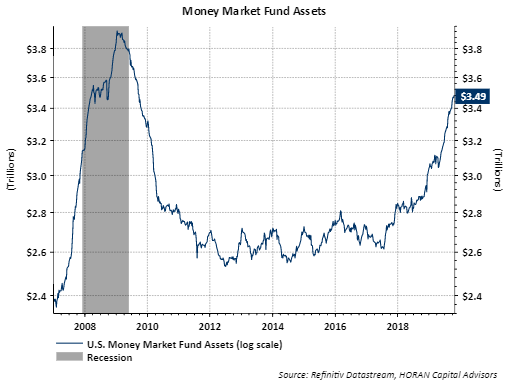

I have noted in recent articles that investment flows into ETFs and equity mutual funds has been strongly negative, i.e., outflows. Some of the equity outflows have found their way into fixed income ETFs and mutual funds. Another large beneficiary though has been money market funds.

The below chart shows assets in money market mutual funds as reported by ICI as of mid week last week. Money market assets began to trend higher during the volatile market environment in 2018 and the money market inflow has picked up the pace in 2019 with assets now totaling $3.49 trillion.

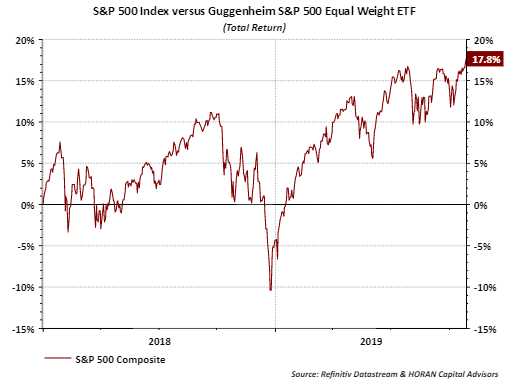

Over the course of the past two years, the S&P 500 index total return equals 17.8% with all of this gain occurring this year and at a time when money market inflows accelerated. Money market assets are now at levels last seen around the financial crisis period in 2008/2009.

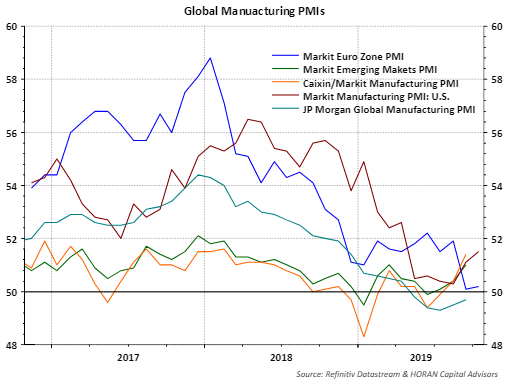

More often than not, market tops do not occur when investors are exhibiting pessimism towards stocks. Some strategists have pinned some of their bearish point of view on some of the weak manufacturing PMI readings. Recent commentary has noted differences in ISM's version versus Markit's version of the PMI.

As the below chart shows, the Market PMI's for various regions around the world are all showing manufacturing PMI's above 50, i.e., expansion. Even J.P. Morgan's Global Manufacturing PMI is turning higher with the recent reading just below 50. There are a number of additional positive economic data points as well.

Possibly, with investors showing reduced appetite for stocks and company forward earnings growth expectations at high single digits, the market might be setting the stage for a further run to new highs into year end.