Market Brief

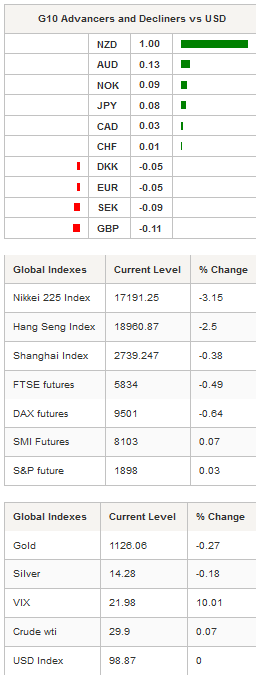

After a modest recovery followed by a very short period of stabilisation, investors are falling off the wagon again. Asian equities tumbled on Wednesday following the lead from Europe and the US against the backdrop of renewed risk-off sentiment and falling oil prices. West Texas Intermediate crude is back below the $30 threshold, down 13% since Monday, while Brent crude fell 9.50% over the same period. It is worth noting that the Brent-WTI spread has hit roughly $3 since Monday on concerns about building stockpiles in the US.

As usual in such market conditions, safe haven assets have been sold like hot cakes. Since the beginning of the week the US dollar has been down 1.70% against the Japanese yen, while the demand for government bonds remains more than solid, pushing treasury yields to multi-month lows. The US yields curve had flattened significantly with the 10-year trading below the 1.90% threshold, while the 30-year hit 2.64% for the first time since August 2015. On the short-end, fading Fed tightening expectations weigh significantly on the 2-year, which has moved back below 0.74%, down 7bps since Monday - or 36bps since early January (!). As a result, faltering US yield increased the pressure on the greenback with the dollar index retreating 1% over the past two days.

In China, the improving Caixin PMIs were of little help in reassuring investors about the state of China’s health. In January, the Services PMI printed at 52.4 versus 50.2 in the previous month, while the Composite gauge came in at 50.1 from 49.4 in December. The Shanghai Composite slipped 0.38%, while the tech-heavy Shenzhen Composite edged up 0.47%. In Japan, the Nikkei fell 3.15% in spite of improving PMIs (Services was up to 52.4 from 51.5 while Composites increased to 52.6 from 52.2). In Europe, futures are broadly edging lower this morning following the footstep of Asian indices: the Footsie is down 0.49%, the DAX -0.64%, the CAC -0.68% while the SMI was up 0.07%. In our view this week’s sell-off will likely be short-lived as nothing new has come out over the past few days, just old fears that resurfaced as crude oil took another hit.

In New Zealand, the kiwi surged 1% against the greenback on surprisingly better-than-expected job report. Unemployment rate fell to 5.3% in the fourth quarter (versus 6.1% expected and 6.0% in 3Q) on falling participation rate (68.4% versus 68.7% in 3Q) and improving job creation (+0.9%q/q vs. 0.8% consensus). NZD/USD is on its way to test the psychological resistance that lies at 0.66. On the downside, a support can be found at 0.6348 (low from January 20th).

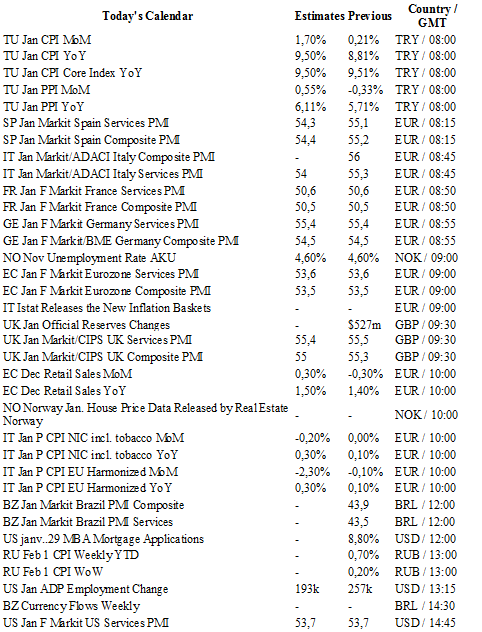

Today traders will be watching inflation report from Turkey, Russia and Italy; PMIs from Brazil, Spain, Italy, France, Germany, the euro zone and the UK; unemployment rate from Norway; retail sales from the euro zone; MBA mortgage application, ADP employment change, PMIs and ISM non-manufacturing from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0920

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4386

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 119.85

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0186

S 1: 0.9786

S 2: 0.9476