On Wednesday, the World Health Organization (WHO) declared the current outbreak of COVID-19 a global pandemic, as the U.S. stock market entered a bear market, falling more than 20% from its peak. What’s next gold?

It’s Global Pandemic

Although I have long described COVID-19 as a pandemic, not an epidemic, WHO has finally admitted the situation is much worse. As WHO Director-General, Dr. Tedros Adhanom Ghebreyesus said yesterday:

WHO has been assessing this outbreak around the clock and we are deeply concerned both by the alarming levels of spread and severity, and by the alarming levels of inaction. We have therefore made the assessment that COVID-19 can be characterized as a pandemic.

It is the first pandemic sparked by a coronavirus. Surely, SARS and MERS were also of international character, but COVID-19 has spread wider. As of Thursday morning, new coronavirus cases were reported in 118 countries. More than 124,000 people were infected and 4,607 have died. The situation is indeed serious. And the numbers are growing. But geography is not the only difference between an epidemic and a pandemic – another is that “we have never before seen a pandemic that can be controlled.” Wow, Dr. Ghebreyesus can lift the spirit, can’t he?

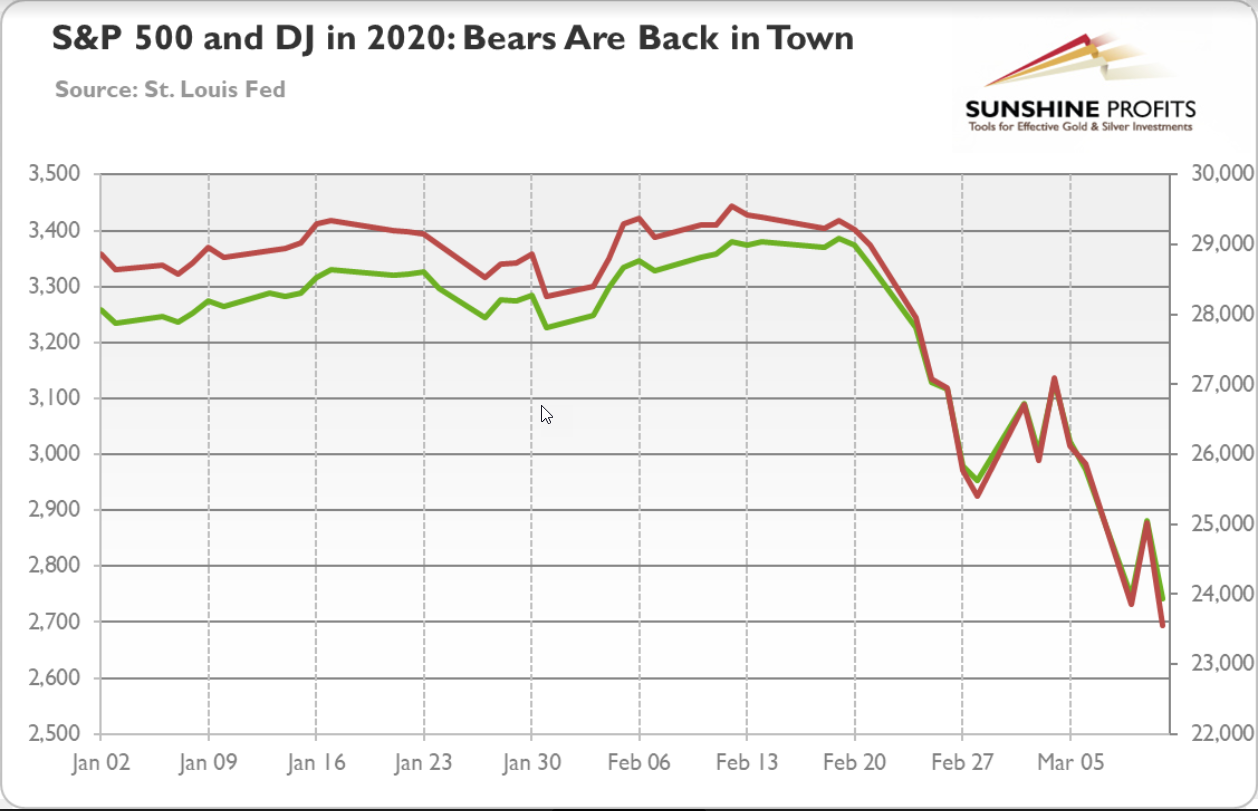

Not surprisingly, the stock markets did not welcome the move. The S&P 500 fell almost 5 percent Wednesday and continued to tank into Thursday trade. As the chart below shows, the S&P 500 has already dropped below 2,800, or 20 percent below its intraday record high from February 19, crossing the threshold for a bear market. Similarly, the Dow Jones Industrial Average also plunged 20 percent below its intraday record high reached on February 12, or below 24,000 points, confirming that the U.S. stock market has entered a bear market for the first time since the Great Recession of 2008.

Recession: Not If, But How Deep

As the spectre of COVID-19 is haunting the globe, analysts, economists and investors are shifting the conversation from whether there will be a recession in 2020, to a debate over how severe the contraction will be and what shape a recovery will take. Yes, the epidemic in China is on the decline and the country is returning to its normal economic potential. However, as the novel coronavirus spreads across the globe, more governments take drastic steps to limit its reach, which will negatively affect supply chains and economic activity. For example, Italy on Wednesday added new restrictions to its lockdown, closing all shops except supermarkets, food stores and chemists. The negative effects of such shutdowns are going to linger, making a quick, V-shaped recovery less likely. The more prolonged the recession, the better for gold.

To support the badly hit economies, governments and central banks are pumping money into economy. The New York Fed increased the maximum offering of its daily operations in the market for repurchase agreements, or repo, to $175 billion. Meanwhile, Britain and Italy have already announced multi-billion-dollar programs to fight COVID-19. The UK government has announced 30 billion pounds of fiscal stimulus and pledged 600 billion pounds by 2025 for infrastructure. And the Bank of England, following the Fed and the Bank of Canada, cut its interest rate by 50 basis points, from 0.75 to 0.25 percent.

It remains to me a mystery how a rate cut is supposed to help if at the same time, people are encouraged to stay at home and limit their economic activity. Which companies are supposed to cheer the lowered interest rates in times of reduced consumer demand and disrupted supply chains?

Let’s repeat: as the easy monetary policy did not manage to revive the economy after the Great Recession, it will neither help now, especially because coronavirus impacts economies mainly through changed human behavior – and central-bank actions will not alter such behavior.

Good News For Gold

Some investors will complain that gold should rally higher given the current turmoil. It’s true that the metal's somewhat limited reaction seems to be disappointing.

People should remember two things:

- first, gold’s relative performance versus other assets (think equities or oil) is actually great

- second, there are many margin calls in the marketplace right now and some panicked investors are beginning to sell gold to raise much-needed cash.

Indeed, as we saw immediately following the Financial Crisis, gold initially fell, only to rally later.