The first week of September started with disappointing data from Asia. China’s official Manufacturing PMI and HSBC Manufacturing PMI were 51.1 and 50.2 respectively in August, both slightly lower than expectations. Also, the Australian AIG manufacturing index once again stepped back to contraction. This index has only stood upon 50 once this year, showing that the domestic industrial section is still weak.

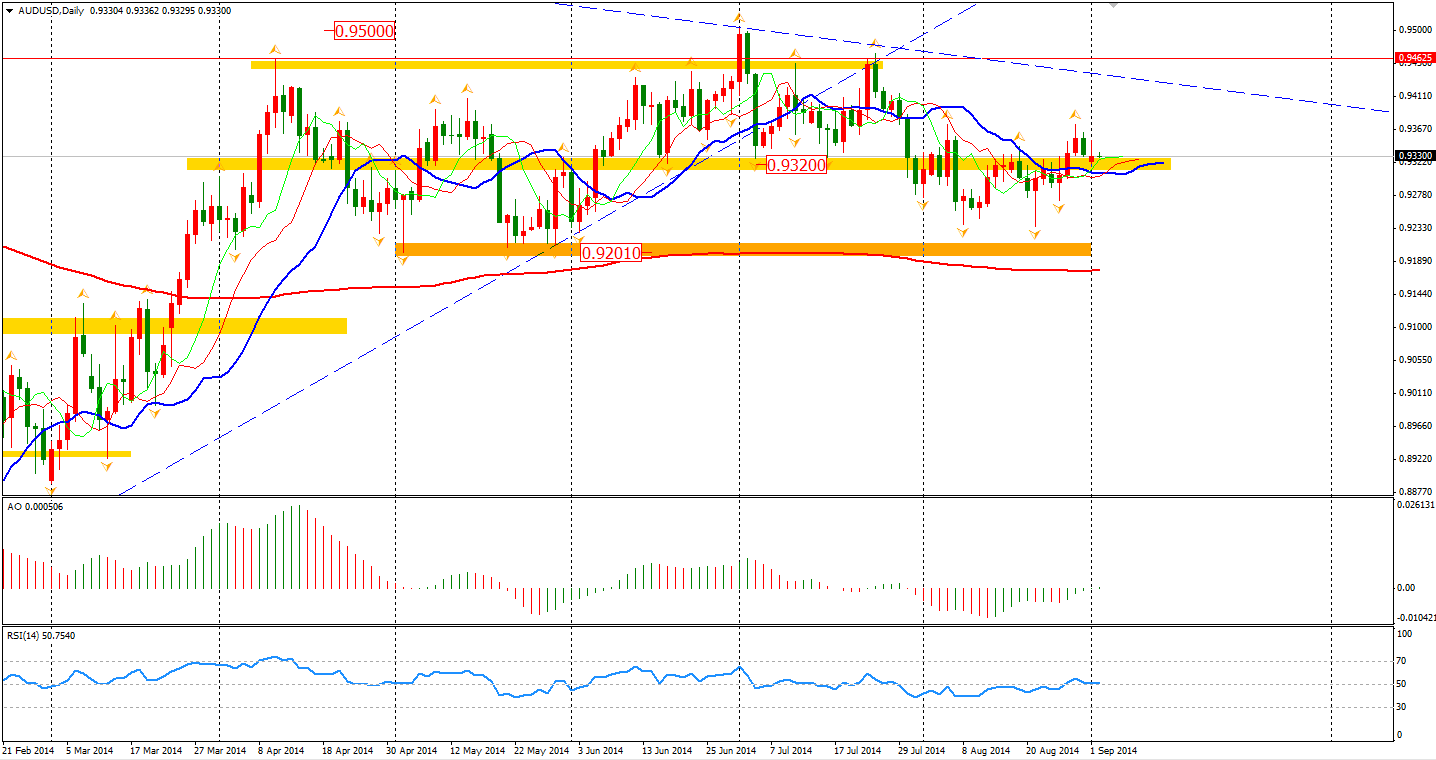

The Aussie, however, ignored those soft data and kept its strength beyond the key level at 0.9320. We can see a reversal signal (engulfing pattern) on the daily chart. Traders will be watching closely the RBA statement today, the GDP tomorrow, and retail sales and trade data on Thursday. Hopefully, those data release will help the Aussie/Dollar choose a defined path to either direction.

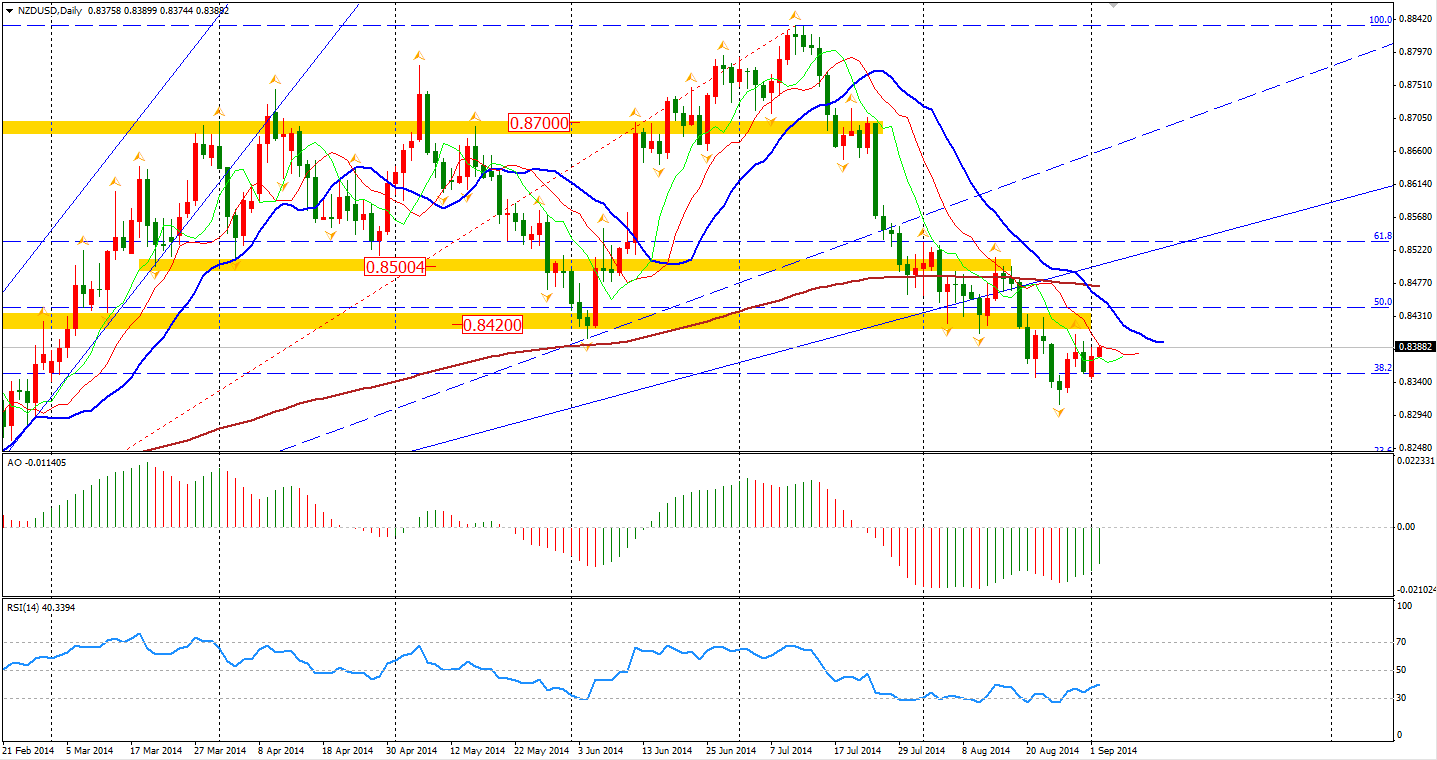

On the contrary, NZD once was a star currency but now has lost most of its gains from this year. Certainly, the economic growth is not as strong as the RBNZ had forecasted at the beginning of the year. New Zealand business sentiment has dropped for six months in a row and the dairy industry is facing fiercer competition from other countries. The NZ economy has now impacted the rate hike. As such, we may not see further rising for the rest of this year and the Kiwi/Dollar may continue its bearishness under 0.84.

Asian stock markets mostly rose yesterday despite the downbeat data and Ukraine tension. Shanghai Composite surged 0.83% up to 2235, stand beyond the 20-day MA. The Nikkei Stock Average gained 0.34%. The Australian ASX 200 was up 0.07% to 5630. In European stock markets, the UK FTSE lost 0.03%, the German DAX fell 0.11% and the French CAC Index pulled back 0.24%. U.S. market was closed for Labour Day.

On the data front, Australia Building Approvals and Current Account will be released at 11:30 AEST. The first Central Bank decision this week is today’s RBA Rate statement at 14:30 AEST. In the early European session, UK Construction PMI will be released at 18:30 AEST. U.S. ISM Manufacturing PMI will be at midnight.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Aussie Traders Waiting For RBA statement

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.