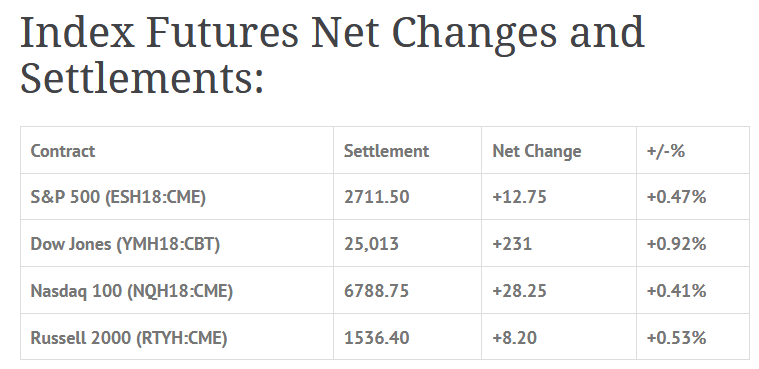

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 5 out of 11 markets closed lower: Shanghai Comp -0.65%, Hang Seng -0.07%, Nikkei +0.55%

- In Europe 12 out of 12 markets are trading higher: CAC +0.39%, DAX +0.71%, FTSE +0.12%

- Fair Value: S&P +0.06, NASDAQ +9.68, Dow -32.37

- Total Volume: 1.2mil ESM, and 526 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Eric Rosengren Speaks 7:30 AM ET, James Bullard Speaks 9:00 AM ET, Consumer Sentiment 10:00 AM ET, JOLTS 10:00 AM ET, Baker-Hughes Rig Count 1:00 PM ET, and Robert Kaplan Speaks at 1:00 PM ET.

S&P 500 Futures: #ES Trump Tweets ‘Bombs Could Fall Soon Or Not At All’

President Trump sent out a tweet Thursday morning that said:

“Never said when an attack on Syria would take place. Could be very soon or not so soon at all! In any event, the United States, under my Administration, has done a great job of ridding the region of ISIS. Where is our Thank you America?”

The tweet sent the S&P 500 futures on a higher track yesterday. After the open, the ES had a few small pullbacks, and at 10:23 am traded up to 2671.50, up +30.50 handles on the day. After the high, the ES pulled back below the vwap, down to 2660.25, and then rallied up to a new high at 2873.00. From there, the futures pulled back to 2655.75 at 12:30, and at 2:29 traded up to 2675.00 as the MiM went to $686 million to buy. Total volume was extremely low, only 1.1 million ES traded.

As the MiM shrank to only $167 million to buy, the ES sold off down to 2670.00 on the 2:45 cash close, and then traded down to 2662.50 on the 3:00 cash close, before going on to settle at 2663.40 on the 3:15 futures close, up +21 handles on the day, or up 0.79%.

In the end the markets want to go higher but with the US, Britain and France all working together to bomb Syria and Russia warning it will strike back the markets are vulnerable should the bombs start flying.While the S&P is trying to go up crude oil traded up to three year high over concerns about rising tensions in the Middle East. CL traded up to $67.15 in the after market.

Seasonal MACD Update & Seasonal Sector Trades: 30-year Bond Summer Rally

From Stock Traders Almanac:

Seasonal MACD Update

As of the today’s close, both the faster moving MACD “Buy” and slower moving MACD “Sell” indicators (at bottom of following charts) applied to DJIA and S&P 500 were positive and trending higher. Combined with improvements in other technical indicators this is an encouraging sign that suggests further gains are possible. The path higher is likely to remain choppy as DJIA and S&P 500 are once again sensitive to breaking news headlines. First quarter earnings season is underway and solid, positive reports could send the market higher by providing a welcome distraction to headlines.

Continue to hold long positions associated with DJIA’s and S&P 500’s “Best Six Months.” We will issue our Seasonal MACD Sell signal whencorresponding MACD Sell indicators applied to DJIA and S&P 500 both crossover and issue a new sell signal.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.