Drug pricing is back in the news with an investigation being launched by Rep. Elijah E. Cummings and Rep. Peter Welch into the skyrocketing prices of multiple sclerosis (“MS”) drugs. MS, an unpredictable and often disabling disease of the central nervous system (“CNS”), interrupts the flow of information within the brain and between the brain and body with symptoms ranging from numbness and tingling to blindness and paralysis.

Letters have been sent to seven companies requesting information about their pricing strategies for their MS drugs. The letters have also raised the issue of “shadow pricing” – when an expensive new drug is launched or the price of an existing drug is raised, other companies follow suit and increase prices to match the higher prices. According to an American Academy of Neurology study, annual sales of MS drugs doubled from $4 billion to almost $9 billion from 2008 to 2012. Meanwhile, information provided by the National Multiple Sclerosis Society shows that the average wholesale price of MS disease modifying therapies shot up from $16,000 in 2004 to $61,000 in 2013 and $83,688 in 2017.

The letters also mention the lack of strong competition from generics with only one generic (for Copaxone 20 mg) being on the market.

There has been a lot of focus on drug pricing over the last couple of years with companies like Mylan (NASDAQ:MYL), Valeant and Turing among others facing criticism for their pricing strategy. Following the announcement of the investigation, the NYSE ARCA Pharmaceutical Index lost 1.6% over the last two trading sessions while the NASDAQ Biotechnology Index was down 2%.

Here is a look at the seven companies that have been issued letters requesting information about corporate profits and expenses and documents concerning pricing strategies, patient assistance programs, and drug distribution systems. The companies have been asked to provide the required information by Aug 31, 2017.

Life-science company, Bayer (DE:BAYGN) AG (OTC:BAYRY) , is among the seven companies to receive a letter for its MS drug, Betaseron. According to the letter, Betaseron’s price has increased 691% since its approval in 1993 and has almost doubled in price over the last five years. Bayer’s shares were down slightly (0.2%) following the news about the investigation. However, year to date, Bayer stock has gained 21.6%, substantially outperforming the 9.3% rally of the industry it belongs to.

Biogen (NASDAQ:BIIB) , a key player in the MS market, has been asked to submit information on five MS drugs – Avonex, Tysabri, Tecfidera, Plegridy and Zinbryta (co-promoted with AbbVie). According to the letter, four of these drugs have seen at least double-digit price increases since approval while the price of one drug has increased by almost 1,000%. Moreover, Zinbryta, was introduced at a price of $86,592 per annum in 2016 and the price of Biogen’s other four MS drugs were hiked to match Zinbryta’s price by 2017.

Biogen is down 4.2% following the announcement of the investigation. The company’s MS franchise accounts for a major part of total sales. Year to date, Biogen stock has lost 0.6% of its value, versus the 4.9% growth of its industry.

EMD Serono, the biopharmaceutical division of Merck (NYSE:MRK) KGaA MKGAF, has also been questioned about the 496% increase in the price of its MS drug Rebif since its approval in 2002. Moreover, the drug’s price has almost doubled in just five years between 2012 and 2017. Rebif has been facing stiff competition from oral formulations. Merck KGaA’s shares are down 2.3% following the receipt of the letter. Year to date, Merck KGaA stock has gained 0.8%, versus the 3.5% decline of the industry it belongs to.

Swiss pharmaceutical giant, Novartis AG (NYSE:NVS) , has been asked to provide information about Extavia and Gilenya. While Extavia’s price has shot up by more than 130% since its approval in 2009, Gilenya’s price has nearly doubled in less than ten years. Novartis has another MS drug in its portfolio, Glatopa, which is a generic version of Copaxone 20 mg. Novartis declined 1.9% over the last two trading sessions though year to date, the stock has gained 13.6%, outperforming the 9.3% rally of the industry it belongs to.

French pharmaceutical giant, Sanofi (NYSE:SNY) , has also received a letter regarding the investigation. Although Sanofi recently said that it would limit future annual price increases to the National Health Expenditures (NHE) growth rate, the company has been asked to provide information about the price increases for Aubagio and Lemtrada. Sanofi’s shares were not affected significantly with shares slipping 0.5% over the last two trading sessions. Year to date, Sanofi stock has gained 19.2%, substantially outperforming the 9.3% rally of the industry it belongs to.

Sanofi is a Zacks Rank #2 (Buy) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

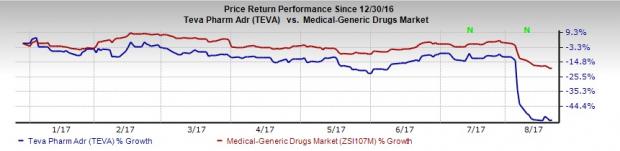

Israel-based Teva Pharmaceutical Industries Ltd.’s (NYSE:TEVA) shares slipped 1% with the company’s pricing pattern for Copaxone 20 mg and Copaxone 40 mg being questioned. While the 20 mg formulation’s price has shot up by more than 1,000% since its approval in 1997, the 40 mg formulation was launched at a steep price and has witnessed a double-digit price increase in three years. Teva has lost 52.3% of its value year to date versus the 19.5% decline of its industry.

Swiss pharmaceutical company, Roche (OTC:RHHBY) has received a query regarding its recently introduced MS drug, Ocrevus. Although Ocrevus was launched at a 20% discount to other branded MS drugs on the market, questions were raised about whether Ocrevus (which is considered to be similar to Roche’s Rituxan) is really a new, breakthrough product or a reformulation of an old drug that is likely to face biosimilar competition soon in the U.S. Roche’s shares were down 0.9% in the last two trading sessions. Year to date, Roche stock has gained 9.5%, versus the 9.3% rally of the industry it belongs to.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Sanofi (SNY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Bayer AG (BAYRY): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Teva Pharmaceutical Industries Limited (TEVA): Free Stock Analysis Report

Original post

Zacks Investment Research