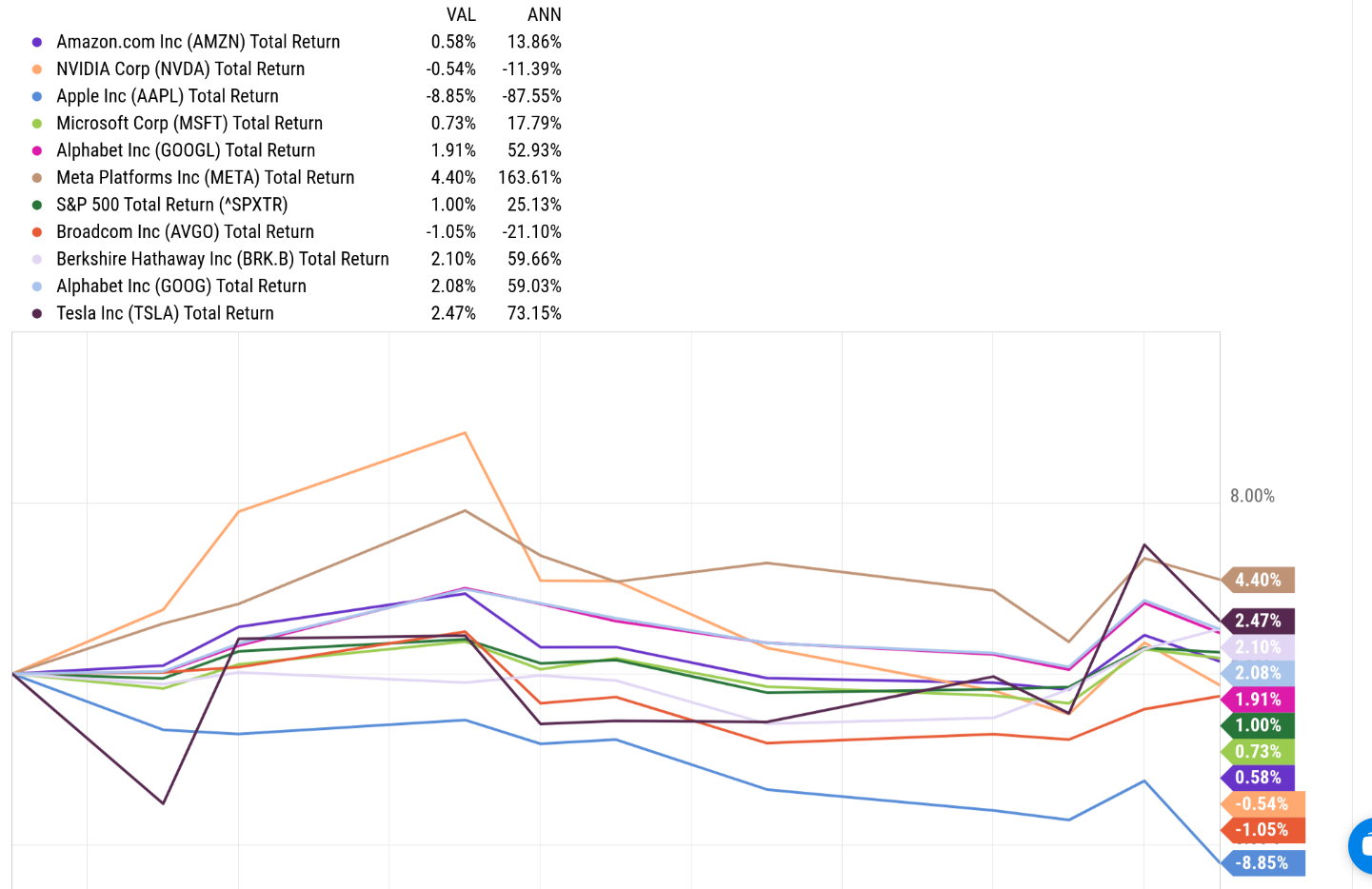

Here’s a chart of the Top 10 S&P 500 names (by market cap) and how the stocks have performed YTD through January 15, ’25, relative to the S&P 500 total return:

Source: Ycharts

None of the top 3 names by market cap, i.e. Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), or Apple (NASDAQ:AAPL) are beating the S&P 500 YTD. (Apple had a very tough day yesterday, January 16th, ’25, as Apple and the QQQ’s fell 3.5% and 4% respectively. )

Here’s how the Top 10 names by market cap rank in terms of YTD ’25 performance, best to worst:

- Meta (NASDAQ:META) (Meta): +4.4%

- Tesla (NASDAQ:TSLA) +2.47%

- Berkshire Hathaway B (NYSE:BRKb): +2.10%

- Alphabet Inc Class C (NASDAQ:GOOG): +2.08%

- Alphabet Inc Class A (NASDAQ:GOOGL): +1.91%

- S&P 500 (SPXTR): +1%

- Microsoft (MSFT): +0.73%

- Amazon (NASDAQ:AMZN) +0.58%

- Nvidia (NVDA): -0.54%

- Broadcom (NASDAQ:AVGO): -0.85%

- Apple (AAPL): -8.85%

Source: Ycharts, as of Thursday close, January 15, ’25

What’s interesting to me is that the top 3 market-cap weights and the largest 3 names in the S&P 500 by market cap weight are down the most YTD in ’25. As of last night’s close that is 19% – 20% of the S&P 500’s market cap weight, and 25% – 26% of the QQQ’s market cap weight.

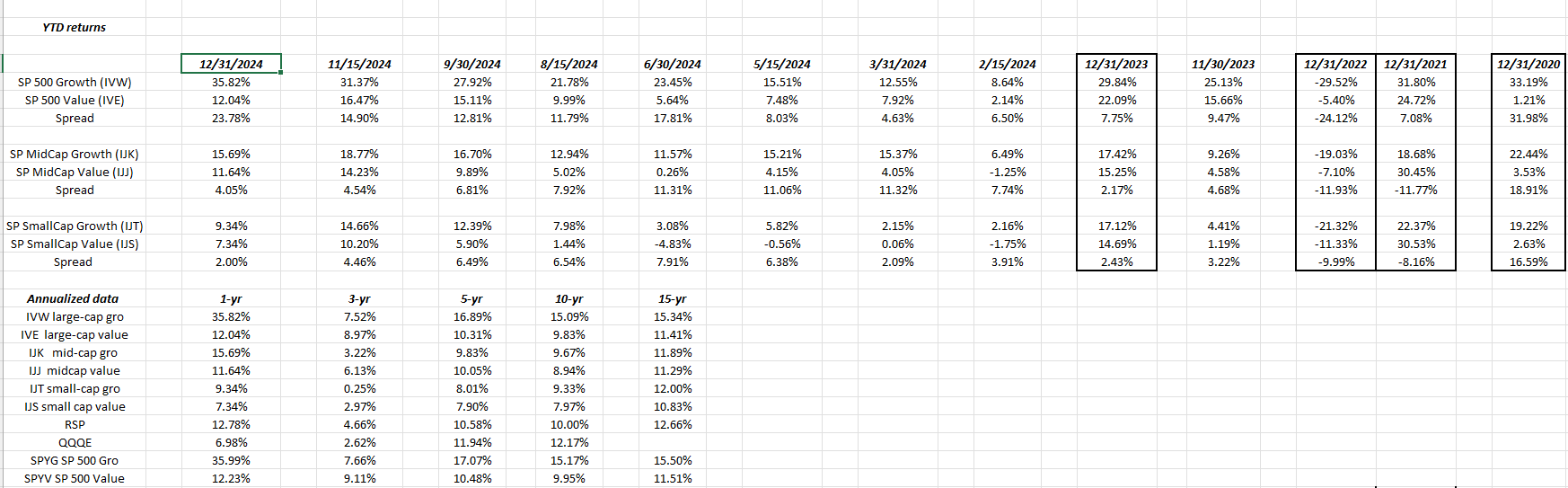

As readers can probably surmise, you should watch for “rotation”, or the move out of large-cap growth and large-cap tech, into the other asset classes, like mid-cap and small-cap (whether growth or value, it won’t matter), and international too.

StyleBox Update:

The above spreadsheet is this blog’s annual returns for the various asset classes, which is updated to track the potential rotation, from large-cap growth to the other equity asset classes.

As of the end of ’24, there isn’t hard evidence of a rotation yet.

The style-box returns are just as they have been for the secular bull market that started either March 9, 2009 or on January 1, 2010.

It’s likely we will need to see Q4 ’24 earnings and guidance for the S&P 500 Top 10 names to see if there’s any material difference in expectations.

Top 10 Client Holdings:

This blog has been cautious since last summer on the AI frenzy and the Nvidia / semiconductor trade, which might have been premature. Taiwan Semi had a good quarter this week, with better-than-expected revenue guidance. Micron’s stock is holding up well, despite horrid guidance and estimate revisions.

Here’s this blog’s top 10 holdings for clients as of 12/31/24:

- JP Morgan Income (JMSIX) Bond fund: ’24 return +7.73%

- JPMorgan Chase & Co (NYSE:JPM): +43.63% ’24 total return

- Amazon (AMZN): +44.39% ’24 total return

- Invesco QQQ Trust (NASDAQ:QQQ) (Nasdaq 100 ETF): +25.58% ’24 total return

- Microsoft (MSFT): +12.91% ’24 total return

- Tesla (TSLA): +62.52% ’24 total return

- Netflix (NASDAQ:NFLX): +83.67% ’24 total return

- Charles Schwab Corp (NYSE:SCHW): +9.03% ’24 total return

- Alphabet (GOOGL): +35.94% total return

- Walmart (NYSE:WMT): +73.51% total return

- iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD): +0.86%

- SPDR® S&P 500® ETF Trust (ASX:SPY): +24.89% YTD return

The majority of clients have balanced accounts under some form of the 60% / 40% asset allocation, with this blog adjusting the equity / fixed income based on market conditions.

The JP Morgan Income Fund (JMSIX) beat the Barclays (LON:BARC) Aggregate in 2024 by around 650 bp’s in ’24. That’s the “credit over duration” trade, that lasts only as long as the US economy stays healthy.

The biggest single position change was the reduction in Microsoft’s weight in the 3rd quarter ’24. It’s spending a lot of money on AI capex, and the CoPilot launch seemed to be received in a luke-warm fashion. Satya Nadella did a fantastic job with the cloud and Azure, but I worry the AI transition might not go as smoothly.

Some larger clients have 100% equity portfolios, that have a big influence on the Top 10 holdings.

Many of these positions have been held for years.

Summary / conclusion:

The last Top 10 holdings posted was way back in early July ’24, when this blog turned more cautious on the large-cap growth trade, but large-cap and growth still performed well in full-year ’24.

I was surprised looking at the style box and the difference in large-cap growth and value in the 2nd half of ’24. Large-cap value didn’t hold up all that well in back half of ’24.

Everything about this post-Covid rally in US stocks has been dominated by AI, Nvidia and semiconductors, and personally Im staying away from that trade, with the exception of smaller trades in larger accounts.

Within most clients balanced accounts, the financial sector is the largest overweight relative to the S&P 500’s financial sector weight of 13%, thus that turned out to be a big winner in late ’24. Some small amounts of JP Morgan are being trimmed in early ’25, while the stocks like Schwab (SCHW) and the KRE (regional bank ETF), should win with a steeper yield curve, and remain below their 2021 high prints.

***

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal even for short periods of time. All returns and style-box return data is soured from Morningstar. None of the information above may be updated and if updated may not be updated in a timely fashion.