Bit of a negative final session of the year for the ASX. But given the strong santa rally run we’ve seen over the past two weeks and with volumes so low even a minor amount of profit taking could well have caused this downturn. Concerns about traders coming back from holidays in January and aggressively selling off the market may have driven a number of investors to take some of the profits off the table after the good run we have seen over the holiday period.

A few charts from me to finish off the year.

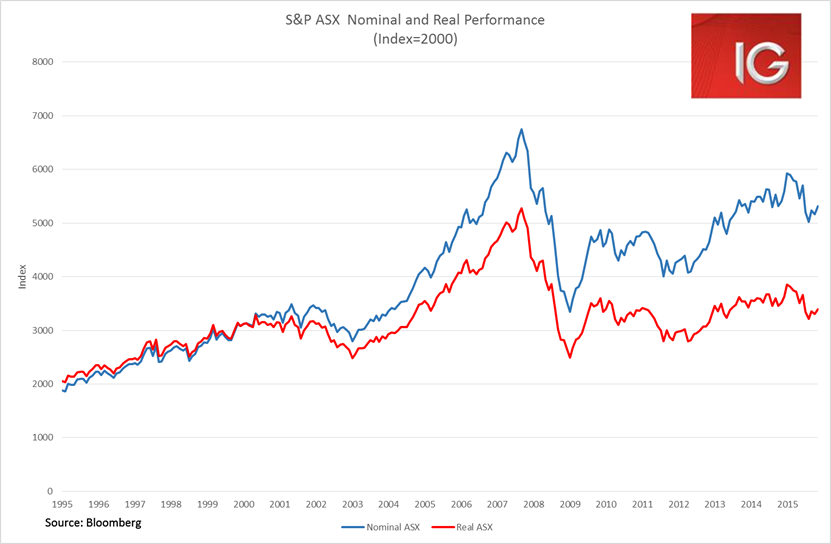

The ASX has had a woeful performance this year in real inflation-adjusted terms, losing 3.5%. And when you look at it on the chart, in real terms the ASX is actually trading back at the same level it was trading at in March 2011. In real terms, the performance of the index has been incredibly disappointing, only gaining 1.5% over the past five years for a compound annual growth rate of only 0.3%. Of course, when one factors in dividend reinvestments the total return of the index has been somewhat better.

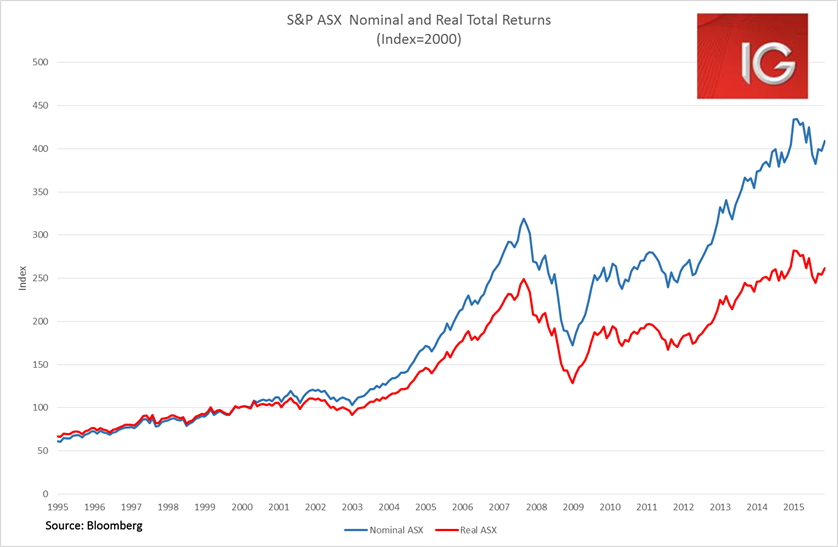

As the dividend payout ratio has risen steadily over the past five years real returns have also benefitted. The real total return for the ASX this year was 2.5%. And over the past five years, the real total return for the ASX has been 44.9% for a compound annual growth rate of 7.7%.

Oil down but junk bonds over it?

The correlation between moves in the oil price and equity markets are becoming increasingly concerning and do not bode well for today’s Asia session. Japanese markets will be closed, and the ASX looks likely to fall short of meeting the 5411 level where it began the year. Of course, as mentioned yesterday, in total return terms, with dividends reinvested, the ASX will actually finish up 4.6% and Aussie SMSF investors can hopefully ring in the New Year on a positive note after the Santa Rally of the past two weeks. BHP's (AX:BHP) ADR is currently pointing to a 1.4% decline at the open, while Commonwealth Bank Of Australia's (AX:CBA) ADR is relatively unchanged. The fortunes of the ASX’s last session for the year will largely be driven by the banks today, and whether the yield hunters come out buying. With any luck strong buying in the rest of the index may help outweigh the inevitable drag that we will be seeing from the materials and energy space.

EIA oil inventories unexpectedly expanded overnight by 2.6 million barrels when markets were expecting a decline. Of course, predictions for the EIA weekly oil inventories number are notoriously unreliable and are akin to a coin toss, personally it’s an area where I would favour the services of Paul the Octopus. This saw a more than 3% drop in both Brent and WTI. Predictably, this saw the energy sector lose 1.5% on the S&P 500 and drive concerns in the whole market. However, unusually this weakness did not carry over into the two main high yield ETFs, iShares iBoxx $ High Yield Corporate Bond (N:HYG) and SPDR Barclays (L:BARC) High Yield Bond (N:JNK), which were both largely flat on the session. It’s a bit early to infer too much into this, but it would not be surprising that much of the oil price weakness has now been priced into junk bonds. If that is the case we could be approaching the turning point for junk bonds, perhaps foreshadowing a much better year ahead in 2016. Some good news perhaps for recent entries in the junk bond market such as Noble Group.

The other growing concern for junk debt is the likely default by Puerto Rico on its US$ 70 billion of debt on 1 January. US$ 1 billion is due on that day, but it’s in doubt whether the government will even be able to make its US$ 330 billion payment on “general obligation” bonds, which many creditors had believe unlikely due to its constitutional guarantee. Of course, there has been plenty forewarning about a potential default by Puerto Rico. But the concern is that the rising defaults in emerging markets, in the energy and materials space and now from Puerto Rico (a semi-sovereign) could al combine together in unforeseen ways that could see counter-party risk premiums rise and significantly raise global cost capital, potentially leading to more defaults.