Bitcoin, the world’s leading cryptocurrency, is entering a period historically marked by reduced trading activity and price stagnation, often referred to as the “summer doldrums.” This seasonal weakness, typically observed from early June to early October, has been characterized by lower trading volumes and diminished investor interest. Past performance suggest that this period may result in a sluggish, sideways market movement rather than dramatic price declines, as Bitcoin consolidates before potentially resuming its upward trajectory in the fall. Despite the current high-interest rate environment and global economic uncertainties, Bitcoin’s resilience as a decentralized, hard money asset continues to attract attention, even as it navigates this traditionally tepid phase.

Review

Around six weeks ago, we predicted “Recovery attempt fails, summer doldrums loom” for Bitcoin and expected a gradual transition into the summer correction. Driven by speculation about a possible Ethereum spot ETF in the USA, Bitcoin prices were initially able to recover somewhat more significantly. However, with highs of USD 71,958 on May 21st and USD 71,949 on June 7th, the all-time high of USD 73,793 from March 14th was missed. Instead, a double top just below USD 72,000 remained!

In the next step, Bitcoin prices got stuck at the psychological mark of USD 70,000 and came under more significant pressure over the last 11 days. Bitcoin is now only trading at USD 63,685, almost 12% below its all-time high. Overall, we see our rather skeptical attitude confirmed.

Record Inflows Into Bitcoin Spot ETFs in Early June

In the first week of June, Bitcoin spot ETFs recorded record inflows of over USD 800 million in just two trading days. The Grayscale Bitcoin Trust (BTC) (NYSE:GBTC) achieved the highest daily volume of all Bitcoin ETFs on June 5th at USD 425 million. Despite the increased institutional demand for the spot ETFs, daily inflows have recently fallen again. Between June 12th and 16th, inflows averaged only USD 120 million per day, which corresponds to a decline of over 80%. Obviously, the demand for Bitcoin spot ETFs remains extremely volatile.

Sell In May and Go Away

In view of the strong rallies in all sectors of the financial markets, we have repeatedly pointed out since late May that Bitcoin and stock markets are strongly correlated and that markets are expected to consolidate sideways or correct or even correct strongly until late summer or autumn. The opposition we received from both the Bitcoin maximalist camp and the gold bug camp to our completely logical “summer lull forecast” was harsh and intense. This confirms our assumption all the more that we should act with extreme caution over the next few months.

Ethereum Spot ETFs in the Starting Blocks

In the meantime, the US Securities and Exchange Commission (SEC) has permanently closed its investigation into Ethereum, paving the way for an Ethereum exchange-traded fund (ETF). Trading could begin within the next two to three weeks. Crypto enthusiasts expect this to be the starting signal for a major rally among altcoins (“altseason”).

In the medium term, the start of trading in Ethereum spot ETFs is likely to have a positive impact on many altcoins. Ethereum (ETH-USD) itself in particular is likely to benefit from the increased legitimacy and attention. Likewise, Ethereum Layer 2 solutions such as Optimism (OP-USD) and Arbitrum (ARB-USD) could gain importance as integral parts of the Ethereum ecosystem. In addition, DeFi projects such as Uniswap (UNI-USD) or Aave (AAVE-USD), which are built on the Ethereum Virtual Machine (EVM), should be legitimized by ETF approval and gradually receive new capital inflows. EVM-compatible projects and blockchains such as Avalanche or Polygon are also closely linked to Ethereum and could gain more attention again, too.

In general, the approval of Ethereum ETFs should give the entire crypto industry more legitimacy and, in the medium term, new wings for the next stage in this bull market. However, the hype is unlikely to be as extreme as when the Bitcoin spot ETFs started trading, and not all altcoins will certainly benefit from it. In particular, closed blockchain systems with no connection to Ethereum, as well as outdated token projects or non-updated technologies, as well as projects with insider dumping and poor tokenomics will fall by the wayside.

Technical Analysis for Bitcoin in US-Dollar

Bitcoin Weekly Chart – Sell Signals Continue to Increase

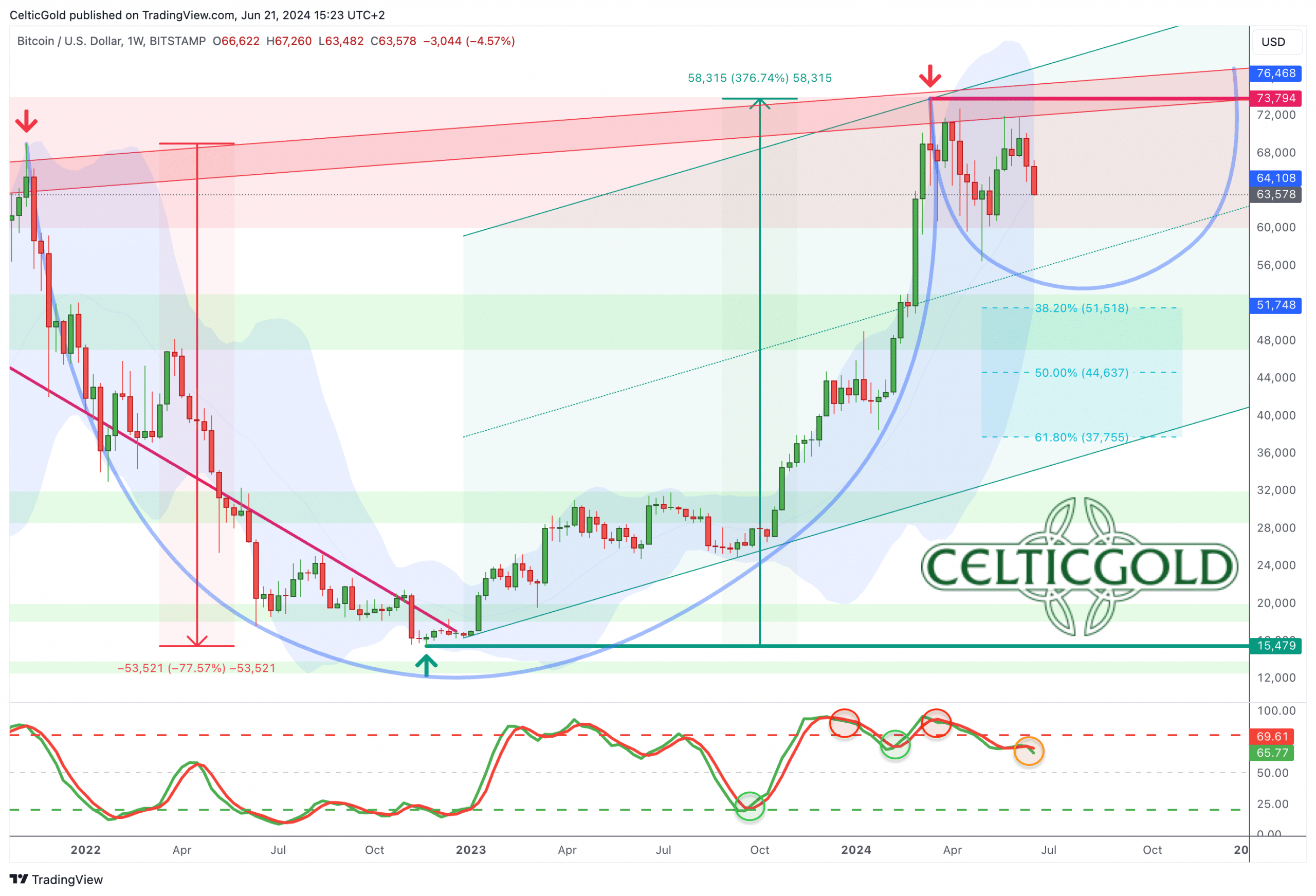

More than three months have already passed since the new all-time high from March 14th, 2024 at USD 73,794. Instead of the continuation of the rally that many had hoped for, Bitcoin is meandering through its weekly chart slowly and without a clear trend. So far, it has been a sideways consolidation at a high level.

However, the sell signal from the weekly stochastic oscillator has recently become somewhat more solid. The lower Bollinger Band (USD 51,748) initially caught up quickly with the current price action, but progress has now slowed due to the long sideways phase. Nevertheless, prices below USD 50,000 have become quite unlikely due to this strong support.

Overall, the weekly chart is neutral. As part of the potential cup-and-handle formation, however, one should continue to plan for a pullback towards the 38.2% retracement (USD 51,518) as a precaution. If, on the other hand, the consolidation or correction only takes place in the upper part of the uptrend channel, the maximum downside risk would be towards around USD 55,000 USD over the summer months. On the upside, a weekly closing price above USD 74,000 is still needed to clearly and unambiguously end this correction.

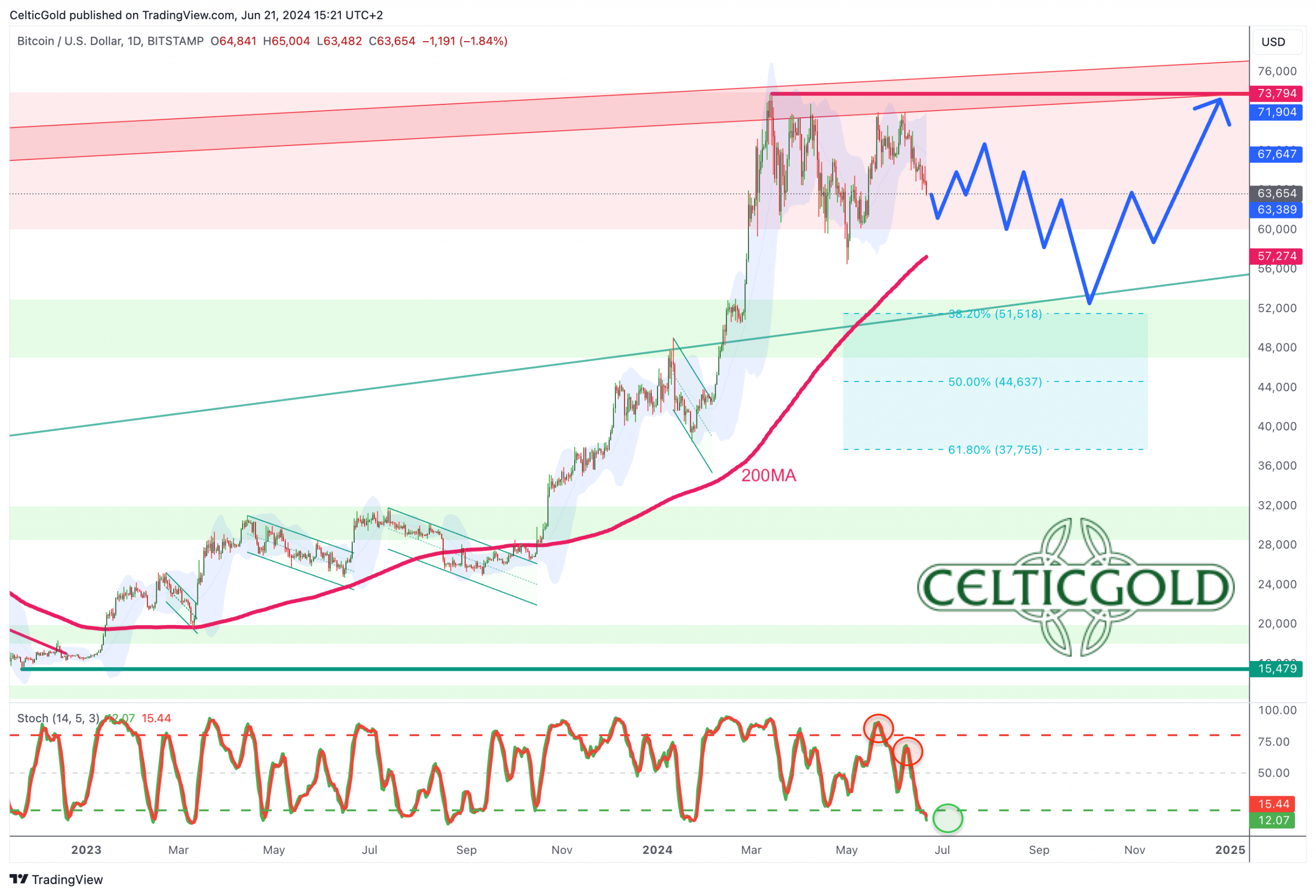

Bitcoin Daily Chart – On the Way to Meet the 200-Day Moving Average

On the daily chart, Bitcoin is currently trading more or less in the middle of its sideways zone, which has been causing a tough back and forth in the range between around USD 60,000 and USD 70,000 for three months. A decision has not yet been made, hence the rapidly rising 200-day moving average (USD 57,274) has now almost caught up with the current price action. This provides additional support for consolidation at a high level, while at the same time a reunion with this important average line is looming.

Meanwhile, the ongoing pullback has led to an oversold stochastic oscillator. The remaining short-term downside risk has therefore probably become manageable. In addition, Bitcoin is likely to start a new recovery attempt soon due to this oversold situation.

Overall, the daily chart is bearish, but increasingly oversold. A recovery or reaction to the sell-off could therefore start soon and might push prices back towards the resistance zone of around USD 70,000. After that, probably in mid-summer, we should anticipate the reunion with the rising 200-day moving average somewhere in the range between approx. USD 60,000 and 65,000.

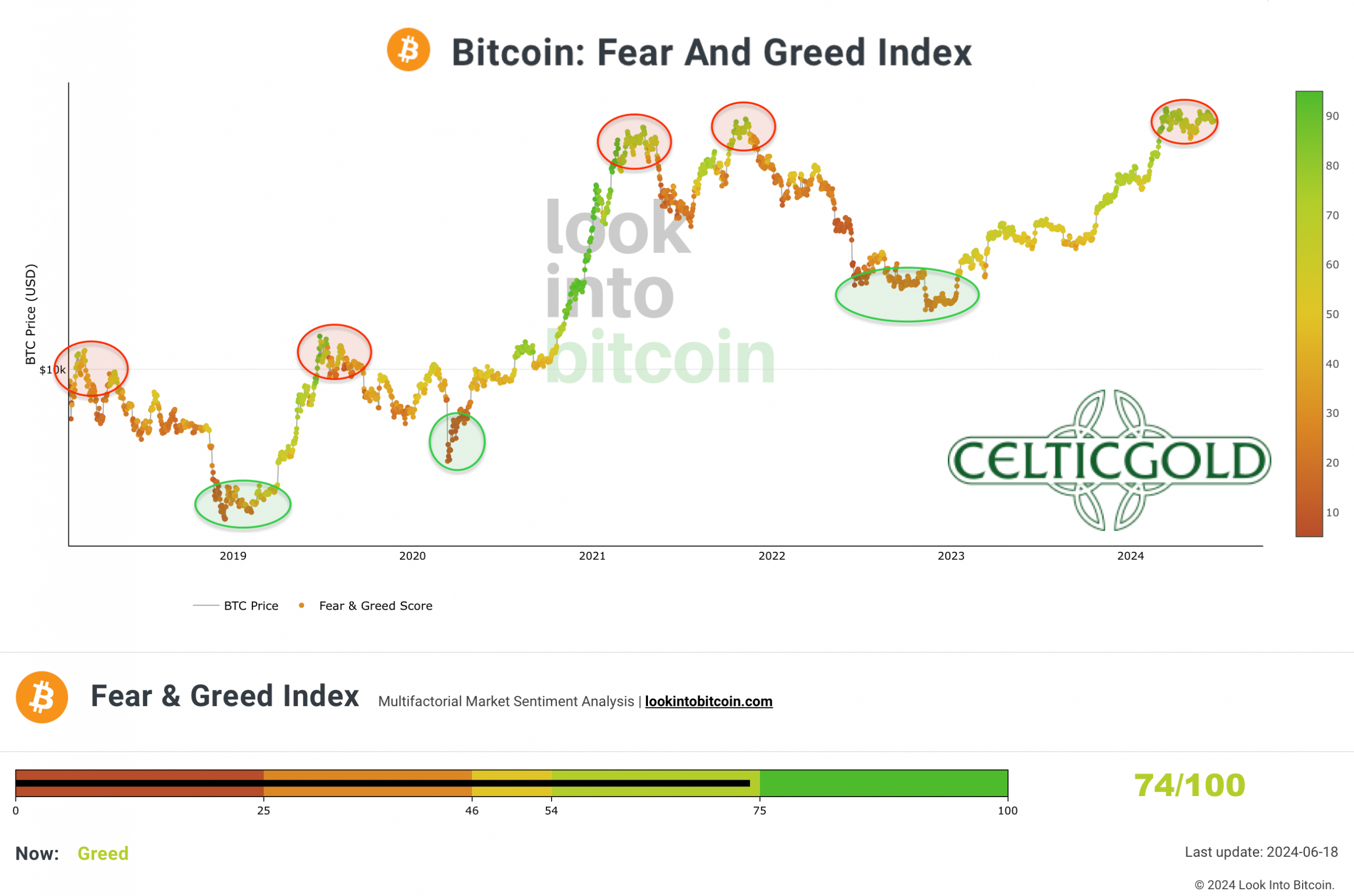

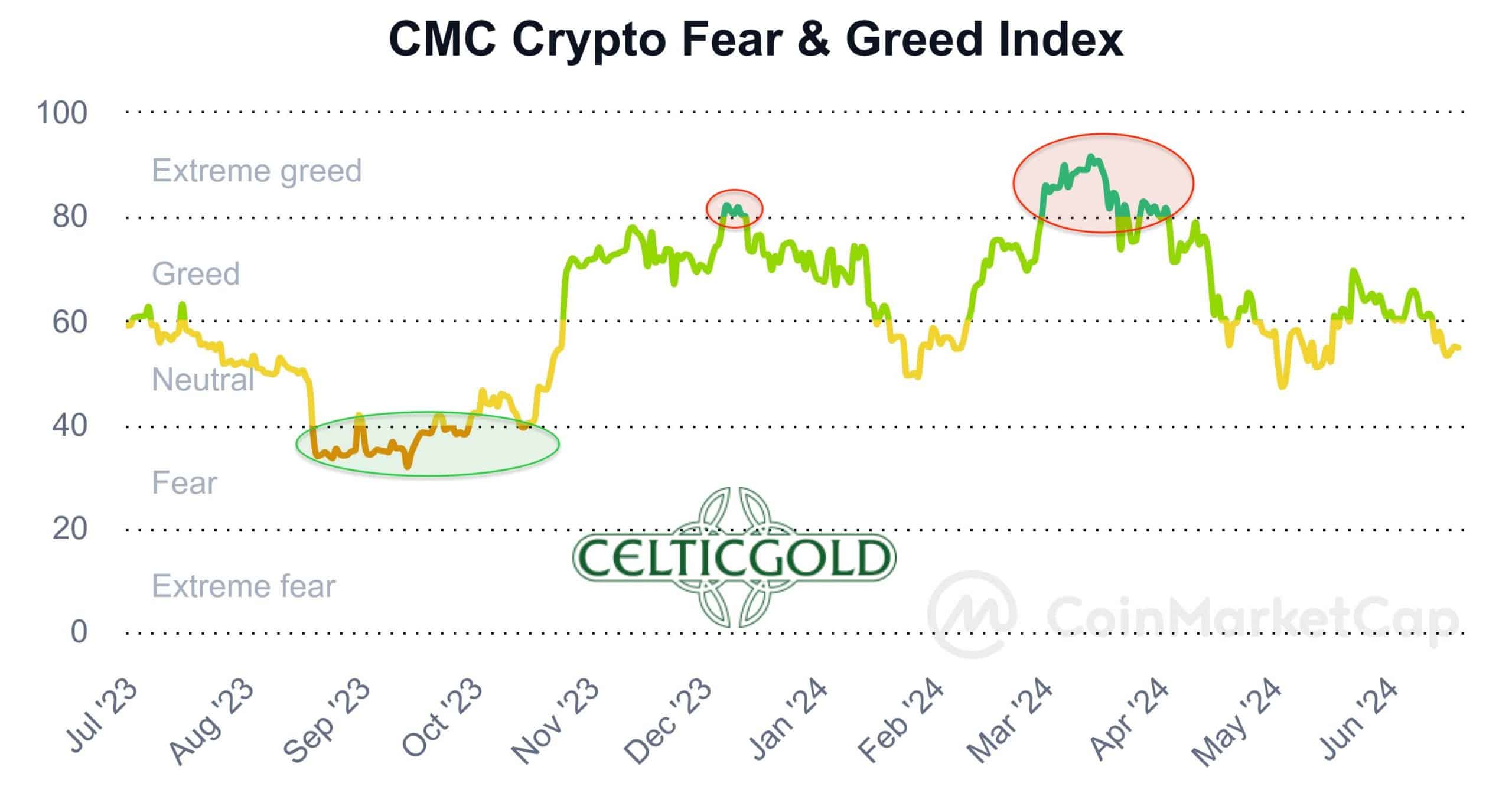

Sentiment Bitcoin – Optimism Still Too High

The “Crypto Fear & Greed Index” is at 74 out of 100 points, only slightly below its March 14th high of 88. Despite the pullback and the almost three-month, tough consolidation at a high level, sentiment has not yet been sustainably cooled down.

The “CMC Crypto Fear & Greed Index” from CoinMarketCap, on the other hand, is currently measuring a somewhat clearer progress towards a neutral sentiment. In our opinion, this would be the minimum requirement for the start of a new and sustainable uptrend in the crypto sector. From a contrarian and psychological point of view, however, a real panic would be the best thing. Obviously, there is no sign of that (yet). Only the smaller altcoins have suffered greatly in recent weeks.

Overall, sentiment is still too optimistic. Either another big wave of selling will be needed or the sideways stretching torture will have to drag on for much longer. We expect a mixture of both until September. Only then will the potential for surprises be to the upside again.

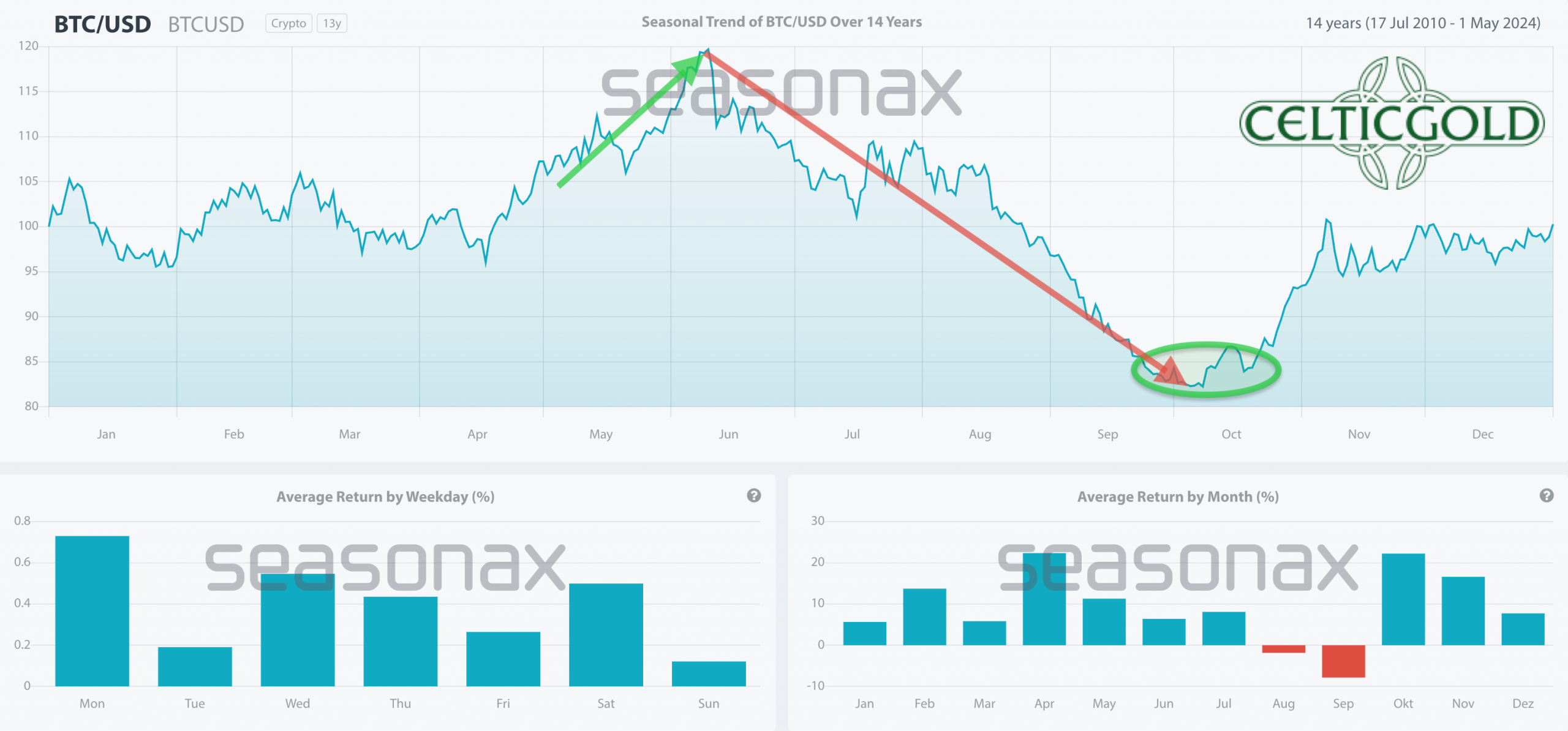

Seasonality Bitcoin – Seasonality Extremely Unfavorable Until the End of September

According to seasonal statistics, Bitcoin is already in its worst phase of the year. On average over the last 14 years, Bitcoin prices have mostly fallen sharply until the end of September or the beginning of October. In addition, there is a strong correlation with the stock markets, for which unfavorable seasonal trends (“Sell in May”) have also been active since the beginning of May.

In summary, seasonality is extremely unfavorable until at least the end of September. The seasonal traffic light is dark red.

Sound Money: Bitcoin Vs. Gold, Bitcoin – Summer Doldrums Loom.

With prices of around USD 64,000 for one Bitcoin and around USD 2,322 for one troy ounce of gold, you currently have to pay around 27.5 ounces of gold for one Bitcoin. Put another way, one ounce of gold currently costs around 0.036 Bitcoin.

After the Bitcoin/Gold-Ratio experienced a sharp decline from 34 to 25 over a month and a half starting in mid-March, it rebounded from 25 to 30 during May. However, since June 9th, gold has once again outperformed Bitcoin.

Overall, the overarching correction that began in mid-March is not yet over. In the short term, however, the Bitcoin/Gold-Ratio is increasingly oversold. A recovery in favor of Bitcoin therefore seems likely in the near future. Over the coming summer months, the correction is expected to continue to around 24, before the overarching uptrend takes over again in the fall.

Macro Update – Summer Doldrums Are Approaching With Temporary Liquidity Shortage

After the global financial crisis of 2008/2009, the financial markets experienced a long phase of low and sometimes even negative interest rates in the USA and the Eurozone. This period of “cheap money” ended abruptly due to sharply rising inflation rates. This inflation was caused by massive money supply expansions, the Corona lockdowns and the resulting supply and logistics problems (inflation due to scarcity and shortages), as well as the geopolitical escalation caused by Russia’s invasion of Ukraine and completely misguided climate and redistribution policies. In order to combat high inflation, the central banks decided to make a radical change of course and ended the 40-year bull market in bonds (falling interest rates).

Still No US Pivot in Sight

In March 2022, the Federal Reserve (Fed) was the first central bank to begin a dramatic increase in key interest rates. Between March and December 2022, the Fed raised the US key interest rate four times in a row by 0.75 percentage points each time. In total, there were seven interest rate hikes by December 2022. More than a year ago, on May 3rd, 2023, the Fed raised the US key interest rate by 0.25 percentage points to a range of 5.0 to 5.25 percent for the last time. Since then, the markets have been speculating tensely before each Fed meeting about the next time a possible interest rate cut will take place, which on the one hand accounts for a significant part of the dynamics in the financial markets and contributes to price formation and liquidity, but on the other hand is also beyond absurd.

As early as the end of 2021, financial markets came under pressure due to the expected and then actually implemented interest rate hikes. Rising interest rates led to higher financing costs and a deterioration in the economic outlook, which weighed on the stock markets in particular, led to massive declines in bond prices, caused a severe bear market in the crypto sector and also severely affected commodity prices and real estate markets.

By the fall of 2022, market participants’ confidence had been so shaken that hardly anyone believed in a recovery. The consensus was that a recession was imminent, and there were practically no bullish market participants left.

The Most Hated Rally in 2023

To everyone’s great surprise, the stock markets (DAX +60%, S&P500 +58%, Nasdaq +92.5%) and, with a slight delay, Bitcoin (+377%) have recovered massively since then. Despite a strong first half of 2023, the majority of market participants distrusted the recovery and were constantly predicting a recession. The rally in stock markets was driven in particular by short sellers who repeatedly bet against the seemingly senseless rally.

The Fed’s intervention in March 2023, when the bank collapses of Silicon Valley Bank and Signature Bank temporarily shook the financial markets, once again injected incredible amounts of new liquidity into the financial system through a multi-billion dollar lending program. In order to restore confidence in the banking sector and ensure the stability of the financial markets, the Bank Term Funding Program (BTFP) and other measures were introduced jointly by the Fed, the US Treasury Department and the Federal Deposit Insurance Corporation (FDIC). The stock markets and especially Bitcoin immediately and quickly priced in the new liquidity.

The Narrow Market Breadth Is Extremely Unhealthy

Nevertheless and until today, the “casino bull market” is still mainly driven by a few tech stocks, especially Nvidia (NASDAQ:NVDA), which indicates an extremely unhealthy market breadth. In fact, Apple (NASDAQ:AAPL), Nvidia and Microsoft (NASDAQ:MSFT) fight almost daily for the title of the largest publicly traded company in the world. All three rank well ahead of number four Alphabet (NASDAQ:GOOGL) with a market capitalization of over USD 3.1 trillion.

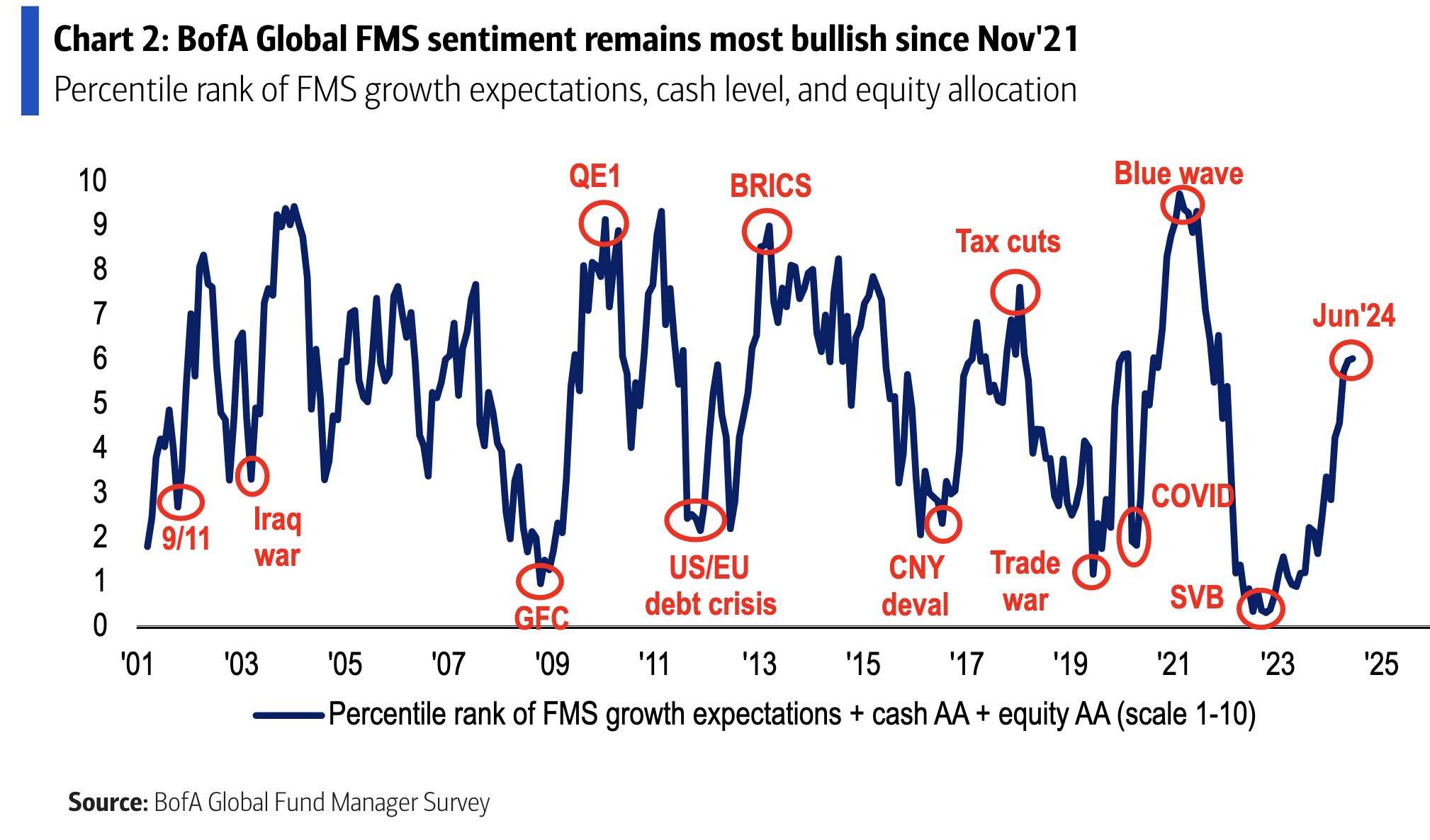

But even though Nvidia has already risen over 190% since the beginning of the year, investors are still bullish on the company. A recent Bank of America fund manager survey showed the most bullish sentiment since November 2021. Still, global risk sentiment has not yet reached extremes compared to previous hyperbole.

However, a rally driven by a few stocks is more vulnerable to pullbacks if those key stocks lose value. Market-weighted indices in the US have been distorted by the outperformance of a few large stocks for over two decades already, giving a misleading picture of overall market health. The current focus on the AI sector has led to dramatic imbalances in market structure and has created a speculative bubble.

With trading volume concentrated in a few stocks, the rest of the market suffers from compromised liquidity. However, a healthy market rally should be characterized by broad participation across different sectors and companies, indicating more robust and sustainable growth and better dispersing risk. Narrow market breadth virtually guarantees a future pick-up in volatility.

The longer this largely artificially inflated financial and economic cycle continues, the more people begin to suspend their disbelief and believe things that are too good to be true. As long as stock prices are rising, doctored company figures or fraudulent practices are ignored. But when people start losing money on a large scale, they blame management and rightly suspect fraud (see Enron). Then the pressure on regulators increases significantly. But that chapter is still in the future.

The Music Just Stopped Playing

What is already worrying in the short term, however, are reports from Japan that Norinchukin, the fifth-largest banking giant, has liquidated around USD 63 billion in government bonds and European bonds to cover massive unrealized losses in its bond portfolio. Norinchukin is now forced to take the path of an orderly liquidation of tens of billions of securities at a time when they are still liquid and well priced, in the hope of avoiding a disorderly liquidation and much worse in a few months.

Reverse Repo Facility Dries Up

At the same time, since the reverse repo facility in the US only has around USD 300 billion left, liquidity for the gamblers on Wall Street is becoming increasingly thin. A year ago, this reverse repo facility was still over USD 2 trillion! Of this, USD 1.7 trillion in new money has already been pumped into the economy. These funds existed as excess bank reserves that were held outside the economy and parked at the Fed. They were withdrawn by the Fed and used to buy government bonds, flooding the economy with fresh money to stimulate consumption. It also fueled the AI stock boom and offset or concealed the falling demand for US government bonds.

US Treasury Is Increasingly Under Pressure

In addition, the cumulative US budget deficit is expected to reach USD 1.2 trillion this year. This forecast takes into account the continued increase in spending on social security and healthcare programs as well as the impact of higher interest rates on interest payments on the national debt. The deficit has already increased significantly in recent years as spending continues to rise and revenues do not grow at the same rate. This is leading to a deterioration in the long-term fiscal position of the USA. The exploding deficit, which is mainly due to the rising interest payments on the national debt, amounted to USD 357 billion in May alone. The high interest rates are therefore not only affecting banks and companies, but also putting the US treasury under pressure.

However, the Fed is unlikely to make any dramatic interest rate cuts before the US election in November. Only if economic conditions deteriorate significantly would central bankers be able to react quickly. However, such a step would require considerable economic stress and a significant pullback in the financial markets beforehand. It is therefore likely that volatility will rise sharply in the second half of the year.

Summer Doldrums Are Approaching With Potential Pullback Into Autumn

For the stock markets and the closely correlated Bitcoin, the outlook for the coming months is therefore initially rather unfavorable. It is to be expected that there will be a typical summer lull into the autumn and then (in September) at least a somewhat larger pullback. Ideally, there will be enough pessimists in October to serve as cannon fodder for a new uptrend, so that the next chapter of the crack-up boom can begin.

Conclusion: Bitcoin – Summer Doldrums Are Approaching

Our prediction of “Recovery attempt fails, summer doldrums loom” for Bitcoin has largely proven to be correct. Despite short-term speculation and several recovery attempts, Bitcoin continues to trade well below its all-time high. Institutional inflows into Bitcoin spot ETFs remain volatile and have recently failed to lead to new sustained increases.

In terms of technical analysis, the situation is neutral overall, although the oversold situation could certainly lead to a larger recovery in the short term. However, the consolidation within the cup-and-handle formation could well drag on for a while. The most dangerous is the potential stress that could spill over from the traditional stock markets into the crypto sector in the wake of a healthy pullback. After all, the AI rally is not just a bubble, but also closely linked to Bitcoin mining and the crypto sector in general.

In total, the expectation remains that the summer doldrums are approaching followed by a potential correction in the fall. In any case, investors should prepare for increased volatility and act with caution. A sustained recovery and a continuation of the rally can then be expected from the fall onwards.