Once again, a single tweet on drug pricing resulted in weakness in the biotech sector with ARIAD (NASDAQ:ARIA) losing ground on a tweet regarding the company’s price hikes for cancer drug, Iclusig. Meanwhile, Regeneron (NASDAQ:REGN) suffered a pipeline setback with the FDA putting a clinical hold on one of its studies.

Recap of the Week’s Most Important Stories

ARIAD Shares Fall on Sanders Tweet: Shares of ARIAD declined 14.8% after Senator Bernie Sanders tweeted on the company’s price hike of leukemia drug Iclusig. The tweet “Drug corporations' greed is unbelievable. Ariad has raised the price of a leukemia drug to almost $199,000 a year” was in response to an article according to which ARIAD had raised the price of Iclusig the fourth time this year with the treatment now costing $16,561 per month, or almost $199,000 per year, excluding discounts or rebates. Drug pricing issues are not something new but with the Presidential election round the corner, concerns regarding the implementation of new drug pricing policies are picking up.

Regeneron-Teva Study on Clinical Hold: Regeneron and partner Teva were hit by a clinical hold on their experimental pain treatment, fasinumab. The FDA placed a phase IIb study in patients with chronic low back pain on clinical hold and asked for the study protocol to be amended following the discovery of adjudicated arthropathy in a patient receiving high dose fasinumab – the patient had advanced osteoarthritis at study entry.

Fasinumab is an investigational nerve growth factor (NGF) antibody. Dosing in the study has been stopped and Teva and Regeneron are now planning a pivotal phase III study for chronic low back pain excluding patients with advanced osteoarthritis.

Meanwhile, the companies plan to study only lower doses in the phase III osteoarthritis pain program as the incidence of adjudicated arthropathies was found to be potentially dose-dependent, with a higher rate in the higher dose groups. Shares of both Regeneron and Teva were down on the fasinumab update (Read more: Regeneron & Teva Hit by Clinical Hold on Chronic Pain Study). Regeneron is a Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ocular Gains on Regeneron Collaboration: Ocular Therapeutix’s (NASDAQ:OCUL) shares jumped on the company’s collaboration agreement with Regeneron for the development of a sustained release formulation of the latter’s blockbuster eye drug, Eylea (aflibercept) for the treatment of wet age-related macular degeneration (wet AMD) and other serious retinal diseases. In addition to receiving milestone payments, Ocular will be entitled to royalties on potential future sales (Read more: Ocular's Stock Jumps on Collaboration with Regeneron).

PTC Plunges on Translarna Update: PTC Therapeutics’ (NASDAQ:PTCT) shares declined almost 40% with the FDA’s Office of Drug Evaluation I (ODE-I) denying the company's first appeal of the refuse to file letter for its Duchenne muscular dystrophy treatment, Translarna, earlier this year. The company said that it intends to appeal to the next supervisory level of the FDA and believes that multiple cycles of appeals to progressively higher levels of the FDA may be required.

The Medicines Co. Gains on PCSK9 Data: The Medicines Company’s (NASDAQ:MDCO) shares were up on positive top-line results from a Day 90 interim analysis of an ongoing phase II study (ORION-1) being conducted on PCSK9si, an investigational PCSK9 inhibitor. The company said that the safety and efficacy data support a triannual, and potentially biannual, low volume subcutaneous dose regimen, for treating patients with hypercholesterolemia. Currently approved PCSK9 inhibitors include Sanofi (PA:SASY) and Regeneron’s Praluent and Amgen’s Repatha. Repatha gained FDA approval for a new, monthly single-dose administration option in July this year.

Performance

Medical - Biomedical and Genetics Industry Price Index

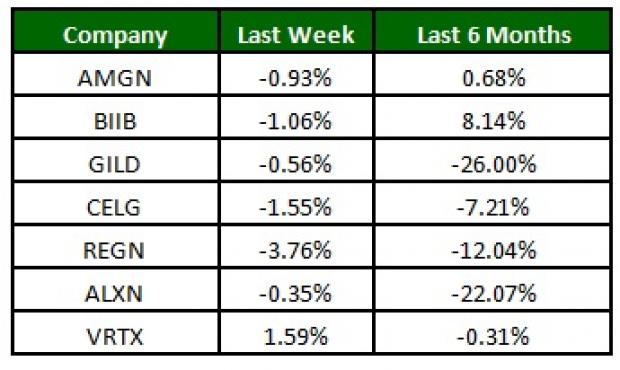

The NASDAQ Biotechnology Index declined 2.8% over the last five trading days. Almost all major biotech stocks recorded a decline with Regeneron losing 3.8% while Vertex (NASDAQ:VRTX) was up 1.6%. Over the last six months, Biogen (NASDAQ:BIIB) was up 8.1% while Gilead lost 26% (See the last biotech stock roundup here: Alnylam Slumps on Revusiran Update, TESARO Impresses at ESMO).

What's Next in the Biotech World?

Watch out for earnings reports from companies like Biogen and Vertex in the coming days.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

VERTEX PHARM (VRTX): Free Stock Analysis Report

REGENERON PHARM (REGN): Free Stock Analysis Report

MEDICINES CO (MDCO): Free Stock Analysis Report

BIOGEN INC (BIIB): Free Stock Analysis Report

ARIAD PHARMA (ARIA): Free Stock Analysis Report

OCULAR THERAPTX (OCUL): Free Stock Analysis Report

PTC THERAPEUTIC (PTCT): Free Stock Analysis Report

Original post

Zacks Investment Research