Financial stocks are currently hogging the lime light with the post-election rally and a looming rate hike. Putting a great show, quarter to date, the Sector gained nearly 23% compared with 4% increase in the .

On Nov 17, 2016, testifying before the Joint Economic Committee of Congress, Federal Reserve Chair Janet Yellen signaled that the Fed may raise interest rates "relatively soon.” She said “the case for an increase in the target range had strengthened.”

The uncertainty-induced market volatility, amid the transition to Trump administration is set to boost trading revenues of the financial institutions. Moreover, Trump’s bias for higher interest rates and lesser financial regulations gives the sector hopes of a boost in bottom-line growth in the near term.

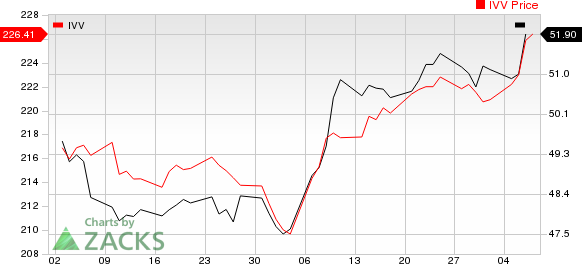

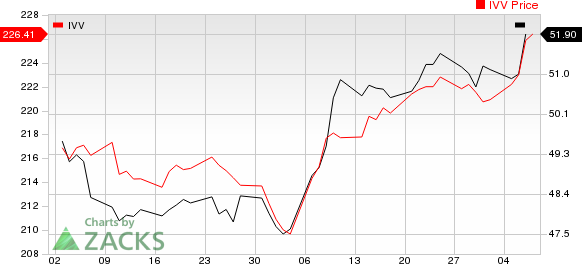

Finance Sector Price Index

Finance Sector Price Index

Why Bet on Financial Sector

When it comes to picking stocks, the finance sector seems to be a good bet now, as several industries including banking, insurance, brokerage and asset managers tend to benefit from rising rates.

After a prolonged low-rate environment, the impact of rising rates is typically beneficial for Banks. The benefit primarily comes from a steep yield curve, i.e. when the spread between long-term and short-term rates is wide. The interest rates on deposits are usually tied to short-term rates while loans are often tied to long-term rates. This means that the potential rise in rates will enable the banks to charge more for loans, leading to an increase in their spread income.

The very first stock that comes to mind is definitely Bank of America Corporation (NYSE:) . The Charlotte, NC-based banking giant has gained more than 35% year to date and is currently trading at $22.95 (as of Dec 8, 2016). The company’s growth momentum continues to be driven by strength in several areas including growing loans and deposits, while maintaining a strong capital position.

According to the company’s latest quarterly filing, BofA projected that as of Sep 30, 2016, a 100 basis points expansion in short- and long-term rates will add $5.3 billion to its net interest income (NII). The company currently sports highly desirable Zacks Rank #1 (Strong Buy) and has a long-term expected earnings per share (EPS) growth rate of 7%.

Other potential gainers from the banking space include Regions Financial Corporation (NYSE:) . The Birmingham-based company expects NII growth in the range of 2–4% for this year as well as 2017. Notably, during the first nine months of 2016, the company’s NII, which constitutes about 62% of the total revenue, grew 3% on a year-over-year basis.

Interestingly, the stock has gained more that 50% year to date, closing at $14.55 yesterday. Regions has long-term expected EPS growth rate of 5.4%. It sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Insurance companies invest majority of the premium income received from policyholders in government and corporate bonds to earn investment income. The potential rise in rates will allow the insurance firms to invest their new premium income in higher yielding securities, thereby leading to higher future returns.

A good pick in this space is CNA Financial Corporation (NYSE:) . The Chicago, IL-based company’s third-quarter 2016 operating income of $1.15 per share surpassed the Zacks Consensus Estimate of 84 cents by 36.9%. Also, the bottom line improved 49.4% from the year-ago quarter. The outperformance was driven by higher net investment income and net written premium growth.

Notably, the company carries a Zacks Rank#2 (Buy) and has a long-term expected EPS growth of 5%. Year to date, the stock returned more than 15%, closing at $40.91 on Dec 8.

With a rise in rates, Brokerage firms are likely to engage in more investment activity. The firms earn interest income on un-invested cash in customer accounts. The rise in rates will allow them to invest at higher rates. The low-rate environment had forced several firms to waive fees in order to maintain positive return for clients. However, the rising-rate environment would reverse the trend.

Once such firm is E*TRADE Financial Corporation (NASDAQ:) which derives nearly 60% of its total revenue from interest income. Further, we remain optimistic given the company’s renewed focus on strengthening its brokerage business with a target of achieving 2–3% incremental growth.

The New York-based brokerage firm gained nearly 20% year to date closing at $35.44 on Dec 8. E*TRADE currently carries a Zacks Rank#2 and has a long-term expected EPS growth of 14.2%.

Additionally, Asset Managers can position themselves favorably with the rise in rates. In the fixed income sector, default rates are likely to decline and higher interest rates will enable reinvestment at higher yields, which ultimately will boost portfolio returns. The benefit can be achieved by positioning fixed income portfolios strategically through proper management of duration, diversification of sources of yield and maximizing the reinvestment of income.

In this industry, Virtus Investment Partners, Inc. (NASDAQ:) seems to be a good choice. The Hartford, CT-based company flaunts a Zacks Rank #1 and has a long-term expected EPS growth of 14.2%. Year to date the company has gained 8%, closing at $127.00 on Dec 8.

Bottom Line

The long-awaited Dec 2015 rate hike certainly depicted how the U.S. economy has gradually gained traction since the 2008 financial crisis. While the final move by the Fed at its Dec 13–14 meeting will depend largely on the slew of readings in several areas including consumer spending, housing sector, job report and industrial production, the recent positive trends so far keeps the optimism over rate hike alive.

Zacks' Best Investment Ideas for Long-Term Profit

Today you can gain access to long-term trades with double and triple-digit profit potential rarely available to the public. Starting now, you can look inside our stocks under $10, home run and value stock portfolios, plus more. Want a peek at this private information? Click here >>

BANK OF AMER CP (BAC): Free Stock Analysis Report REGIONS FINL CP (RF): Free Stock Analysis Report E TRADE FINL CP (ETFC): Free Stock Analysis Report VIRTUS INVESTMT (VRTS): Free Stock Analysis Report CNA FINL CORP (CNA): Free Stock Analysis Report Original post Zacks Investment Research