- The S&P 500 index surged in the first quarter, with nearly half of this growth attributed to select top-performing stocks like Nvidia.

- Amid this trend, it's crucial to consider the cyclical nature of the market and its impact on investor sentiment and price trends over the next few years.

- Today's high valuations may translate to lower expected future returns, prompting investors to consider alternative investment opportunities beyond popular choices.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

The S&P 500 index rose by 10.6% in the first quarter. Nearly half of these gains, 4.8% to be specific, came from top-performing stocks like Nvidia (NASDAQ:NVDA).

While many expect this trend to persist for some time, looking ahead 3-5 years from now is essential. The market operates in cycles, with periods of growth and decline impacting both investor sentiment and price trends.

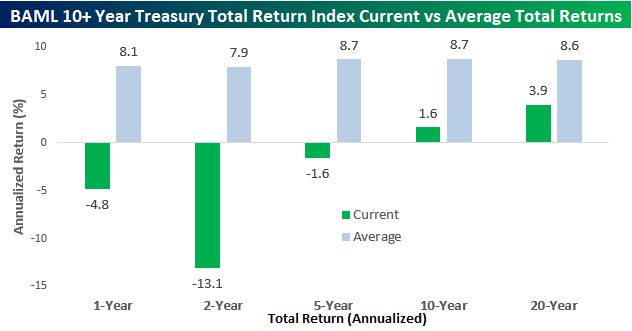

Every investor must remember the golden rule: "Today's high valuations often mean lower expected future returns tomorrow" and vice versa. To validate this rule, one can examine various asset classes, including 10+ Treasuries, among others.

Looking Beyond the Magnificent 7 for Outperformance

The Magnificent 7 have been delivering outstanding returns since 2023 and 2024.

This is quite a turnaround from 2022 when hardly anyone showed interest in them. I recall buying Meta Platforms (NASDAQ:META) during its low points, but back then, many were skeptical about its success due to competition from TikTok.

Now that we've established some solid facts, let's explore some companies that could follow a similar trajectory.

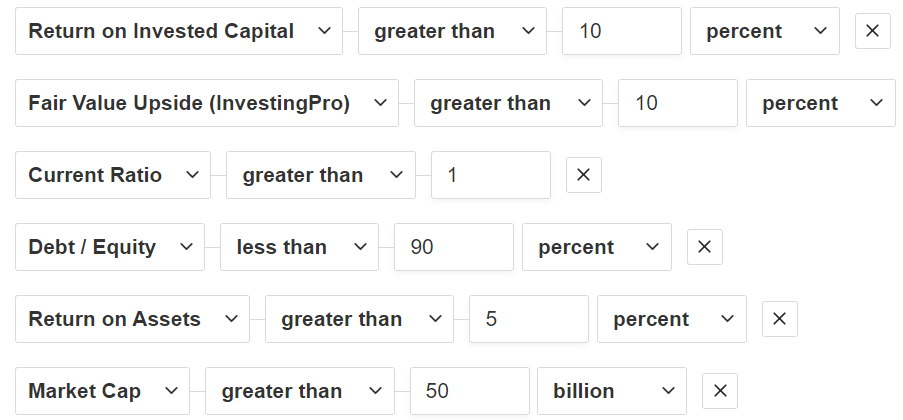

Here's a list of 7 potential stocks that meet specific criteria similar to those used with InvestingPro:

- Return on Invested Capital (ROIC) greater than 10%

- Bullish potential of at least 10%

- Current Ratio exceeding 1

- Debt-to-Capital Ratio below 0.9

- Return on Assets (ROA) surpassing 5%

- Market Capitalization exceeding 50 Billion

Source: InvestingPro

7 Picks Poised to Outperform

The companies you see listed below are 7 well-known stocks with all of the characteristics above, along with a P/E rating of less than 17 (historical average S&P 500 area)

- PayPal Holdings (NASDAQ:PYPL)

- Alibaba Group (NYSE:BABA)

- Berkshire Hathaway (NYSE:BRKa)

- Total Energy Services (TSX:TOT)

- Rio Tinto (NYSE:RIO)

- Stellantis NV (NYSE:STLA)

- Cisco Systems (NASDAQ:CSCO)

Many of these companies have faced challenges for a while now, mainly due to falling prices rather than fundamental weaknesses. Typically, they're initially criticized and then overlooked.

Not all of them will bounce back statistically, but we can start assessing those with better odds of delivering higher returns to investors in the future.

While not every stock can be outstanding, potential greatness may hide within each one.

Here's to the next opportunity!

***

DON'T forget to take advantage of the InvestingPro+ discount on the annual plan (click HERE), and you can find out which stocks are undervalued and which are overvalued thanks to a series of exclusive tools:

- ProPicks, stock portfolios managed by artificial intelligence and human expertise

- ProTips, simplified information and data

- Fair Value and Financial Health, 2 indicators that provide immediate insight into the potential and risk of each stock

- Stock screeners and

- Historical Financial Data on thousands of stocks, and many other services!

That's not all, here's a discount on the annual plan of InvestingPro! click HERE

Disclaimer: The author holds long positions in Paypal, S&P 500 and Nasdaq. This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.