The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday higher.

- ES pivot 2142.75. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- YM futures trader: short at 17,670.

Recap

The Night Owl has been away for a week but we're finally back and ready to rock. Last I wrote I mentioned that things should start cooking again after Labor Day. It took a week but we finally got some real action when the Dow took a giant dump last Friday and then retraced 2/3 of its losses equally fast on Monday. So lets get back to the charts and see what's what.

The technicals

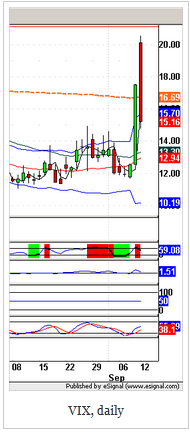

The VIX: I've not been doing all the daily charts lately but this one is worth a look. Here's a textbook dark cloud cover that as an added bonus slices right through its 200 day MA. Add i two days above its upper BB and this VIX sure looks lower again to me.

Market index futures: Tonight, all three futures are lower at 12:16 AM EDT with ES down 0.55%.

ES daily pivot: Tonight the ES daily pivot rises from 2140.25 to 2142.75. That leaves ES above its new pivot so this indicator is bullish.

And the winner is...

With a big indication of a move lower in the VIX and some nice bullish piercing patterns in the Dow and SPX, technically all the charts tonight sure look bullish to me. All except the futures which are guiding non-trivially lower. It appears that Mr. Market has a bad case of the pre-Fed jitters even though that's still ore than a week away. As such, he's prone to go tearing off in some random direction every time some Fed-head twitches his (or her) left eyelash. So in the face of two rather contradictory signs (candles vs. futures) tonight, I'm just throwing up my hands and calling Tuesday uncertain.

YM Futures Trader

No trade tonight.