ARE YOU FEELING LOW ON ENERGY? OR IS IT JUST NATURAL GAS?

- Energy and Health Care are two sectors that have not participated in the Great Bull Market that followed 2008's Great Recession.

- Ignoring these two sectors means ignoring a combined 27% of the US GDP!

- “Energy” stocks, to me, mean natural gas and LNG, lithium, oil, hydro, solar, wind, biomass and more. I always own at least some of these, and some health care as well.

- Even in times when the energy sector writ large is out of favor, some sub-sectors are moving nicely. My goal is to find these hiding-in-plain-sight opportunities and profit from them. Today I’ll talk about energy.

Energy and Health Care are two sectors that have not participated in the Great Bull Market that followed the Great Recession. Both have been ignored as investors flocked to Tech and Financials (including REITs and business development companies – BDCs – for yield.)

On a valuation basis, I believe Energy offers the best opportunities to buy future growth at reasonable prices. According to S&P’s analysis of its 11 primary sectors as measured by their overarching sector ETFs, Energy has declined 1% over the past 5 years while the S&P has risen 86%. (1) Even those invested in the boring old Utilities sector have seen their investments rise 59% during this time.

But not all energy. For instance, it is in both the national security interests and the economic interests of the United States for oil and natural gas to remain somewhere in the area they both are right now.

The ideal position from a national security standpoint is that oil and gas firms are profitable enough for the best companies with the best technologies to make a profit but not so high that adversarial nations whose interests are inimical to our own receive a windfall infusion of new cash with which to blackmail, harass, fund terrorism or intrude upon America or our allies.

Do we really want to see oil and gas prices rise to the point where Russia can fund a new round of the nuclear arms race, Iran can fund its ballistic missile programs and increased terrorism, or autocracies like Venezuela can continue to prevent Venezuelans from enjoying the fruits of their labors?

The same price range works best for the average American’s pocketbook as well. Our daily lives are deeply affected by the price of energy. Where and how often we travel, whether we can afford to accept a better job with a longer commute, how comfortable we can make our internal living spaces, even what we eat all depend upon the price of energy. Gasoline at $2.40 a gallon is bearable. Gasoline at $4.20 a gallon is not. The equation is simple: affordable energy makes our lives better than they otherwise would be. On a macro level, affordable energy promotes growth.

You won’t hear me saying “I’ll buy energy companies when I think oil prices are going to go higher.” Yes, the companies will increase their earnings if that happens. But we don’t have to wait. Some companies are doing just that right now.

In my opinion, the two most promising areas of growth right now, today, are in the natural gas and LNG exploration and production, transportation, and refining areas and in the extraction and processing of lithium for use as batteries and other storage systems. To keep this article less than 50 pages, I’ll concentrate solely on natural gas today, specifically on one speculative explorer and on one blue-chip refiner.

If you are a long-term subscriber or reader, higher gasoline prices at the pump are a bother, but not a hardship. You have made enough money on energy stocks (starting around 2001!) that the price of gasoline could go to $10 a gallon and you could still pay for it out of your profits from owning energy companies.

But what if you are a newer reader who didn’t buy early and then take profits on gas and oil companies over the last few years? Opportunities still abound. Remember, all the energy firms on the S&P 500 have moved exactly -1% over the past five years. Within that range some are down 50% and more, some are up 100% or more. Selection is key.

By the way, I do not believe the current Saudi-inspired sprint up in oil prices will hold. I do believe that, longer term, as energy stocks pull back from this geopolitical event, prices will still stabilize in a good buying range, especially if the dollar declines as I expect it to. In this quarter and 2018, we will again be buying energy in size.

About the Saudi uncertainty. As I wrote just yesterday:

“Oil is rising because Saudi Arabia’s 32-year-old heir apparent to the crown, Mohammed bin Salman, is doing what every autocrat who wants to wield power does, from Bashar al-Assad to Vladimir Putin to Xi Jinping: consolidating his power.

“In this case, he is smart enough to do so while daddy, current king Salman bin Abdulaziz, is still alive and the absolute monarch—who can do whatever he pleases. Once King Salman dies or more likely anoints / appoints his son as king, Mohammed bin Salman's ("MBS") aggressive ways may make it more difficult for him to secure unbought allies.”

What action am I taking with the energy holdings in our portfolio? Simply maintaining our profitable positions with trailing stops. In the short-term, stocks react to news. In the long term they react to earnings. It is earnings derived from significant discoveries at low costs of production that drive serious gains in energy, not a one-off geopolitical event.

I already discussed EnCana (NYSE:ECA) here and added it once again to our model portfolio. EnCana and Canadian Natural Resources (NYSE:CNQ) are two of the Big Dogs in Canadian gas and oil production. Both are powerhouses in the Montney formation spanning Alberta and British Columbia. But allow me to introduce you to a somewhat smaller firm. Its shares are by definition more speculative in nature but I believe its prospects may well warrant at least a small position in the higher-risk portion of many portfolios.

The stock I am referring to is Advantage Oil & Gas Ltd. (NYSE:AAV), a Canadian company that is listed on the New York Stock Exchange. (The symbol, on either the NYSE or the Toronto Exchange, is the same: AAV.)

You might want to review my article on the “Montney Formation” of Alberta and British Columbia. I believe the Montney has the capability to outperform every formation in the US with the possible exception of the Permian. You can read that story, which compared the potential reserves of the Montney with the better-known and older US formations Marcellus, Haynesville and Eagle Ford, here. AAV, Seven Generations Energy Ltd (TO:VII) and Birchcliff Energy Ltd. (OTC:BIREF) are three lesser-known explorers that are active and successful in the Montney. Here is the story on AAV (2):

When seeking the most attractive companies in the energy business the first thing I look for is efficiency. I want to find companies that spend the least amount of money to get the greatest return on their capital. This isn’t as easy in the energy business as it is in many others.

I have to rely upon my experience gained over many years in assessing whether a new find, always unprofitable until the fuel starts flowing to a customer that is actually paying for it, is worthwhile. After that, I need to ensure that the trends of production are such that costs per unit of energy are rapidly coming down as they should when expenses are overwhelmed by the revenue. Finally I have to ensure that management, relieved they can finally pay themselves bonuses after all the hard work and uncertainty, are resisting the temptation to spend lavishly and instead are putting most of the money back into further exploration and production. Advantage Oil & Gas satisfies all three of those criteria.

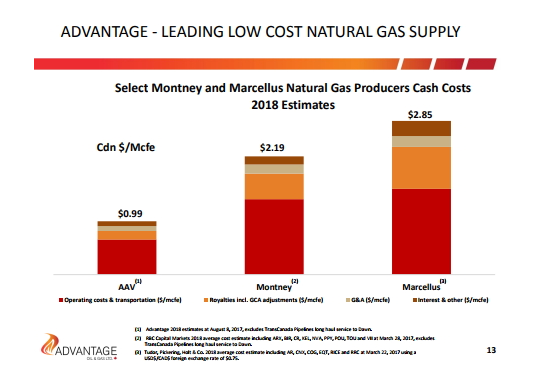

As you can see in the chart above, AAV is not just a low cost leader when compared to some of the best US producers like Range Resources (NYSE:RRC) and Cabot Oil & Gas (NYSE:COG) but also beats its peers in the more prolific Montney formation like ARC Resources (TO:ARX) and NuVista (TO:NVA). An operating cost of 99 cents (Canadian) per mcf of gas produced means a greater cushion for those times when natural gas dips below its current $3 ($3.80 Canadian) spot price.

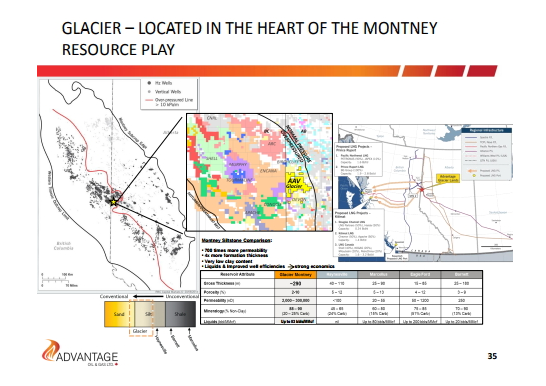

I have written in-depth about why I believe the Montney is the next beneficiary of enhanced oilfield technology in my two previous articles cited above so I will simply say here that, within the Montney, some geographic locations are likely to be better than others. The early results from the gas that is flowing here clearly shows the likelihood of continued elephant finds and it looks to me like AAV has some of the most promising acreage.

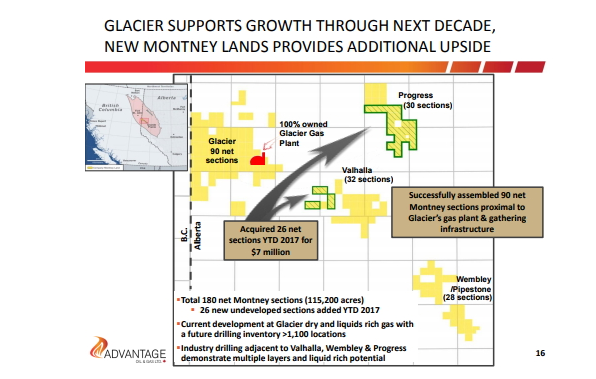

You’ll notice something special about AAV, a property only Birchcliff (BIREF) also enjoys in the Montney. Please note the red “building” icon on the map above. Advantage has the advantage of owning its own gas processing plant. That is a big part of how they are able to keep their operating costs down. They can deliver gas to the pipeline companies “ready to pipe.” Most of AAV’s competitors pay the pipeline companies to prepare the raw gas into a form that can be shipped via their pipelines.

Finally, please note below the positioning I believe to be so important when selecting a potential winner in exploration. The bulk of Advantage’s properties lie truly within the heart of the Montney. They are on the over-pressurized side of the formation which makes it more likely that when they discover gas and liquids the costs of extraction relative to the size of the flow will be a dynamic in their favor. And you will note that they are also at the center of the best pipeline distribution systems, ensuring easy access to the most favorable markets, be they in Eastern Canada, the US or Asia.

AAV has been steadily paying down debt and has a current debt-to-equity ratio of just 12%. Their increasing cash flow can easily render the debt moot within 2-3 years if they choose to do so.

___

Having spent this much time on AAV, I will only discuss my favorite blue chip briefly – mostly because it is well-known to clients and frequent readers.

Valero Energy (NYSE:VLO) is, quite simply, the best-positioned and most-profitable refinery in the United States. (It is also the biggest but I consider that a secondary consideration.) Most US refineries were built before new technologies made shale exploration and production viable. As a result, most refineries in this country were built to process all that gooey high-sulfur oil coming from overseas.

The bonanza of oil that is now flowing due to enhanced recovery techniques and horizontal hydraulic fracturing is light sweet crude. Valero is uniquely positioned to refine both types. With the supply of light sweet crude continuing to accelerate, VLO finds itself in the catbird seat, the most flexible company with the highest operating and net margins in the business.

By the way, the simplistic—and inaccurate—way many people view the relationship between oil and gas prices is this: the Energy Information Administration (The numbers-crunching arm of the Department of Energy) estimates that the average barrel of oil contains 5.8 million British thermal units (BTUs) of energy. With a barrel of oil selling around $57, and natural gas, as of today, trading at $3.14, you can buy the same amount of energy produced by natural gas for just $18 or so.

Aye, but here’s the rub: In fact there isn’t a great deal of fungibility between these two resources. Oil is used mostly for transportation. 75% of a typical barrel goes to diesel, gasoline, and jet fuels, with the rest going into plastics, medicines, over-the-counter health aids (look at the ingredients of the Vaseline jar -- 100% petroleum jelly) and food. Yes, food.

Natural gas, on the other hand, is used primarily for heating and cooling by being used to create electricity, or burned directly for gas cooking and heating. Hence my emphasis more on natural gas than oil. The transportation dynamic is changing rapidly, thanks to electric vehicles powered by natural-gas-fired electricity and rechargeable lithium batteries. But that’s a subject for a whole ‘nuther – and forthcoming – article

(1) Source

(2) All charts from AAV Investor Presentation October 2017

Disclosure: We are long AAV, VLO. Do your due diligence! What's right for me may not be right for you; what's right for you may not be right for me. Past performance is no guarantee of future results. Rather an obvious statement, but too many people look only at past performance instead of seeking the alpha that comes from solid research and due diligence.