Currencies

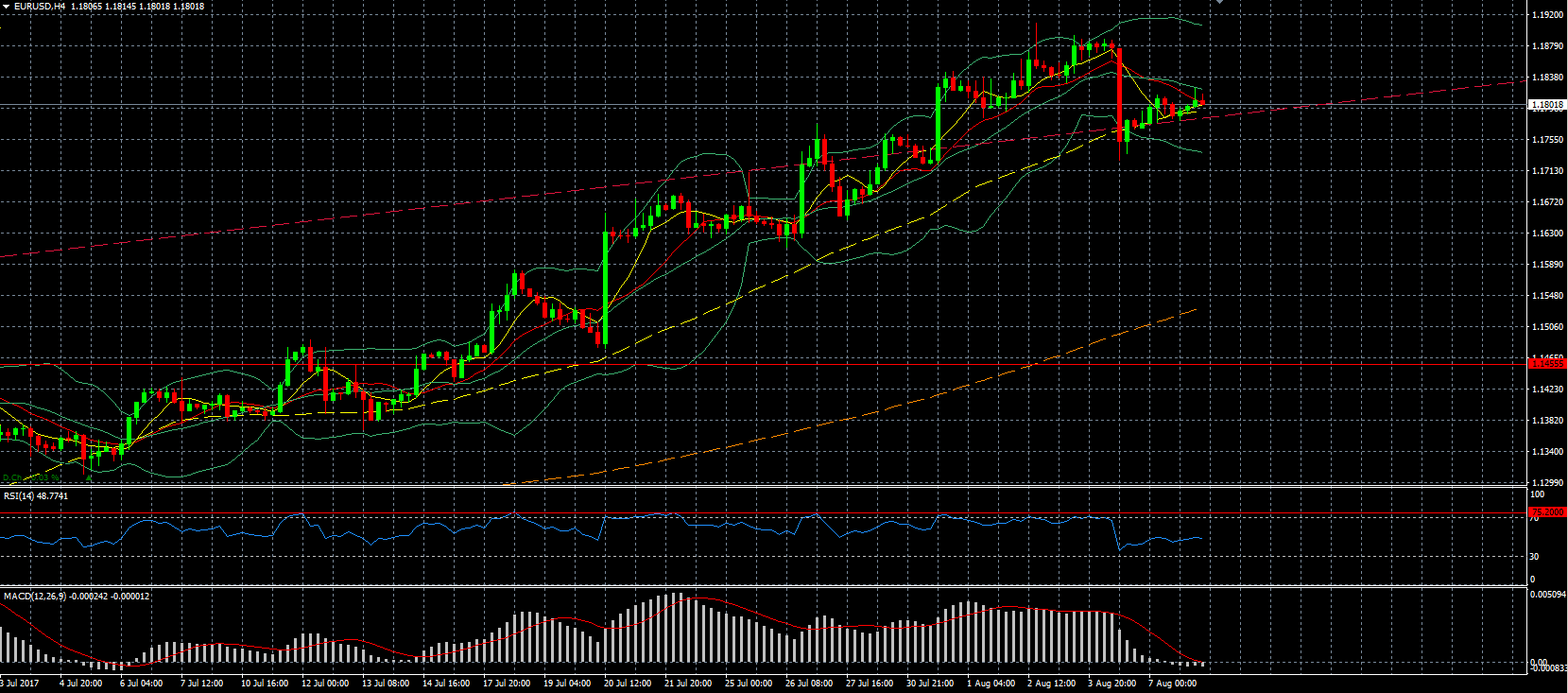

EUR/USD – while immediately after the NFP we dropped shortly below the upwards trendline, we can see that in the hours thereafter we were able to find support there and have since remained above the trendline, even though German industrial production surprisingly fell in June. Today there is no major data coming out except for the Redbook and the JOLTs job openings later this day and the important data start rolling in at Wednesday, culminating on Friday with the inflation data which will be closely watched.

USD/JPY – is moving down again as the USD weakens further and was unable to hold on to its gains after the NFP. We re trading in a 100 pip range so far this month, between the resistance just below the 111 level and above the support around the 110 level.

GBP/USD – one of the few currencies that was not able to recover from the losses against the USD was the GBP as the reason for the bullish move was the expectation of a rate hike, but that has vanished for the most part after the latest rate hike vote and meeting minutes. There is no major data coming up out of the UK today or tomorrow, but on Thursday there will be, but as always there can be issues related to the Brexit which could cause the GBP to move. Almost each day brings with it Brexit related stories, and most are not positive for the UK with more companies looking to relocate to other places.

USD/CAD – after dropping over 1000 pips since the beginning of June, it is starting to climb up and has recovered around 300 pips since the end of July.

USD/ZAR – dropped after the South African Parliament allowed for a secret ballot on a no-confidence vote on President Zuma. A secret ballot is seen as having a higher chance of succeeding than an open ballot, although the overall chance for succeeding are not considered high.

Bitcoin – has surged to another record high as the split has worked very much in its favor. On the other hand, Bitcoin Cash which was created after the hard fork has been going down. It was trading at a market cap of over $12 billion, but currently that is over $5 billion and has also dropped from the 3rd to the 4th largest cryptocurrency. All of this seemingly helps Bitcoin as more people turn towards Bitcoin and away from Bitcoin Cash – at least for now.

Indices

DJ 30 – the Dow Jones marked yet another record high and this is not something new anymore, also the fact that the 22,000 level was breached. We were struggling a few months ago with the 20,000 level and that was seen as a magical level to be breached, but since then we have climbed another 2,000 points in a relatively short time. The fact that Boeing (NYSE:BA) has been moving up and is trading near record high is helping especially since it has the heaviest weight in the index.

Dollar Index – is dropping again as it has been unable to hold on or build on the gains after the NFP as the focus now shifts to the inflation data due later this week which could prove crucial on the outlook for a rate hike, as it is the inflation data that could be holding back the FOMC from raising the interest rate.

S&P 500 – moved higher as most sectors where in green, especially the technology sector helped the S&P up, while the energy sector kept a lid on the gains. With the vast majority of companies reporting strong earnings the S&P has been able to benefit and move higher and higher and since November only moved down in March as more and more people are wondering how long this can continue and when the correction will come.

Commodities

Gold – is moving up to correct some of its drop on Friday after the NFP, as the USD also softens a bit. The FED officials that were speaking yesterday didn’t cause for much fluctuations, although they did both pointed to the fact that inflation levels are lower than they would like to see and as such another rate hike is not sure, despite the strong NFP. Also, North Korean rhetoric kept up after the Security Council adopted new sanctions against the country.

Oil – dropped as Libya announced that its Sharara oil field, its largest, has resumed operation and is working as normal again after a protest shortly caused a halt in production. Yesterday and today also sees a meeting in Abu Dhabi between OPEC and non-OPEC countries to discuss how they can improve the compliance levels which is seen as slipping in recent months. This evening we will also look at what the API data will show us with regards to the inventories. While we have seen that there is a difference of a few million barrels between the API and EIA data, the API data still causes oil to move in the immediate aftermath and sets also the expectation for the EIA data the next day.

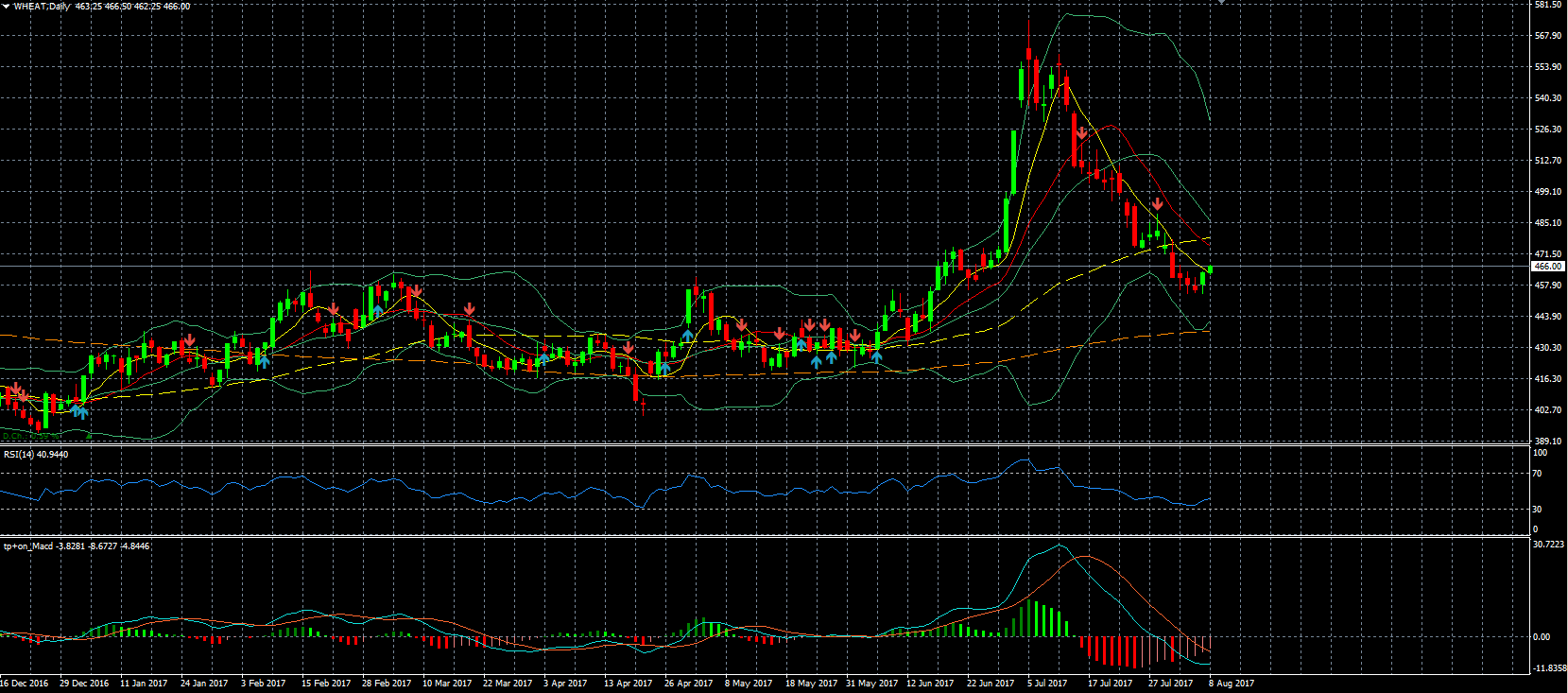

Wheat – last week I mentioned that wheat could be headed for a correction after a large drop since the beginning of July, and we are starting to see wheat move up as it is also helped by weather that could hamper the harvest in Australia, Europe as Thursday will see the monthly WASDA report.

Stocks

Tesla (NASDAQ:TSLA) – it was already expected that Tesla would issue bonds to help it finance is ambitious production plans, but it has done so faster than expected. It plans to raise $1.5 billion by selling 8-year bonds as it is burning cash at a fast rate and this is not likely to slow down with expected investments in an effort to increase production levels.

Teva – dropped another 10% to close a 40%+ drop since its earnings report on Thursday and is now trading at the lowest level since November 2002 as it was also downgraded with a price target of $16 by Morgan Stanley (NYSE:MS).