As recent weeks pass it seems the investor sentiment measures are increasingly indicating an investor that is becoming more bearish even as the market continues to trend higher this year. The current investment environment seems like one where the market is climbing the proverbial "wall of worry."

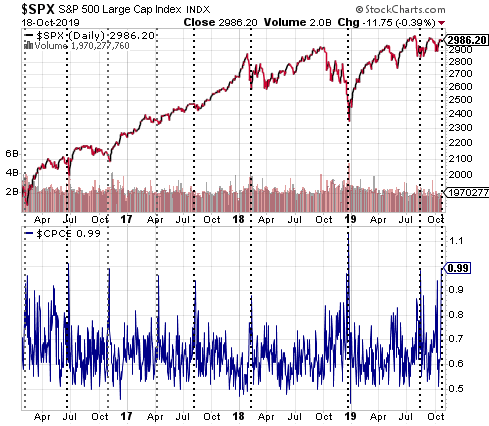

A case in point is the spike on Friday in the CBOE Equity Put/Call ratio to .99. This is the highest level since the Equity Put/Call ratio reached 1.13 on December 21, 2018, Historically, readings above 1.0 have been associated with levels where the market is near a point where it turns higher. This potential set up to a move higher is on top of the 21% gain achieved year to date.

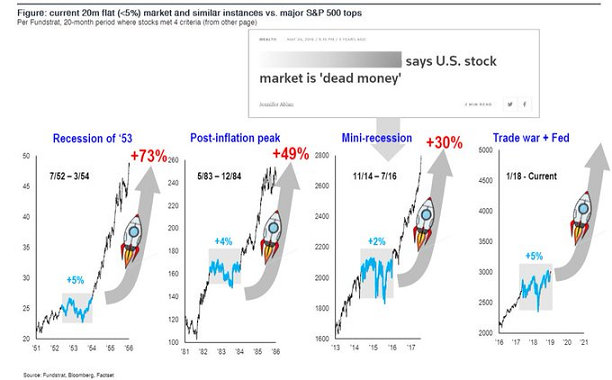

Looking back further though the S&P 500 Index has mostly traded sideways since January of last year. Tom Lee, of Fundstrat, recently noted prior periods where the market traded sideways and subsequent market moves have been strong to the upside as seen in Lee's chart below.

In spite of the strong market returns this year, equity fund flows continue to be decidedly negative. Between domestic equity and international equity, cumulative outflows total $165.7 billion this year through October 9, 2019.

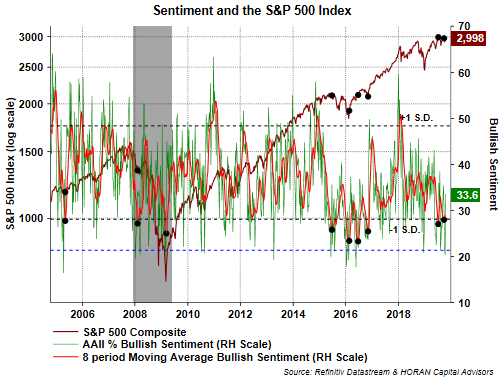

Also last week, the AAII bullish investor sentiment jumped 13.3 percentage points to 33.6%. In order to smooth the weekly volatility in the measure the 8-period moving average is often evaluated as well. This past week the 8-period moving average of the bullishness reading equaled 28.5%. This is a low level and as a contrarian signal, this is a bullish for equities too, all else being equal.

We are in active period where a large number of companies are reporting earnings, mostly for their third quarters. Earnings results to date are being reported better than expected and beginning to trend higher.

Looking out to 2020, S&P 500 earnings are expected to grow 11.2% and another 9.2% in 2021. As Ed Yardeni recently noted, "Forward earnings tend to be a very good 12-month leading indicator for actual earnings as long as there is no recession over the next 12 months. If you agree with me that the economy should continue to grow through the end of next year, then forward earnings remains bullish for stocks."