Key highlights this week include impressive data from Vertex’s (NASDAQ:VRTX) cystic fibrosis (CF) pipeline while companies like Gilead (NASDAQ:GILD) and Puma (NASDAQ:PBYI) got FDA approval for their hepatitis C virus (HCV) and breast cancer treatments, respectively.

Recap of the Week’s Most Important Stories

Vertex CF Data Impresses: Vertex got a major boost with positive data on three different triple combination regimens in people with cystic fibrosis (CF) who have one F508del mutation and one minimal function mutation (F508del/Min). These are the first data to show the potential to treat the underlying cause of CF in these patients, who have a severe and difficult-to-treat type of the disease. The company is looking to start a pivotal program in the first half of 2018. Vertex’s shares were up significantly in pre-market trading.

CRL for Amgen/UCB Osteoporosis Drug: Amgen (NASDAQ:AMGN) and partner UCB got a Complete Response Letter (CRL) from the FDA for Evenity (romosozumab), their investigational treatment for postmenopausal women with osteoporosis. However, the CRL doesn’t come as a surprise considering the emergence of a new safety signal in a late-stage study (ARCH). Although Evenity met both the primary endpoints and the key secondary endpoint in the study, the companies said that an imbalance in positively adjudicated cardiovascular serious adverse events was observed.

The FDA has asked the companies to include data from the ARCH study in the resubmission as well as data from the BRIDGE study in men with osteoporosis (Read more: Amgen Gets CRL for Osteoporosis Drug Evenity's BLA). Amgen is a Zacks Rank #3 (Hold) stock -- you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FDA Nod for Gilead HCV Drug: Gilead has added another drug to its hepatitis C virus (HCV) portfolio with the FDA granting approval to Vosevi, a single-tablet regimen for the re-treatment of adults with chronic HCV. Vosevi provides physicians with a new therapeutic option for their hardest-to-treat patients. However, Vosevi comes with a boxed warning regarding the risk of hepatitis B virus (HBV) reactivation in HCV/HBV co-infected patients -- this could limit uptake.

Gilead’s HCV franchise, which was a major revenue generator, is under considerable strain due to new competition and pricing pressure. The company has underperformed the Zacks-categorized Medical-Biomedical/Genetics industry so far in 2017 with shares gaining 0.1% while the industry is up 8.9%.

Puma Up on FDA Approval of Nerlynx: Puma gained FDA approval for its breast cancer treatment, Nerlynx (neratinib), which has blockbuster potential. Nerlynx, the first approved drug in Puma’s portfolio, is indicated for the extended adjuvant treatment of early-stage, HER2+ breast cancer, an aggressive type of tumor. This means that Nerlynx can be taken after an initial treatment so that the risk of the cancer coming back can be reduced further. Nerlynx’s approval was in line with expectations considering a favorable advisory panel vote earlier this year. Puma’s shares were up 8.5% on the news. Year-to-date (YTD), Puma’s shares are up a whopping 204.4%.

Sarepta-BioMarin Settle Patent Dispute: Sarepta (NASDAQ:SRPT) and BioMarin settled their patent dispute regarding the use of Sarepta’s Exondys 51 and all future exon-skipping products for the treatment of Duchenne muscular dystrophy (DMD). The companies signed a licensing agreement providing Sarepta with global exclusive rights to BioMarin’s DMD patent estate for Exondys 51 and all future exon-skipping products. BioMarin has the option to convert the license to a co-exclusive right if it decides to proceed with an exon-skipping therapy for DMD. Terms of the deal include a one-time $35 million payment from Sarepta as well as certain milestone-based payments and royalties. Sarepta’s shares were down 3%.

Performance

Medical - Biomedical and Genetics Industry 5YR % Return

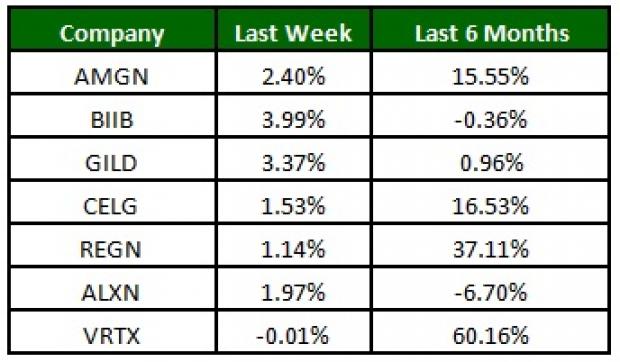

The NASDAQ Biotechnology Index was up 1.1% over the last five trading sessions. Among major biotech stocks, Biogen (NASDAQ:BIIB) was up almost 4%. Over the last six months, Vertex was up 60.2% while Alexion (NASDAQ:ALXN) was down 6.7% (See the last biotech stock roundup here: Arena Shoots Up on Study Data, CELG Inks Immuno-Oncology Deal).

What's Next in the Biotech World?

Watch out for earnings reports from companies like Biogen and Sarepta.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT): Free Stock Analysis Report

Puma Biotechnology Inc (PBYI): Free Stock Analysis Report

Original post