This article was first published at TopDown Charts

-

Russian CDS pricing rises on escalating tensions with Ukraine

-

Sovereign bond yields have climbed to levels not seen since the COVID crash as investors turn jittery about increasing odds of an invasion

-

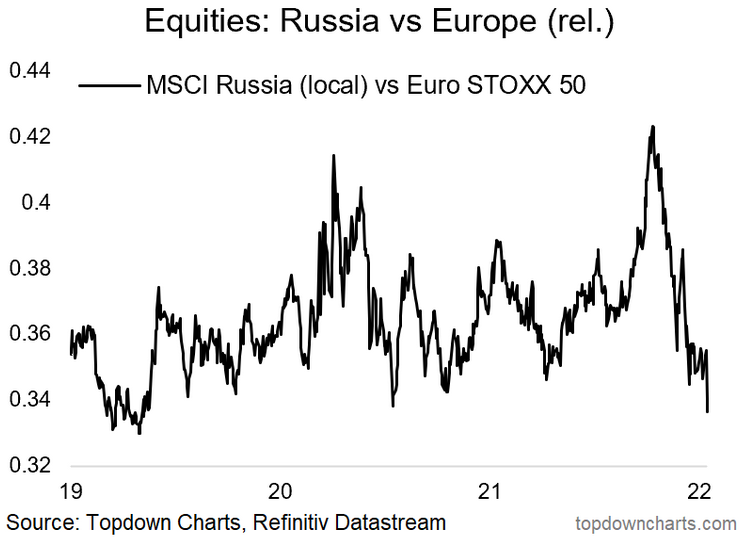

Russian equities sold off despite the rally in oil prices. Relative to European stocks, Russia’s market has fallen back near 4-year lows.

Geopolitical risks are back on the table. Fears that Russia might invade Ukraine have resulted in turmoil for the Russian stock market. This issue has been simmering since mid-December, and talks aimed at de-escalating tensions seem to have collapsed as of last week.

What’s Priced-in?

Gauging the likelihood of political and military actions is never easy. Nor is anticipating the impacts those actions will have on financial markets. It appears that something will happen soon between these two nations. The question for investors is how much is priced into equity and bond markets at this point?

CDS Spreads Widening

One area we can analyze is the credit default swap (CDS) market. The CDS market has not received much press in recent years (sans a fleeting time during the COVID crash) as sovereign borrowing rates have been low and there has been little fear of widespread defaults. In the US, a recent survey of credit investors found that expectations for high yield defaults are under 2%. That is low relative to the average number of defaults through history.

Fears Confined to Russia and Ukraine So Far

In our weekly Global Cross Asset Market Monitor report sent each Monday morning, we track US Bank and EU Bank CDS spreads to gauge risk. (This week’s report also dives into macro implications of this developing Russia/Ukraine risk.) Those financial sector CDS spreads are coasting near historic lows, too. At about 50bps and 80bps fears of default are a far cry from peaks around the European sovereign debt crisis of 2011 and 2012 when they peaked above 300bps and 400bps, respectively.

How about Russia’s 5-year CDS? It surged to 185bps on Monday morning, indeed the highest since the COVID crash of March 2020. Ukraine CDS of the same tenor jumped to 868bps. The market is discounting severely negative impacts on financial asset pricing in the event of further geopolitical tensions. CDS pricing began to take off when initial reports of troop build-ups crossed the wires. Further legs higher have taken place since last week.

Sovereign Bond Yields Higher, Russian Ruble Lower

Russia’s 4-year bond was priced to yield just 1.7% in Q3 last year but is now 3.3%. Ukraine’s 10-year sovereign bond yield is now near 11% after flirting with 1.5% last August. Meanwhile, the Russian ruble, always a rocky currency when conflicts bubble up to the surface, has dropped versus the EMFX index.

Oil Prices Provide No Cushion

What makes this turmoil in Russia more interesting is that it comes as oil prices have climbed. Russia is among the most energy-exposed countries in the world. Some investors may have been playing the energy commodity long trade via Russian stocks or ETFs. Those securities rose substantially last year when oil prices climbed. This time, however, Russian equities and crude prices have diverged.

European Equities and Broader EM Fairing Fine

European stocks, on the other hand, are among the best regional performers in the last month and a half. Ex-US developed markets and EM (ex-Russia) have fared well amid a falling USD and more risk appetite for value and yield-sensitive equities. Our featured chart tells the tale.

Russia stocks versus the Euro Stoxx 50 has sunk to its lowest level in nearly three years. What’s stunning about this move is that Russia broke to fresh rebound highs versus Europe just a few months ago.

Bottom line: Emerging market risk often perks up quickly. Interestingly, the broad EM index has held up fine while Russian stocks have fallen hard. The market remains on edge as evidenced by more expensive CDS pricing and higher bond yields in Russia and Ukraine. The relative strength Russian stocks enjoyed through Q3 2021 is long gone.