Investing.com’s stocks of the week

Stocks on Wednesday suffered their worst day in months -- or years, in the case of the tech-rich Nasdaq Composite. The S&P 500 Index (SPX) endured its steepest one-day percentage loss since February, giving up 3.3%. Meanwhile, the S&P 500 ETF Trust (SPY (NYSE:SPY)) 14-day Relative Strength Index (RSI) fell below 25 -- into oversold territory. However, if recent history is any indicator, stocks could be ripe for a short-term rebound -- and airline stocks could extend today's rally.

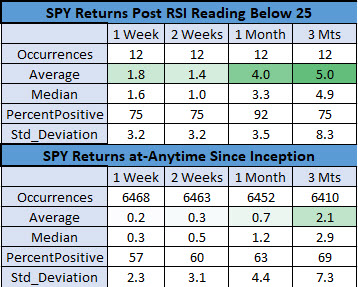

Rare Oversold Signal for SPY

The last time the SPY RSI fell south of 25 was more than three years ago, during the August 2015 stock market decline. Prior to that, you'd have to go back to May 2012, per data from Schaeffer's Quantitative Analyst Chris Prybal. In history, this has happened only 13 other times, considering one signal every 30 days.

If past is prologue, this sets up a nice "bounce" environment for SPY in the near term. One week after signals, the exchange-traded fund (ETF) was up 1.8%, on average, and higher 75% of the time. That's nine times its average anytime one-week return of 0.2%, with a win rate of just 57%. It's a similar story two weeks out, with the SPY up a better-than-usual 1.4% and higher 75% of the time.

A month after SPY RSI signals, the shares were 4% higher, on average -- more than five times the average anytime one-month return -- and were in the black a whopping 92% of the time. Three months later, the SPY was up 5%, on average, more than doubling the norm.

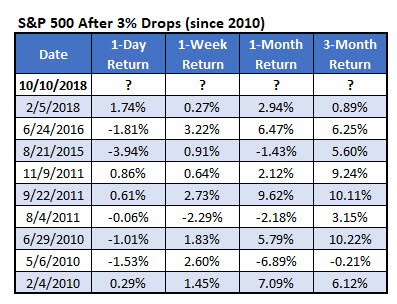

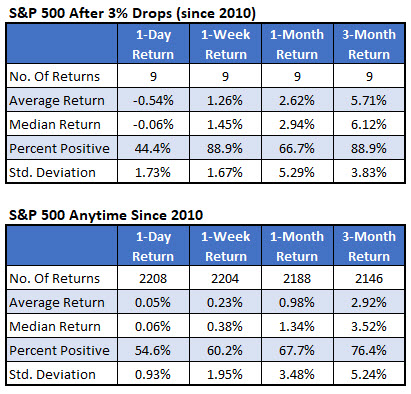

Stocks Could Bounce Back in Q4

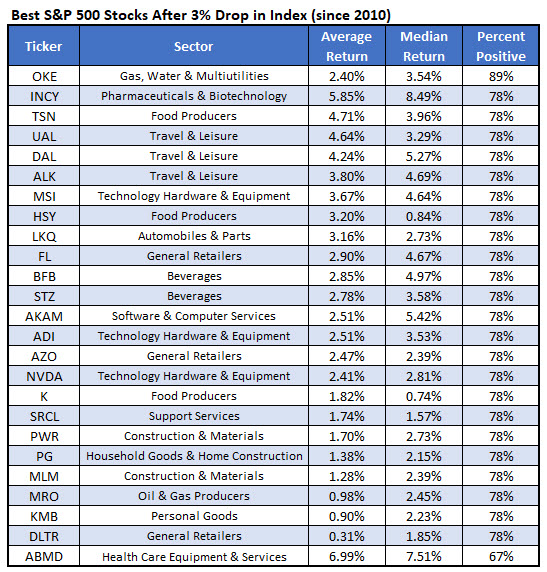

In the same vein, the SPX tends to outperform in the short term, after dropping 3% in the span of one day. Since 2010, this has happened just nine times, considering only one signal per every two weeks, per Schaeffer's Senior Quantitative Analyst Rocky White. The last time was during the February 2018 stock market correction, and prior to that you'd have to go back to the June 2016 Brexit brouhaha.

One day after these drops, the S&P tends to remain weak, dropping 0.54%, on average. So far today, the broad-market barometer is, in fact, on pace for a sixth straight loss. Further, the index was positive less than half the time a day after a steep sell-off. That's compared to an average anytime one-day gain of 0.05%, with a win rate of 54.6%, looking at data since 2010.

However, a week after these stock market routs, the S&P 500 was up 1.26%, on average, and higher an impressive 88.9% of the time. That's about six times its average anytime one-week return of 0.23%, with a positive rate of 60.2%. One month after a 3% drop, the S&P was up 2.62%, on average, and three months later, the index was up 5.71%, handily exceeding its anytime returns.

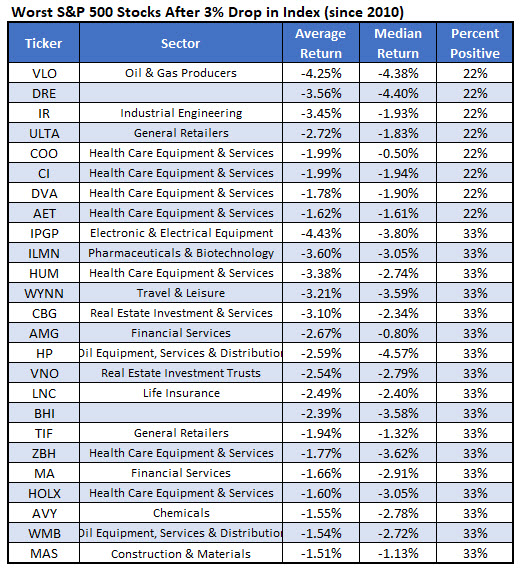

Best (and Worst) Stocks to Buy After a Sell-Off

So, where should you put your money after the latest stock market swoon? Well, if past is precedent, airline stocks could continue to climb into November. The sector is defying broad-market headwinds today, thanks to a well-received earnings showing from Delta Air Lines, Inc. (NYSE:NYSE:DAL).

DAL stock is up 3.0% to trade at $51.24 today, after yesterday falling to a nearly three-month low. Following S&P 500 drops of 3% or more in one day, Delta stock gained 4.24% in the subsequent two weeks, on average, and was higher 78% of the time. Fellow airline issue United Continental Holdings Inc (NASDAQ:UAL) was also higher 78% of the time two weeks after a steep SPX drop, boasting an even better average return of 4.64%. Meanwhile, Alaska Air Group Inc (NYSE:ALK) was up an average of 3.8%, with a win rate of 78%.

On the other hand, Valero Energy Corporation (NYSE:NYSE:VLO) tends to sink in the two weeks after an SPX drop of at least 3%. The oil stock is at the top of our list of worst stocks to own after these sell-offs, averaging a two-week loss of 4.25%, and higher just 22% of the time. VLO shares are already pacing for their lowest close since July, down 3.37% to trade at $107.10.