Market Brief

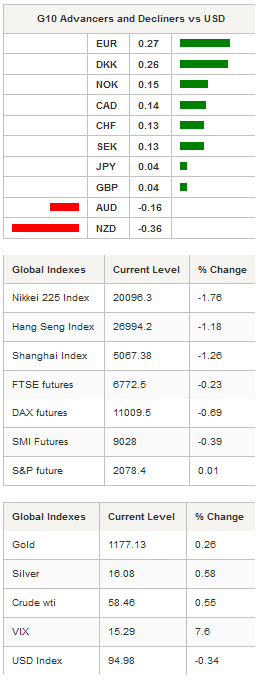

In the Asian session, the dollar paired losses against most G10. Only the Aussie and the kiwi didn’t manage to take advantage of the current dollar’s weakness. AUD/USD lost 0.16% to $0.7690, unable to maintain the pace against the greenback, in spite of a rising Australia’s business confidence index. NAB Business Confidence rose in May to 7 from a figure of 3 in April, while the Conditions index printed at 7 compared to 4 previous month. Even if AUD/USD already reached our $0.76 target, we still anticipate further downside as the recent USD weakness is mainly due to post-NFP profits taking and negative backdrop of the Australian economy. Although we remain dollar bulls, we think that the dollar rally has to be fueled with strong US data to resume.

In China, deflation risk lingers as consumer prices index slipped to 1.2%y/y in May from 1.5% a month earlier, well below market expectations of 1.3%. The country is facing weaker demand and excess supply, which are pushing prices lower. We can therefore anticipate that the PBoC will act to support the economy further, especially since inflation is below Beijing’s 3% target. Chinese equities reconnect with reality this morning; Shanghai Composite is down -1.26%, Hong Kong’s Hang Seng retreats -1.18% while in Japan, the Nikkei falls 1.76%. Japan’s M2 money stock increased 4%y/y in May (3.6% expected and previous read), while M3 printed at 3.3%y/y (3% expected and previous read). USD/JPY is losing steam, unable to stay above the 125 threshold. The dollar returns within its 2 weeks range between 123.70 and 125, after having failed to turn the resistance implied by the high from June 2002 into a support.

In Switzerland, unemployment rate holds steady at 3.3% (seasonally adjusted) in May. CPI figures are due later this morning and are expected at 0.1%m/m (-0.2% prior read) or -1.3%y/y (-1.1% prior read). Deflation is accelerating in Switzerland after the SNB decided to remove the peg and introduced negative rates. In addition, the bond purchase programme launched by the ECB is adding upward pressure on the Swiss franc and is therefore pushing inflation further into negative territory. USD/CHF fell sharply yesterday and is back below the 0.93 threshold. On mid/long-term, the pair is heading toward the 0.9258 support level (Fib 50% on January-March rally).

In Europe, the weakness of Asian equities is spreading to European equity futures. UK shares are down -0.23%, DAX down -0.69%, CAC down -0.36% and SMI down -0.39%. EUR/USD strengthen in the Asian session, and is currently testing the 1.13 resistance implied by the bottom of its previous uptrend channel. The euro will need to find fresh boost to break the resistance at 1.1467 (previous high). While on the downside, the closest support stands at 1.11 (previous low).

Today traders will be watching Eurozone Q1 GDP second revision; Mexico CPI; US JOLTS and Wholesale inventories; UK trade balance.

Today's Calendar Estimates Previous Country / GMT SP 1Q INE House Price Index QoQ - 0.20% EUR / 07:00 SP 1Q INE House Price Index YoY - 1.80% EUR / 07:00 SP Apr House transactions YoY - 2.10% EUR / 07:00 DE Apr Trade Balance ex Ships - 8.5B DKK / 07:00 DE Apr Current Account Balance 11.0B 2.9B DKK / 07:00 DE Apr Current Account (Seasonally Adjusted) - 12.4B DKK / 07:00 SZ May CPI MoM 0.10% -0.20% CHF / 07:15 SZ May CPI YoY -1.30% -1.10% CHF / 07:15 SZ May CPI EU Harmonized MoM - -0.20% CHF / 07:15 SZ May CPI EU Harmonized YoY - -0.80% CHF / 07:15 EC ECB's Weidmann, World Bank's Kim Speak in Frankfurt - - EUR / 08:00 UK Apr Visible Trade Balance GBP/Mn -£9950 -£10122 GBP / 08:30 UK Apr Trade Balance Non EU GBP/Mn -£3000 -£3163 GBP / 08:30 UK Apr Trade Balance -£2600 -£2817 GBP / 08:30 EC 1Q Gross Fix Cap QoQ 0.60% 0.40% EUR / 09:00 EC 1Q Govt Expend QoQ 0.40% 0.20% EUR / 09:00 EC 1Q Household Cons QoQ 0.60% 0.40% EUR / 09:00 EC 1Q P GDP SA QoQ 0.40% 0.40% EUR / 09:00 EC 1Q P GDP SA YoY 1.00% 1.00% EUR / 09:00 US May NFIB Small Business Optimism 97.2 96.9 USD / 10:00 BZ May FGV Inflation IGP-DI MoM 0.38% 0.92% BRL / 11:00 BZ May FGV Inflation IGP-DI YoY 4.80% 3.94% BRL / 11:00 EC ECB's Makuch Holds Press Conference in Bratislava - - EUR / 11:00 US Apr Wholesale Inventories MoM 0.20% 0.10% USD / 14:00 US Apr Wholesale Trade Sales MoM 0.60% -0.20% USD / 14:00 US Apr JOLTS Job Openings 5044 4994 USD / 14:00 EC ECB's Nouy Speaks in Berlin - - EUR / 14:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1268

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5302

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 124.50

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9294

S 1: 0.9287

S 2: 0.8986