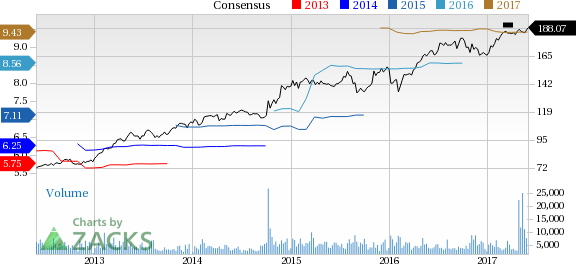

Share price of Becton, Dickinson and Company (NYSE:BDX) , based in Franklin Lakes, NJ, Becton, scaled a new 52-week high of $188.48 on May 30, eventually closing a bit lower at $188.07. The company has gained 14.3% over the past six months, ahead of the S&P 500’s 10.7% gain. The stock has a market cap of $42.75 billion.

Comparison with Broader Industry

For the majority of last one year, the company’s share price has consistently outperformed the Zacks categorized Medical - Dental Supplies sub-industry. The stock has rallied 12.6% over this period, outshining the sub-industry’s gain of 8.3%. The company’s five-year historical growth rate is also favorable at 10.1% as compared to 2.8% of the S&P 500 index.

Estimate Revision Trend

This Zacks Rank #3 (Hold) company’s estimate revision trend for the current year is also favorable. In the past 60 days, five estimates have moved up with one moving at the opposite direction. The magnitude of estimate revision over the same time period increased around 0.1% to $9.43 per share.

Catalysts

The market is upbeat about the strategic acquisitions and collaborations made by the company. In this regard, we note that Becton, Dickinson announced a collaboration for its IMPRESS instrument management system with cloud-based solution provider UniteOR's cloud-based surgical tray tracking and vendor management solution that enables greater visibility of surgical tray management to health care workers in the operating room and sterile processing department. This integration with UniteOR allows Becton, Dickinson to offer a truly integrated approach for complex challenges that hospitals and health systems face with regard to surgical tracking.

This apart, Becton, Dickinson has inked an agreement to acquire C.R. Bard. This deal will enhance Becton, Dickinson’s portfolio and offerings in high-growth areas. Per management, Becton, Dickinson is on its way to become one of the biggest medical technology devices companies in the world with this buyout.

Also, the company recently completed the buyout of Israeli-based, global infusion pump systems manufacturer, Caesarea Medical Electronics (CME).

Apart from the acquisitions and mergers, other catalysts include the company’s receipt of 510(k) clearance from the FDA for a flow cytometer system with a leucocount reagent assay used in residual white blood cell enumeration.

The company also announced the global distribution of a complete line of products for mass spectrometry that provides high-speed and high-confidence identification of pathogens in clinical laboratories – a critical first step in the fight against antimicrobial resistance. The company’s mass spectrometry solutions suite includes MBT Biotargets and MBT Sepsityper as well as standard reagents and other products.

Further, Becton, Dickinson’s focus on geographical expansion in overseas markets like India, China, Brazil and Turkey is also boosting market’s sentiments for the share.

Key Picks

A few better-ranked stocks in the broader medical sector are Luminex Corporation (NASDAQ:LMNX) , Inogen, Inc. (NASDAQ:INGN) and Accelerate Diagnostics, Inc. (NASDAQ:AXDX) . Notably, Luminex and Inogen sport a Zacks Rank #1 (Strong Buy), while Accelerate Diagnostics carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Luminex has an expected long-term adjusted earnings growth of almost 16.3%. The stock added roughly 7% over the last three months.

Inogen has a long-term expected earnings growth rate of 17.5%. The stock has a solid one-year return of around 81.9%.

Accelerate Diagnostics has an expected long-term adjusted earnings growth of 30%. The stock added roughly 7.5% over the last three months.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Luminex Corporation (LMNX): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Accelerate Diagnostics, Inc. (AXDX): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research