Bank of America (NYSE:BAC), Ticker: $BAC

Bank of America, $BAC, saw its 50, 100 and 200 day SMA’s come together in September and then the stock took off to the upside. It met resistance 2 weeks ago and traded sideways. Lat week it ended back pushing on resistance. The RSI is bullish and strong while the MACD is avoiding a cross down. Look for a push through resistance to participate higher…..

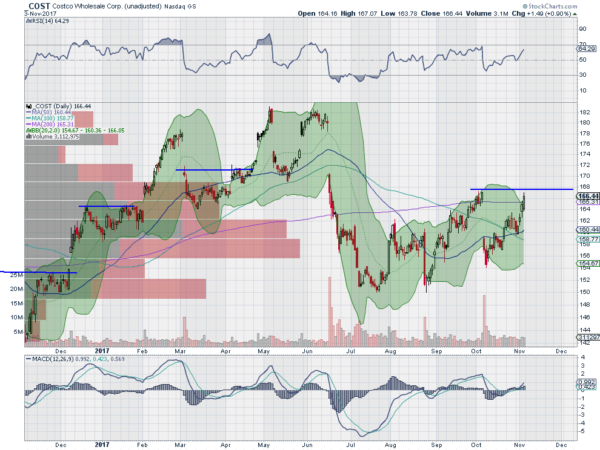

Costco (NASDAQ:COST), Ticker: $COST

Costco, $COST, gapped down in June after the Amazon (NASDAQ:AMZN) /Whole Foods deal was announced. It found a bottom in July and bounced but could not get to the gap. It tried again and made a higher high in October, but gapped down on earnings, to a higher low. Now it is back at that October high with a RSI rising and bullish and a MACD turning up. Look for a push to a higher high to participate…..

Nike (NYSE:NKE), Ticker: $NKE

Nike, $NKE, gapped lower in August, had a small bounce and then continued, finding a bottom in October. Since then it rose up into the gap and then stalled. After a small pullback it found support and Friday started to move higher. The RSI is bullish and rising and the MACD is also rising. Look for continuation to participate higher…..

Pfizer (NYSE:PFE), Ticker: $PFE

Pfizer, $PFE, started moving higher off of tight moving averages in September. It met resistance in September and pulled back briefly before it reached a peak in early October. It pulled back from there to test the 50 day SMA again and started higher late last week. The RSI is moving back higher and the MACD is curling flat. Look for continuation to participate higher…..

PPG Industries (NYSE:PPG), Ticker: $PPG

PPG Industries, $PPG, pulled back in July after reporting earnings, ending an 11 month trend higher. It found a bottom at the 200 day SMA in August and then started another trend up that continues. It had a short term pullback at the end of October that looks to have reversed last week. The RSI is turning back up and the MACD is falling. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the next week sees Equity markets are strong but mixed with the IWM lagging the SPY (NYSE:SPY) and that trailing a red hot QQQ.

Elsewhere look for Gold to continue its short term downtrend while Crude Oil races higher. The US Dollar Index looks to continue its move up while US Treasuries join it in their short term trend higher. The Shanghai Composite and Emerging Markets look to consolidate their gains at multi-year highs.

Volatility looks to remain non-existent keeping the wind at the backs of the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The QQQ looks to continue higher leading the charge with the SPY moving up at a slower pace and the IWM sitting on the curb, watching as it consolidates. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.