Veeva Systems Inc. (NYSE:VEEV) recently announced that its Vault Submissions and Vault Submissions Archive, implemented by Japan’s Sumitomo Dainippon Pharma, have enabled it to respond faster to health authority requests. Notably, the Vault Submissions and Vault Submissions Archive are part of the Vault RIM Suite. This fortifies Veeva’s foothold in the healthcare IT (HCIT) space.

For investors’ notice, Sumitomo Dainippon Pharma focuses on research and development activities for better healthcare worldwide.

On Vault Submissions & Vault RIM Suite

Veeva Vault Submissions is a unique platform, which creates a single authoritative source for submissions content. This makes storage and processing of data easier for healthcare companies. The platform tracks the progress of documents through actionable reports and dashboards, mitigating risks to submission timelines.

Meanwhile, the Vault RIM Suite is a global source for all regulatory content and product registration data.

It provides unified regulatory information management (RIM) capabilities on a single cloud-based platform including submission document management, product registration management, health authority correspondence and commitments, and submission archiving.

Veeva Systems has experienced robust demand for its Vault platform in recent times. In fact, management at Veeva Systems expects Vault subscription revenues to grow a significant 40% in fiscal 2020.

Product Portfolio Strong

Veeva Systems’ industry-specific focus lends it significant leverage.

The company’s unique solutions include Veeva Vault, Veeva CRM, Veeva Network and VeevaOpenData. Veeva Vault is the first cloud-based content management system built specifically for life sciences. Veeva CRM is a customer relationship management platform that offers cloud-based solutions to reach customers on any channel.

Another new cloud application of the company is Veeva Vault Training, designed to simplify role-based training across life sciences organizations and help quality teams remain audit-ready and compliant.

Market Prospects

BCC Research says that the global market for cloud technologies in healthcare is expected to reach $35 billion by 2022, at a CAGR of 11.6%.

Hence, the latest development has been a profitable one for Veeva.

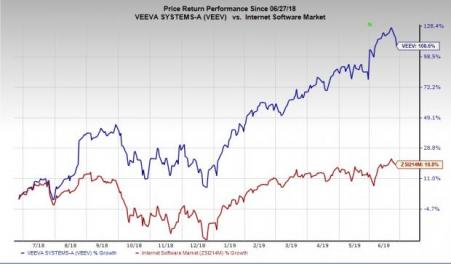

Price Performance

Buoyed by these solid prospects, this Zacks Rank #2 (Buy) stock has skyrocketed 108.5% compared with the industry’s 18.8% and the S&P 500 index’s 6.8% rise, in a year’s time.

Other Key Picks

A few other top-ranked stocks in the broader medical space are DENTSPLY SIRONA (NASDAQ:XRAY) , Penumbra (NYSE:PEN) and CONMED Corporation (NASDAQ:CNMD) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DENTSPLY’s long-term earnings growth rate is expected to be 11.5%.

Penumbra’s long-term earnings growth rate is projected at 21.5%.

CONMED’s long-term earnings growth rate is estimated at 13.3%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

Penumbra, Inc. (PEN): Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY): Free Stock Analysis Report

CONMED Corporation (CNMD): Free Stock Analysis Report

Original post