The bear-market bias that’s been lurking for the US stock market since last autumn remains intact, according to several econometric applications. Although equities overall continue to trade near all-time highs, the mild downward slope in pricing in recent months suggests that the market’s capacity to rally is wearing thin.

What would kill the bear-market threat? A convincing run of strong economic reports. Granted, the macro trend isn’t terrible, as outlined in yesterday’s US economic profile. But the numbers aren’t particularly encouraging either. The net result: the market’s in a state of limbo, waiting for a convincing signal, for good or ill. But as long as the incoming macro figures are mixed, as they have been this year, the bear-market bias for equities will roll on.

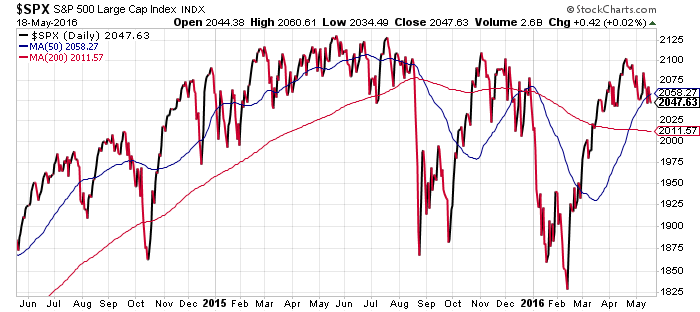

The latest clue for arguing that the stock market has lost its mojo is the failure of the latest rally to rise decisively above the previous high. The S&P 500 peaked in late-April, just below last November’s high, which marked a rally that failed to reach the highs set earlier in 2015. It’s a slow grind lower, interrupted by bear-market rallies, or so one can argue. In sum, it looks like an extended topping-out process is unfolding in slow motion.

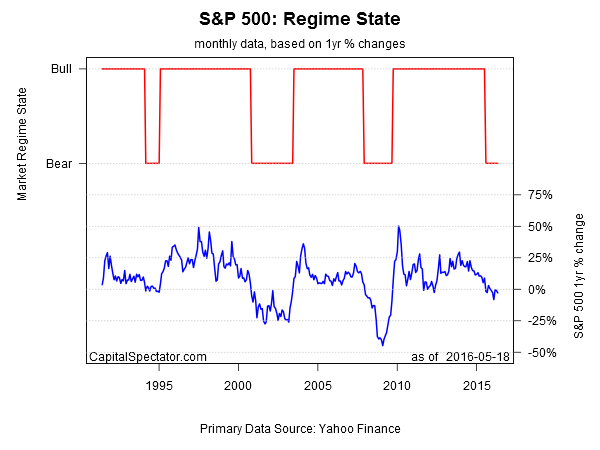

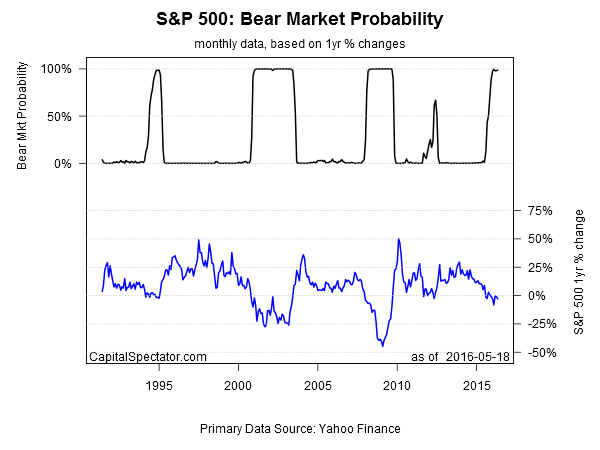

Meantime, a quantitative measure of bear-market risk, based on a Hidden Markov model (HMM) that was profiled here and here, supports the view that the outlook remains challenged. The Capital Spectator’s HMM model has been signaling elevated downside risk for months (see here and here, for instance), and the warning is still in force as of yesterday’s close (May 18), as summarized in the next two charts.

Models can be wrong, of course, and so it’s a mistake to interpret the HMM results as fate. The future’s always uncertain. As such, extreme changes in asset allocation are almost always misguided.

Rather, the point of analyzing market behavior through a quantitative lens is to develop a degree of objective insight about the current and prospective risk climate. An HMM application is hardly the last word on this front, but its warning of late isn’t easily dismissed until or if the economic profile offers a more encouraging outlook. In short, the case for reducing portfolio risk looks compelling these days, as it has been for some time. (For a broader perspective on expected returns in an asset allocation context, see the monthly updates on risk premia estimates–here, for instance.)

Quite a lot of the basis for managing expectations down for US equities is linked to the argument that the macro trend is a gray area these days. Recession risk is low, but the near-term estimates for growth remain modest bordering on weak. The next round of economic reports may bring clarity, one way or the other. Or maybe not.

In any case, the stock market’s looking tired and that’s not likely to change until or if the incoming macro releases provide an incentive to project a brighter future for equity prices. Meantime, the bear-market bias endures.