5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

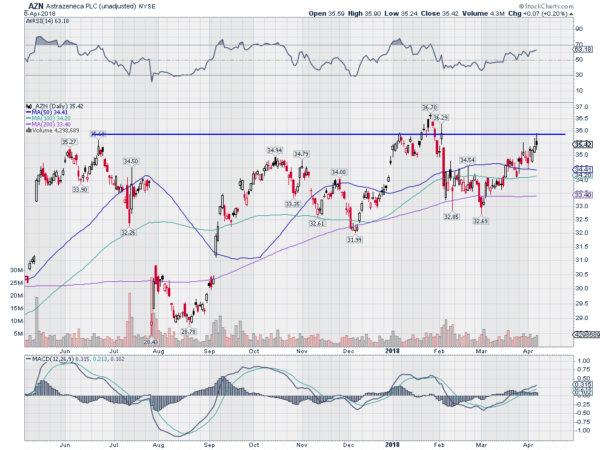

Astrazeneca (LON:AZN) PLC ADR (NYSE:AZN)

AstraZeneca, $AZN, gapped down through its 200 day SMA in August last year. It quickly recovered back to the 200 day SMA and then gapped back above it in September. Since then it has made a series of marginally higher lows, using the 200 day SMA as support, and marginally higher highs. In a broad view it looks a lot like consolidation. Coming into the week the price is at the top of the range with the RSI rising in the bullish zone and the MACD positive and moving higher. Look for continuation to participate higher…..

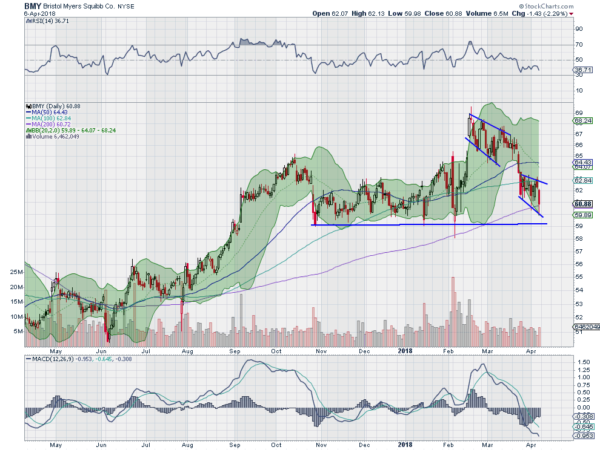

Bristol-Myers Squibb Company (NYSE:BMY)

Bristol-Myers Squibb, $BMY, rose from a base around the confluence of SMA’s last summer, topping in October. It pulled back into the end of that month and found support. That level would act as support for 3 and a half months before a push higher in February. That second push has been breaking down and it is now approaching prior support. The RSI is falling and in the bearish zone with the MACD falling and negative. Look for a break of support to participate lower…..

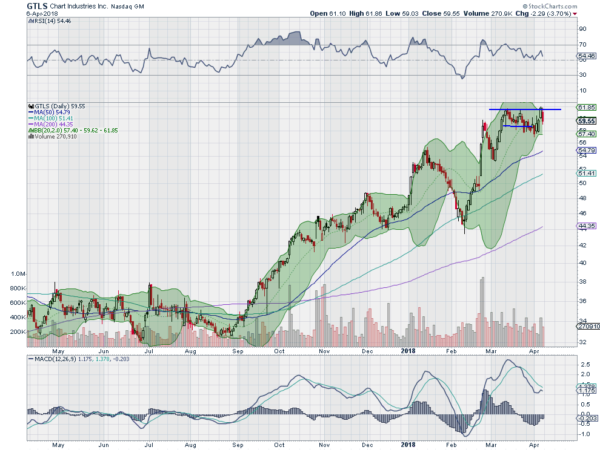

Chart Industries Inc (NASDAQ:GTLS)

Chart Industries, $GTLS, started higher in September, hitting an interim peak in January. It pulled back to its 100 day SMA and found support. The bounce from there made a higher high in February before another pullback, to a higher low. Then another move higher made a higher high and it has consolidated since. The RSI is holding in the bullish zone with the MACD level after resetting lower. Look for a push to a new high to participate…..

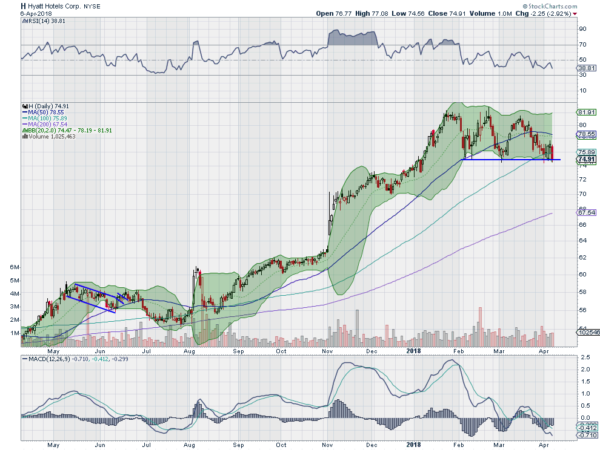

Hyatt Hotels Corporation (NYSE:H)

Hyatt Hotels, $H, started a prolonged move higher in August and reached a top in January. It pulled back from there to the 50 day SMA and found support. It has consolidated in a range between that top and support since, while crossing below the 100 day SMA last week. The RSI is falling and at the edge of the bullish zone while the MACD has turned down. Look for a break of support to participate lower…..

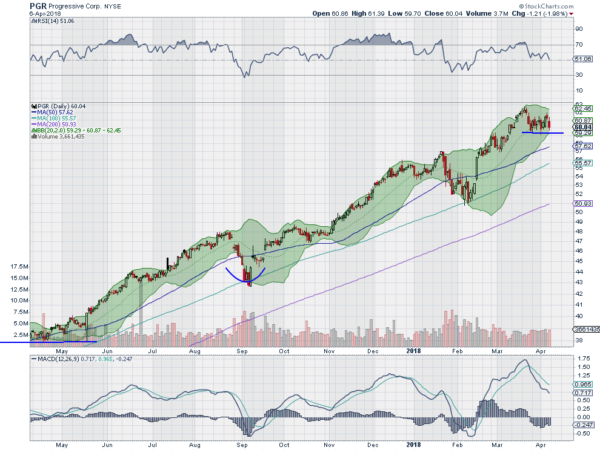

Progressive Corporation (NYSE:PGR)

Progressive, $PGR, started higher off of its 100 day SMA in September. It continued through to January before meeting resistance and pulling back to the 100 day SMA again. Another move higher met resistance 3 weeks ago and it pulled back, but found support more quickly and has consolidated since. The RSI is pressing down on the mid line with the MACD falling. Look for a break of support to follow lower…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as we head into the new week sees the equity markets continuing to hold onto long term uptrends, consolidating in broader ranges. They also printed nearly identical weeks, ending lower.

Elsewhere look for Gold to continue to consolidate in a broad range while Crude Oil consolidates with a bias lower. The US Dollar Index looks to mark time sideways while US Treasuries consolidate with a bias higher. The Shanghai Composite returns after a short week stuck in a range at the February lows while Emerging Markets continue to build a bull flag at the highs. Volatility looks to remain elevated creating a headwind for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show broad consolidation after the recent pullback with the QQQ at greatest risk of a move lower. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.