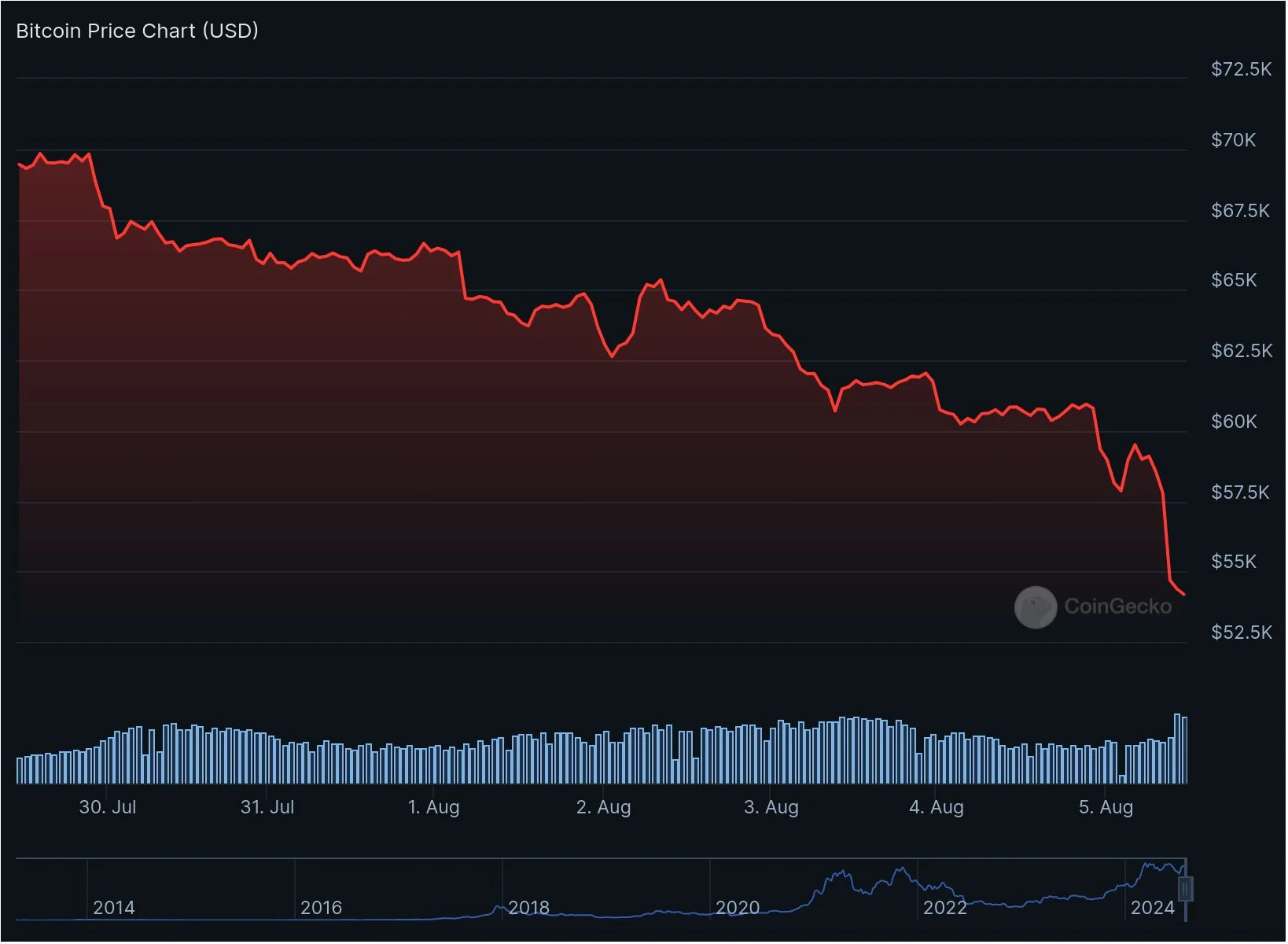

The US 10-year Treasury yield has also fallen sharply to 3.75%, down from 4.25% a week ago. Bitcoin Price Chart July 30 to August 4, 2024. Source: CoinGecko

Bitcoin Price Chart July 30 to August 4, 2024. Source: CoinGecko

The chart shows a sharp decline in Bitcoin’s price over a short time period, with the value dropping from around $70,000 to below $55,000.

The downward trajectory is steep and consistent, showing very few moments of price recovery or stabilization throughout the timeframe.

This dramatic fall of roughly 17% in Bitcoin’s price indicates a significant market correction or sell-off event, potentially triggered by broader economic factors.